What Is a C Corporation?

By definition, a C corporation is a tax status, not a business entity type. In fact, all corporations are, by default, C corporations, unless they do one of two things:

- File Form 2553 with the IRS for S corporation status;

- or file a 501(c) application with the IRS for non-taxable status.

A Delaware C corporation is a separate entity from its shareholders, and therefore C-corps offer limited liability protection to Directors and shareholders. In addition, C-Corps differ from other corporations in taxation and ability to raise investor capital, though they share the same structure as other corporations.

C-Corp Taxation

One of the most relevant C-Corp benefits is its taxation. C corporations offer flexibility in planning and strategizing your federal income taxes; in fact, there is much more flexibility than in either partnerships or sole proprietorships.

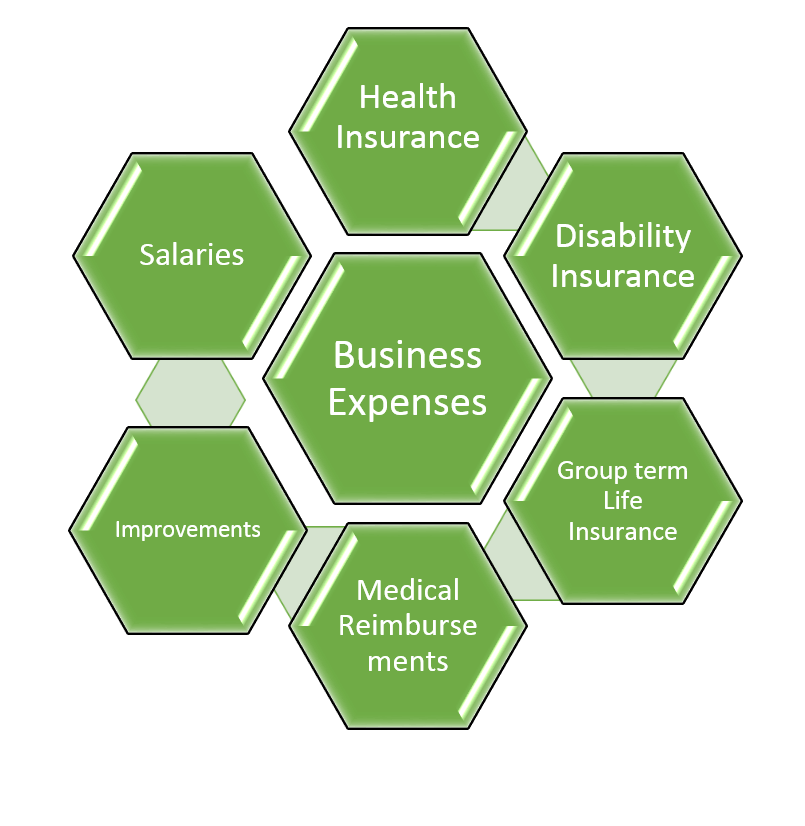

A Delaware C-Corp can pay for employees’ fringe benefits and then deduct these amounts as business expenses. That way, neither the owner nor the employee pay income tax on the value of the fringe benefits received.

For example, a C-Corp can deduct the following employee benefits:

- Health insurance

- Disability insurance

- Group term life insurance

- Reimbursement of employee medical expenses not covered by insurance

A start-up will have to wait a few years, until the company earns a profit, before it can take advantage of these tax benefits. However, in a C corporation, fringe benefits can be deducted as a business expense.

The fringe benefits caveat, however, is that the employee benefits must be provided to an array of employees, not just the C-Corp's owners. In fact, 70% of eligible employees must be able to take advantage of the benefits.

The benefits must also be non-discriminatory, i.e., not designed solely to benefit the owners.

In addition, as long as the owners pay themselves reasonable salaries, their salaries can be deducted from the C-Corp's profits, thus lowering the amount of corporate tax owed.

First, the C-Corp deducts all business expenses, including but not limited to cost of goods, salaries, fringe benefits, interest payments and improvements. By this method, a C-Corp’s profits are balanced out by the owners' compensation, so there is little taxable income left on which the corporation must pay taxes.

However, shareholders of a C-Corp may face double taxation; the company pays taxes on its profits via Form 1120, and if profits are distributed to shareholders in the form of dividends, those shareholders must pay taxes on the dividends.

A number of C-Corps don’t pay any corporate taxes because the owners are also employees, so their salaries and bonuses (any type of compensation) can be deducted as a business expense.

Thus, one way to avoid double taxation is to pay the owners higher salaries instead of distributing dividends, but the individual’s income tax on a salary is taxed at a higher rate than dividend distributions.

A C corporation is permitted to retain earnings in order to improve the company if it complies with the appropriate tax provisions.

C-Corp taxes are low from retained earnings; this is unique to C Corps, and they also tend to carry a lower risk of an IRS audit than a sole proprietorship or LLC.

