What Is a Delaware LLC?

A Delaware LLC is a business vehicle with a legal existence separate and distinct from its owners. The owners and managers of a Delaware LLC are not personally liable for the company's debts and obligations.

A Delaware LLC has the ability to be treated as a pass-through entity for tax purposes. As such, it is considered a hybrid business formation that combines some of the best features of corporations and partnerships. However, it is important to clarify that while LLCs can be treated as legal partnerships, they are not corporations. Owners (or members, as they are called in an LLC structure) can be individuals or any type of entity, from anywhere in the world, and are unlimited in number.

What Does LLC Mean?

The abbreviation LLC stands for "limited liability company," which refers to the entity's ability to limit its owners' personal liability in relation to business matters. In other words, if the Delaware limited liability company is sued or is unable to pay its debts, the personal assets of its owner (e.g. house, car, etc.) generally are not at any legal risk.

Advantages of an LLC

Creating an LLC in Delaware comes with the benefits of a low start-up cost and an affordable Franchise Tax. Setting up a Delaware LLC is so easy, affordable and beneficial that most businesses will create their business in Delaware, but are often doing business elsewhere.

The features of a Delaware limited liability company, when combined with non-U.S. source income, mean non-resident aliens of the United States can avoid U.S. taxation when using an LLC.

The Delaware LLC is a truly unique business entity in that the structure of the company and the rules that govern the members, or owners, of the company are contained in a contract called the operating agreement, which is drafted by the company's members.

The operating agreement can be customized to provide for whatever terms the members and/or founders want subject to law and public policy. The contractual flexibility offered by the state of Delaware is unmatched by any other LLC statute in any other state.

When creating an LLC in Delaware, members will have asset protection against liability and creditors, since a limitation on personal liability means that LLC members cannot be held responsible for a sum higher than their initial investment in the LLC, even if a member participates in management (as opposed to protections in a limited partnership).

Therefore, if you are sued and a judgment is levied against you personally, the judgment creditor cannot take the assets owned directly by your Delaware LLC.

The single-member LLC also provides a good way for you to purchase assets without revealing your personal identity. For example, if you create a single-member LLC in Delaware, you can contract to purchase a piece of real estate without revealing your personal identity to the seller.

Then, once you have purchased the property and titled it in the name of your Delaware LLC, no one will be able to search public records in order to connect you with the LLC. The reverse is also true. If someone sues your LLC and a judgment is levied against the LLC, the creditor cannot seek assets that are not owned by the LLC.

What Is the Best State to Form an LLC?

Delaware is traditionally the best state to form an LLC. Because of its extensive state law, the Delaware Court of Chancery, Delaware is hailed as one of the most business-friendly environments in the country. You can read more about why so many businesses are formed in Delaware on our website.

Do LLCs have to file annual reports?Some states require LLCs to file annual reports and pay annual renewal fees. One of the benefits of the Delaware LLC is that there are no annual report requirements, but every Delaware LLC is required to pay a $300 Franchise Tax payment every year.

Can a Single Person Form an LLC?

Yes. To form a Delaware LLC only one person is required to form the company. An LLC provides limited liability protection over a sole proprietorship and will also help build a brand with credibility in the public eye. An LLC can add new members (owners) at any time.

Can an LLC Have Employees?

Yes. LLCs can hire employees as they see fit for various positions. You will want to refer to your state employment laws and regulations in the state in which you are hiring employees.

Can Another Business Own an LLC?

Yes. Another Business can own an LLC. This is referred to as a subsidiary to the parent company. An LLC subsidiary is typically established by a parent LLC to separate all business activities, assets, or liabilities from the parent company itself. By doing so, this will separate all your eggs so they are not in one basket.

Can any Business Be an LLC?

Most businesses can be structured as an LLC, but there are a few exceptions to the rule. For example, financial institutions like banks typically have to organize under a different structure. In addition, non-profit organizations cannot operate as LLCs, as they have their own specific structure.

