What Is a Delaware S Corporation?

The definition of an S corporation is either a general corporation or a close corporation that has elected to be taxed pursuant to Subchapter S of the IRS code.

To create an S-Corp you must first form one of the following:

- General Corporation: The most basic form of corporation, often referred to as a stock corporation or open corporation;

- Close Corporation: A closely-held corporation in which a small group of people are the shareholders, directors and officers, and who wish to remain a small group;

- Public Benefit Corporation: A for-profit entity that commits to supporting a chosen public benefit cause as identified on its Certificate of Incorporation.

Once your corporation is formed, you can then file Form 2553 with the IRS within 75 days of the formation date to elect for S-Corp tax status.

After the IRS approves your application, your corporation will not have to pay U.S. federal income taxes. Instead, the tax liability (or tax credit) will be passed through to the individual shareholders according to their ownership share of the S corporation.

How to elect a C-Corporation to an S-Corporation?

As a pass through entity, S-Corps protect their owners from double taxation. One of the disadvantages of general and close corporations is that the profits on these types of corporations can be taxed twice—once at the corporate level by way of a corporate income tax and again at the individual shareholder level if a dividend is declared.

The election of Subchapter S tax status allows the profits of the corporation to pass through the entity to the individual shareholders and, accordingly, is only taxed once. Thus one of the benefits of an S corporation in Delaware is that it has all of the benefits of a Delaware corporation but with a different tax status. Comparing Delaware S-Corps vs C-Corps, S-Corp losses are passed through to the shareholders, who are protected from double taxation. C-Corps have more flexibility in ownership with unrestricted classes of stock and the option to have an unlimited number of shareholders. You can learn more about C Corporations on our website.

Subchapter S tax status is reserved for small business corporations and refers only to a company's federal taxation. In some states, it may be necessary for the corporation to file IRS Form 2553 in order to be treated as an S corporation for state income tax purposes.

If you don't submit Form 2553, your corporation will be a C corporation.

Difference Between an S Corporation and an LLC

Corporations and LLCs are seperate legal entities that offer limited liability protection to the owners. If a General or Close Corporation elects for S-corporation tax status the shareholders must be U.S. citizens or residents. Furthermore, S-corporations cannot be owned by other entities like LLCs, partnerships, or other corporations. Corporations and LLC have different ownership structures. LLCs can have Members (owners) serve as managers or have separate members and managers. Corporations have three tiers of power; shareholders (own the company), directors (run the company) and officers (run the day-to-day operations). In a Delaware corporation one person can hold all company positions.

Can an S Corporation Own an LLC?

Yes, an S-corp can own an LLC. S-corporations have their own limitations and cannot be owned by other entities, but they can serve as owners for other entities.

Qualifications for S-Corp Tax Status

- Must file IRS Form 2553 in a timely manner to elect subchapter S status

- Requires the approval of all shareholders

- Cannot have more than 100 shareholders

- Cannot have more than one class of stock

- The entity must be a domestic corporation

- Shareholders cannot be non-resident aliens

- Shareholders cannot be other companies

Benefits of an S-Corp?

- Pass-through tax treatment

- Can own shares of a C-Corp

- Allowed to own 100% of a C-Corp

- Investors can write off early losses

- Avoids double taxation on dividends

- Can be a member of a single-member LLC or a multi-member LLC

Disadvantages of S-Corp Status

- Restricted to 100 shareholders

- Restricted to one class of stock

- Cannot own shares in another S-Corp

- Losses passes through to the shareholders

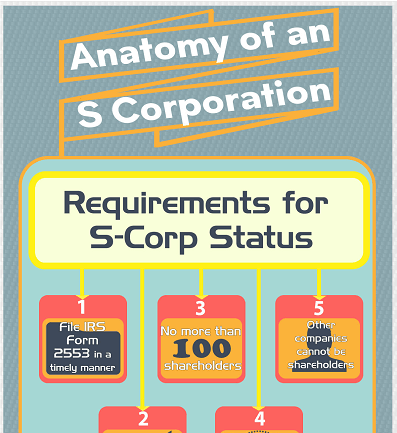

Infographic: Requirements for S-Corporation Status

Here's a quick reference for the requirements of having S-Corp status for your corporation, along with the advantages and disadvantages.

The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups and general business topics.

Since 1981, Harvard Business Services, Inc. has helped form 430,641 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: