The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups, cryptocurrency, venture capitalism and general business topics.

Is an SSN or ITIN Required For Obtaining an EIN?

By

Justin Damiani

Monday, January 28, 2019

Contrary to what many assume, you can still obtain an EIN for your company even if you do not have a U.S. Social Security Number or ITIN as long as the SS4 form is completed correctly and sent to the IRS... Read More

Operating in Kentucky with Delaware LLC or Corporation

By

Devin Scott

Tuesday, January 22, 2019

Kentucky, like other states, has an application process and a state fee in order to qualify to do business there as a foreign entity. The form that is filed with Kentucky is called a Certificate of Authority and grants your Delaware business the authority to operate in the state... Read More

Kentucky, like other states, has an application process and a state fee in order to qualify to do business there as a foreign entity. The form that is filed with Kentucky is called a Certificate of Authority and grants your Delaware business the authority to operate in the state... Read More

Is a Corporate Kit Really Necessary?

By

HBS

Tuesday, January 15, 2019

Not only is a Corporate Kit a safe, orderly location in which to house all your company’s documents but many of those documents can be utilized in court, if the need ever arises. Maintaining your company’s Corporate Kit makes sense, on all levels... Read More

Not only is a Corporate Kit a safe, orderly location in which to house all your company’s documents but many of those documents can be utilized in court, if the need ever arises. Maintaining your company’s Corporate Kit makes sense, on all levels... Read More

New President of Harvard Business Services Announced

By

HBS

Tuesday, January 8, 2019

Michael Bell, son of Harvard Founder Rick Bell, assumes the role of President for the company effective January 1, 2019. Rick Bell stays on as Chairman of the Board... Read More

Michael Bell, son of Harvard Founder Rick Bell, assumes the role of President for the company effective January 1, 2019. Rick Bell stays on as Chairman of the Board... Read More

Announcing Our New Entrepreneurship Scholarship

By

HBS

Tuesday, December 4, 2018

The new scholarship will be available to all undergraduate students at U.S.-based accredited colleges or universities who are majoring in entrepreneurship or another business program. Students can apply by submitting a short essay describing their entrepreneurial aspirations and business idea... Read More

The new scholarship will be available to all undergraduate students at U.S.-based accredited colleges or universities who are majoring in entrepreneurship or another business program. Students can apply by submitting a short essay describing their entrepreneurial aspirations and business idea... Read More

Introducing Our New Account Management Tool

By

Michael Bell

Monday, December 3, 2018

Harvard Business Services has developed and is now ready to officially launch our new account management tool. This new tool, called My Control Desk (or MCD for short), enables our clients to handle some of their most common transactions online at any time... Read More

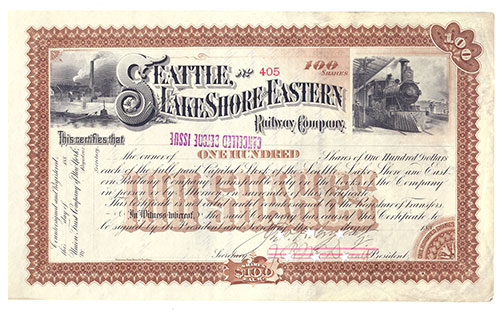

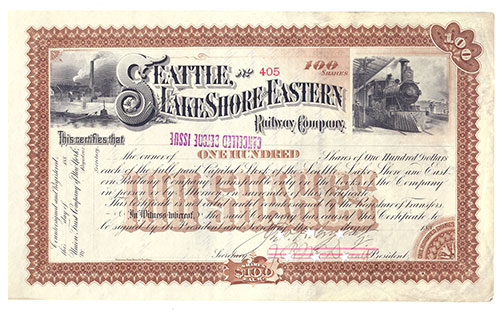

Authorizing Shares for Your Delaware Corporation

By

Paul Sponaugle

Tuesday, November 13, 2018

Now that you've formed a corporation, you may wonder about authorizing shares for your Delaware corporation. How many shares do you need and at what "par value?".. Read More

Now that you've formed a corporation, you may wonder about authorizing shares for your Delaware corporation. How many shares do you need and at what "par value?".. Read More

Operating in Kansas with a Delaware Company

By

Devin Scott

Monday, October 29, 2018

The process in which one state gives you the authority to operate there even though you incorporated in another state is called Foreign Qualification. This post will address Delaware LLCs and Corporations that will operate in Kansas... Read More

The process in which one state gives you the authority to operate there even though you incorporated in another state is called Foreign Qualification. This post will address Delaware LLCs and Corporations that will operate in Kansas... Read More

Do I Need an EIN Number?

By

HBS

Monday, October 15, 2018

Most newly-formed companies will require an Employer Identification Number, but there are exceptions. In this post, we take a look at the criteria provided by the IRS to determine if an EIN is needed... Read More

Most newly-formed companies will require an Employer Identification Number, but there are exceptions. In this post, we take a look at the criteria provided by the IRS to determine if an EIN is needed... Read More

Delaware LLC Requirements to Get a Federal Tax ID

By

Brett Melson

Tuesday, October 2, 2018

Once a Delaware LLC has its Certificate of Formation stamped and approved by the state of Delaware, the next step is to obtain a Federal Tax ID Number, also known as an EIN, from the IRS... Read More

Once a Delaware LLC has its Certificate of Formation stamped and approved by the state of Delaware, the next step is to obtain a Federal Tax ID Number, also known as an EIN, from the IRS... Read More