Can an LLC Own Another Business?

Yes. As mentioned above an LLC can own Another Business. This is referred to as a subsidiary of the parent company.

Can I change my LLC's structure later?Yes. You can convert an LLC into a corporation at any time. This can be beneficial for companies that want to enjoy certain tax benefits or to attract investors. Harvard Business Services is happy to give you a quote when the that time should arise.

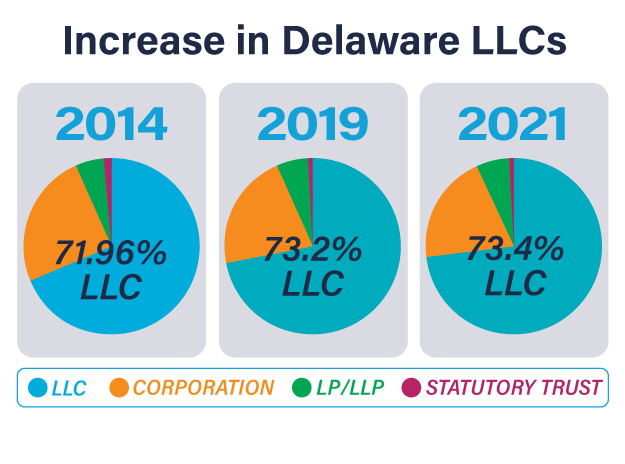

How Many LLCs Are There in Delaware?

Key Elements of a Delaware LLC

- Not taxed by the IRS at the entity level if partnership tax treatment is selected on the SS-4 Employer Identification Number form

- A creditor of an LLC member cannot seize control of the assets of the LLC or another member's voting rights

- Unmatched contractual flexibility

- Corporate formalities such as minutes, bylaws, meetings, officers and directors can be eliminated in the LLC Operating Agreement

- Personal liability is limited for owners and managers to the amount of their investment in the company

- Provides greater tax flexibility in areas of distributions and can be used as a valuable tool for estate planning and wealth transfers

- Non-resident aliens of the U.S. can typically avoid all U.S. federal taxes for their non-U.S. business activities

- Increased protection against judgment creditors

- Can be taxed as a partnership, a C Corporation Entity Level Taxation, an S Corporation Pass-Through Entity, or a disregarded entity.

Types and Uses of Delaware LLCs

- Single-Member LLC - used for managing a solo business venture, holding an asset, and creating a legal separation between assets owned by an individual and those owned by the LLC.

- Multi-Member LLC - used for managing any business owned by multiple members, including family businesses and estate planning.

- Series LLC - used for structuring multiple separate LLCs ("series") under a single "parent" LLC, while keeping assets and liabilities of each separate.

Steps to Setting Up an LLC in Delaware

When you decide that a Limited Liability Company is the best entity type for your business based on liability, taxation, and management flexibility, follow these steps to create a Delaware LLC.

Step 1: Choose a Company Name for your LLC

The name of your Delaware LLC must be unique and available in the State of Delaware. This can be checked for free through our Delaware Company Name Search.

Choose your company name carefully. This will be the foundation of your brand identity. You should consider how your company name will look, not only in print but also on a logo, on a sign, on business cards and on social media.

You may also want to check the availability of a website domain name using your company name. If it’s not available, most domain registrars will suggest similar alternatives.

Step 2: File Your Certificate of Formation

This is the process commonly referred to as “incorporating.” Creating an LLC in Delaware is done through the Delaware Secretary of State. Once the Certificate of Formation is filed and accepted, you officially own your company!

To file a Certificate of Formation, all you'll need is the new LLC's name, then choose one of our formation packages and provide basic contact information and we will take it from there.

We offer several incorporation packages, starting at just $229, which includes all state fees AND your first year of Delaware Registered Agent service, which is required by the State of Delaware. See our options for setting up an LLC in Delaware for both domestic (U.S.) and International formations.

Step 3: Create an Operating Agreement

The LLC Operating Agreement is a required and foundational document for the company. It allows its owners, known as members, to establish ownership shares, responsibilities, and any other terms they wish to formalize. In Delaware, this document is maintained internally by the LLC (not filed with the state or on public record), but is still permissible in court and respected in most cases.

Harvard Business Services offers a variety of templates to help get you started with your Operating Agreement.

Step 4: Open a business bank account

Opening a business bank account is vital to maintaining a “wall” between your personal assets and business assets. If you mix the two in the same account, you risk having your personal assets vulnerable to liabilities (such as lawsuits) of your business.

When setting up an LLC in Delaware, company owners can open a bank account wherever it is most convenient for them, which is generally their home state and/or where they are doing business. A Delaware LLC owner living in another state can open a bank account in that state. An LLC owner in another country can also use a bank local to them – and this is frequently much simpler than opening a U.S. account.

Step 5: Authority to Do Business in Other States

You will need to get a Certificate of Authority after creating a Delaware LLC to do business in another state (besides the one in which it is registered) before beginning your operations there. This is known as Foreign Qualification and the exact process varies from state to state.

Refer to our summary of requirements for each specific state for more information on what you'll need and what exactly constitutes "doing business."

Requirements to Maintain an LLC

After forming an LLC in Delaware, if the company is not physically operating in the state of Delaware there are only two requirements to maintain the LLC here in Delaware.

If you are operating as a Delaware LLC in another state's jurisdiction, along with paying the two annual compliance fees in Delaware, your business will typically be required to abide by any local and state requirements where your business is physically operating. (Ex. A Delaware LLC doing business in the state of New York).

Form a Delaware LLC with Harvard Business Services, Inc.

Forming an LLC in Delaware is easy with Harvard Business Services, Inc. If you are ready to form a Delaware limited liability company with us today, simply navigate to our form your Delaware LLC page. You can create an LLC in Delaware in just a few minutes, and pay online with PayPal or any major credit card.

If you're still unsure about setting up a Delaware LLC with us, these five reasons clarify why we are the leading Delaware business formation company and your best choice of a Delaware Registered Agent.

- Experience: Since 1981, we have formed over 200,000 Delaware companies for clients worldwide.

- Easy Filings: We are one of the few Delaware Registered Agents approved by the Delaware Secretary of State. Thus we maintain a direct, online connection to the Division of Corporations, which allows us to quickly and efficiently file your Certificate of Formation at a reasonable cost.

- Free LLC Operating Agreement Templates*: We provide you with a free, digital selection of Delaware LLC Operating Agreement templates, as well as other basic template forms.

- Lowest Registered Agent Fee: We guarantee your Registered Agent fee will remain $50 per year, per company, as long as your LLC remains in good standing. This means your total cost to maintain your LLC in Delaware is only $350 per year ($300 for annual Franchise Tax, plus $50 for the Registered Agent fee). Learn more about annual fees here.

- Free Lifetime Customer Support: Our experienced and helpful LLC formation experts are happy to answer your questions via phone (1-800-345-2677), email or live chat.

When you form your Delaware LLC through Harvard Business Services, Inc., our Corporate Kit, which is included in the Standard package, will provide you with an Operating Agreement to customize to your specific business needs.

*THE TEMPLATE DOCUMENTS ARE PROVIDED "AS IS", "AS AVAILABLE", AND WITH "ALL FAULTS", AND HARVARD BUSINESS SERVICES, INC. DISCLAIMS ANY WARRANTIES, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE.

After Creating an LLC in Delaware

After forming your Delaware LLC, the next step is usually to obtain your Federal Tax ID Number. Then, you file for a Certificate of Authority in order to do business in your home state and open a business bank account. Read more about the steps to take in our guide to “After Forming Your Company."

The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups and general business topics.

Since 1981, Harvard Business Services, Inc. has helped form over 400,000 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: