Most Popular Blogs

Doing Business in Maryland as a Delaware LLC

By

Devin Scott

Tuesday, July 13, 2021

Maryland, like many other states, has an application process and a state fee for Delaware companies that operate there. The process in which a Delaware LLC registers in Maryland is called Foreign Qualification... Read More

Maryland, like many other states, has an application process and a state fee for Delaware companies that operate there. The process in which a Delaware LLC registers in Maryland is called Foreign Qualification... Read More

Maryland, like many other states, has an application process and a state fee for Delaware companies that operate there. The process in which a Delaware LLC registers in Maryland is called Foreign Qualification... Read More

Maryland, like many other states, has an application process and a state fee for Delaware companies that operate there. The process in which a Delaware LLC registers in Maryland is called Foreign Qualification... Read More

Why Incorporate in Delaware? [INFOGRAPHIC]

By

HBS

Tuesday, July 6, 2021

Minimal start-up costs, the most trusted corporate case law and the most flexible corporate laws in the country are just a few of the excellent reasons to incorporate in Delaware... Read More

Minimal start-up costs, the most trusted corporate case law and the most flexible corporate laws in the country are just a few of the excellent reasons to incorporate in Delaware... Read More

Minimal start-up costs, the most trusted corporate case law and the most flexible corporate laws in the country are just a few of the excellent reasons to incorporate in Delaware... Read More

Minimal start-up costs, the most trusted corporate case law and the most flexible corporate laws in the country are just a few of the excellent reasons to incorporate in Delaware... Read More

How To Order a Delaware Certificate of Good Standing

By

Amy Fountain

Tuesday, May 11, 2021

Learn how to check on the status of your Delaware LLC or Corporation and obtain a Delaware Certificate of Good Standing (also known as a Certificate of Existence).

Perhaps you are applying for a bank loan or filing for Foreign Qualification in another state. Maybe you are entering into a contract with a third party, or maybe your corporation is merging with another corporation... Read More

Learn how to check on the status of your Delaware LLC or Corporation and obtain a Delaware Certificate of Good Standing (also known as a Certificate of Existence).

Perhaps you are applying for a bank loan or filing for Foreign Qualification in another state. Maybe you are entering into a contract with a third party, or maybe your corporation is merging with another corporation... Read More

Learn how to check on the status of your Delaware LLC or Corporation and obtain a Delaware Certificate of Good Standing (also known as a Certificate of Existence).

Perhaps you are applying for a bank loan or filing for Foreign Qualification in another state. Maybe you are entering into a contract with a third party, or maybe your corporation is merging with another corporation... Read More

Learn how to check on the status of your Delaware LLC or Corporation and obtain a Delaware Certificate of Good Standing (also known as a Certificate of Existence).

Perhaps you are applying for a bank loan or filing for Foreign Qualification in another state. Maybe you are entering into a contract with a third party, or maybe your corporation is merging with another corporation... Read More

Top 10 Corporation & LLC Franchise Tax Questions

By

Amy Fountain

Tuesday, March 30, 2021

Here are answers to 10 common Delaware corporation & LLC Franchise Tax questions... Read More

Here are answers to 10 common Delaware corporation & LLC Franchise Tax questions... Read More

Here are answers to 10 common Delaware corporation & LLC Franchise Tax questions... Read More

Here are answers to 10 common Delaware corporation & LLC Franchise Tax questions... Read More

EIN vs ITIN: What's the Difference?

By

Brett Melson

Tuesday, February 11, 2020

There are many numbers that are used to identify ourselves and our corporations or LLCs, such as a Social Security number, driver's license number, passport number, DUNS number and EIN (Employer Identification Number).

Many business owners and employees wonder about the differences between the Federal Employer Tax ID number (EIN) and the individual taxpayer identification number (ITIN)... Read More

There are many numbers that are used to identify ourselves and our corporations or LLCs, such as a Social Security number, driver's license number, passport number, DUNS number and EIN (Employer Identification Number).

Many business owners and employees wonder about the differences between the Federal Employer Tax ID number (EIN) and the individual taxpayer identification number (ITIN)... Read More

There are many numbers that are used to identify ourselves and our corporations or LLCs, such as a Social Security number, driver's license number, passport number, DUNS number and EIN (Employer Identification Number).

Many business owners and employees wonder about the differences between the Federal Employer Tax ID number (EIN) and the individual taxpayer identification number (ITIN)... Read More

There are many numbers that are used to identify ourselves and our corporations or LLCs, such as a Social Security number, driver's license number, passport number, DUNS number and EIN (Employer Identification Number).

Many business owners and employees wonder about the differences between the Federal Employer Tax ID number (EIN) and the individual taxpayer identification number (ITIN)... Read More

What is a Delaware LLC Certificate of Formation?

By

Devin Scott

Tuesday, February 4, 2020

If you are preparing your own Delaware LLC Certificate of Formation, your name will be listed on the Certificate as the Delaware LLC's authorized person; this is is why many people opt to have us act as their Delaware Registered Agent... Read More

Company Formation Documents, Defined

By

Andrew Millman

Tuesday, October 1, 2019

Each business entity requires different company formation documents upon incorporation. Here's what you need to know about them... Read More

Each business entity requires different company formation documents upon incorporation. Here's what you need to know about them... Read More

Each business entity requires different company formation documents upon incorporation. Here's what you need to know about them... Read More

Each business entity requires different company formation documents upon incorporation. Here's what you need to know about them... Read More

Delaware Companies for International Business Owners

By

Andrew Millman

Tuesday, August 27, 2019

Here’s how international business owners who live anywhere in the world can easily form a Delaware company... Read More

Here’s how international business owners who live anywhere in the world can easily form a Delaware company... Read More

Here’s how international business owners who live anywhere in the world can easily form a Delaware company... Read More

Here’s how international business owners who live anywhere in the world can easily form a Delaware company... Read More

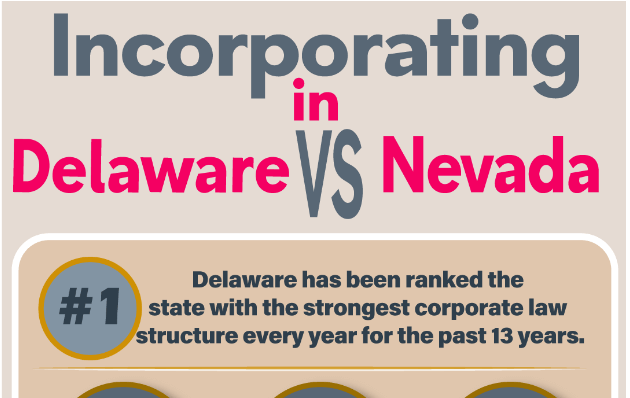

Where to Incorporate: Delaware vs Nevada Infographic

By

Michael Bell

Tuesday, February 26, 2019

Our infographic illustrates the many ways that Delaware is a better state to form a company in than Nevada... Read More

Our infographic illustrates the many ways that Delaware is a better state to form a company in than Nevada... Read More

Our infographic illustrates the many ways that Delaware is a better state to form a company in than Nevada... Read More

Our infographic illustrates the many ways that Delaware is a better state to form a company in than Nevada... Read More

Delaware LLC Requirements to Get a Federal Tax ID

By

Brett Melson

Tuesday, October 2, 2018

Once a Delaware LLC has its Certificate of Formation stamped and approved by the state of Delaware, the next step is to obtain a Federal Tax ID Number, also known as an EIN, from the IRS... Read More

Once a Delaware LLC has its Certificate of Formation stamped and approved by the state of Delaware, the next step is to obtain a Federal Tax ID Number, also known as an EIN, from the IRS... Read More

Once a Delaware LLC has its Certificate of Formation stamped and approved by the state of Delaware, the next step is to obtain a Federal Tax ID Number, also known as an EIN, from the IRS... Read More

Once a Delaware LLC has its Certificate of Formation stamped and approved by the state of Delaware, the next step is to obtain a Federal Tax ID Number, also known as an EIN, from the IRS... Read More