Filing S-Corp Status on a New Delaware Corporation

Delaware Corporate Law structure allows for the formation of three different types of for-profit corporations: General Corporation, Close Corporation and Public Benefit Corporation (called a Benefit Corporation in the other states in which it is a legal entity).

Delaware Corporate Law structure allows for the formation of three different types of for-profit corporations: General Corporation, Close Corporation and Public Benefit Corporation (called a Benefit Corporation in the other states in which it is a legal entity).

S-Corp vs. C-Corp

Although there are three different classifications of for-profit corporations, the Internal Revenue Service only uses two different options for each of these corporations for tax purposes. Where the IRS is concerned, a corporation must be classified either as an S corporation or a C Corporation.

After a Certificate of Incorporation is filed with the state of Delaware Division of Corporations to officially create the new entity, the next step is to obtain a Federal Tax Identification Number, also referred to as an EIN. This is when you will choose whether you’d like the corporation to be taxed as a Subchapter S corporation or a C corporation.

There are advantages and disadvantages to both Delaware S Corporations and C Corporations.

C Corporations

The IRS will tax all corporations as C corporations unless the IRS is notified that the corporation would like to elect Subchapter S corporation tax status. In other words, C corporation tax status is the default status.

The C corporation taxation method is attractive for many reasons, and is something that larger companies, having shown profit over the course of two or more years, may prefer. Companies often take advantage of this method of taxation if they are looking to attract outside investors, but this taxation status is not generally advantageous for many startups.

S Corporations

The Subchapter S tax status, also known as an S corporation or an S-Corp, is a very popular tax status for small newly formed corporations. The Subchapter S of the tax code was first enacted in 1958, and has been used by countless number of entrepreneurs with great success.

Subchapter S tax status allows for a unique taxation method whereby the tax liability for the profits and losses flow through the company to the shareholders in their prorata share. The shareholders are then responsible for the taxes at their personal tax rate. This pass-through rule eliminates the double taxation issue related to the C corporation.

Delaware S Corporation tax status can be very beneficial for startup companies that need to pass along early losses to the shareholder; however, there are restrictions on which companies can take advantage of the Subchapter S tax status.

Delaware S-Corp Filing Requirements:

- The corporation must have only one class of stock

- All shareholders in the corporation must be U.S. Citizens or Residents (corporate entities are not eligible to be shareholders)

- There cannot be more than 100 shareholders

- All shareholders must agree to the election of the S-corp tax status.

How to Apply for the Subchapter S Tax Status:

After the corporation has been formed and the EIN obtained, a corporation can apply for S-Corp status by completing IRS Form 2553 in full, having all the shareholders sign it and sending it to the IRS. The IRS must receive the form within two months and 15 days from the date of the company’s formation in order for the corporation to qualify for Subchapter S election.

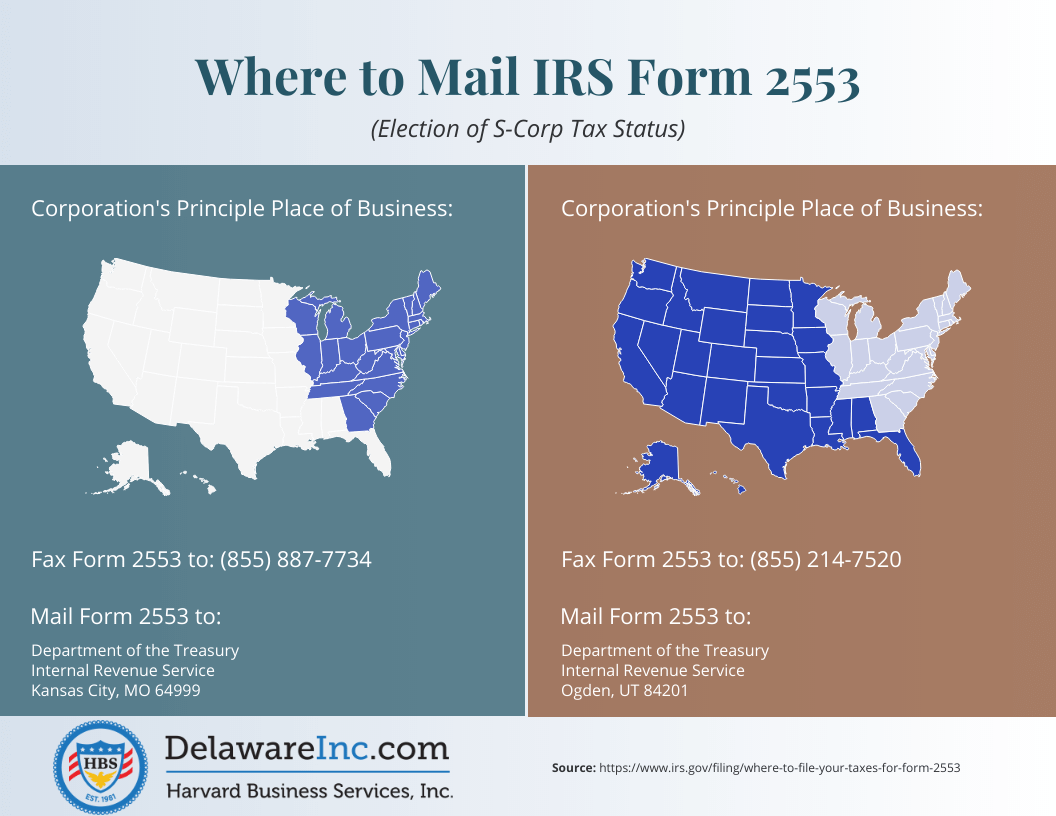

If the corporation's principal business office is located in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin, fax the form to (855) 887-7734 or mail it to Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999.

If the corporation's principal business office is located in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming, fax the form to (855) 214-7520 or mail to Department of the Treasury, Internal Revenue Service, Ogden, UT 84201.

Faxing your Delaware S-Corp tax status application to the IRS is the least reliable way to go about informing the IRS of the election, as many faxes wind up illegible and others are never even received. We recommend that you send your signed application S-Corp status via the United States Postal Service Certified Mail with Return Receipt.

The IRS estimates for the time it takes to complete and file Form 2553 include:

- Record Keeping: 9 hours and 48 minutes

- Learning about the law & the form: 2 hours and 33 minutes

- Preparing, copying, assembling and sending the form to the IRS: 4 hours

Feel free to reach out to one of our business formation specialists with any questions about S-Corps and how to apply for Subchapter S tax status.

You may also find this related article helpful: Why Convert Your Tax Status from S-Corp to C-Corp

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.

There are 2 comments left for Delaware S-Corp Filing Requirements: How to Apply for an S-Corp Status

Parviz Kazi said: Friday, December 8, 2017If I have a Delaware LLC and I am doing business in New York, Can I file Form CT-6 to be treated as a New York S Corporation?

HBS Staff replied: Monday, December 11, 2017Unfortunately, this question is outside the realm of our experience forming Delaware companies. We suggest you contact an accountant in order to best answer your query. Thanks for reading our blog.

David Whitehurst said: Tuesday, July 18, 2017Please assist me with questions on receiving S-Corporation status as I am not certain whether the corporation has C or S status with the IRS. However, I have completed the taxes with the IRS as an S-Corporation. Our Corp name is Faith Christian Center, Inc.

HBS Staff replied: Thursday, July 20, 2017It would be best for you to inquire with your tax professional or the IRS to find out if your entity has S corporation tax status. You can reach the IRS at 1-800-829-4933.