When are C-Corp Franchise Taxes Due?

For C corporations, the due date for the Delaware Franchise Tax is due on or before March 1st each year. All Delaware Corporations must pay the annual Franchise Tax regardless of their incorporation date and company activity.

C Corporation Liability Protection

Another frequently referenced C-Corp benefit is the limited liability protection that comes with this type of company. Business owners who are sole proprietorships or partnerships put their own personal assets and funds at risk if the business starts to lose money or if it becomes the target of a legal action. Whereas, if you are an incorporated entity your limited liability is protected as your business is a completely separate entity with its own financial status making it very hard for someone to come after your personal assets.

Raising Capital as a C-Corp

Another C-Corp defining difference is that C corporations are the entity of choice for venture capital and angel investors.

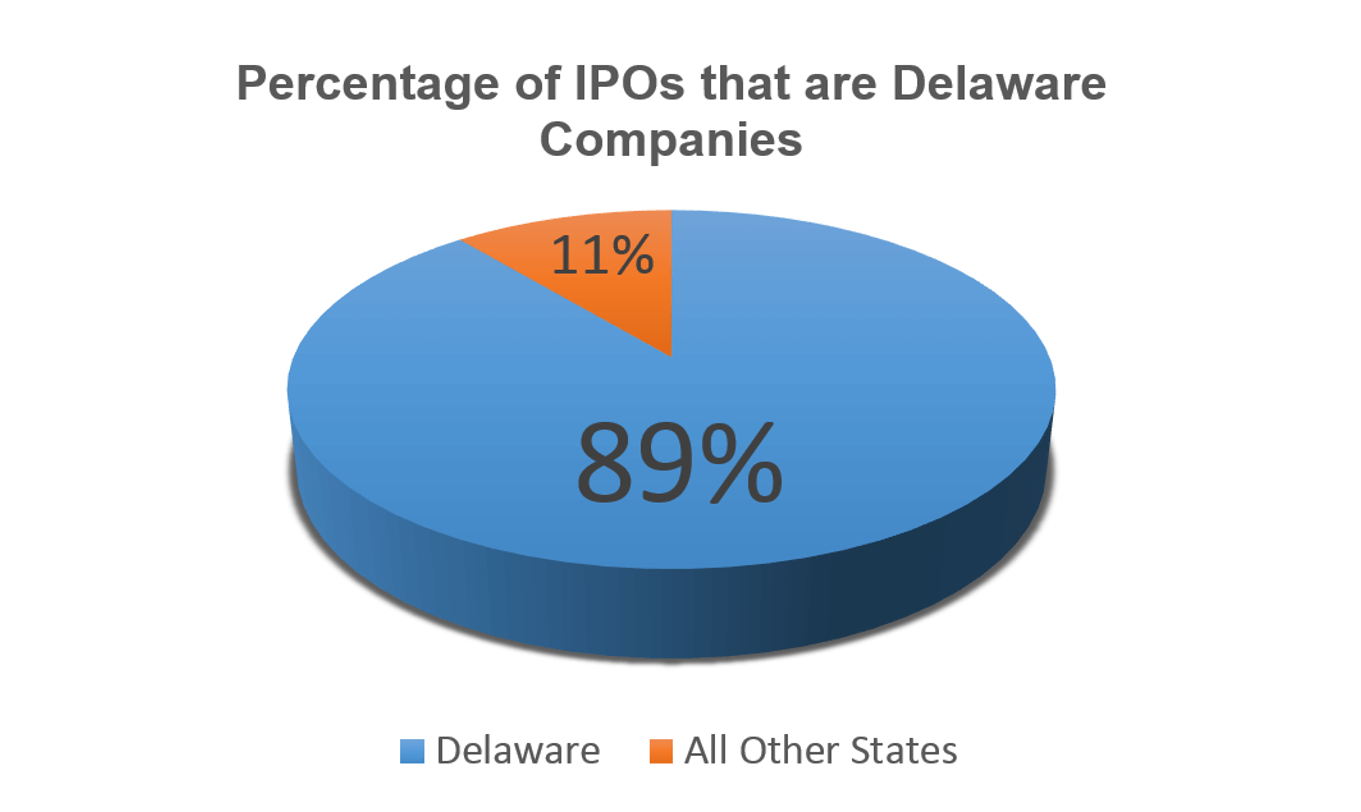

In 2019, more than 89% of new IPOs were undertaken by Delaware C corporations. Most venture capital firms will only invest in Delaware C corporations.

If you have a company they want to invest in that is not a Delaware C corporation, chances are they will require you to re-incorporate in Delaware as a C corporation before they will invest.

The primary tool for raising capital is the class of stock known in the world of corporate finance as "Delaware Blank Check Preferred Stock." This is a class of stock which allows the Board of Directors to negotiate with investors and tailor a series of stock to fit the needs of both the investors and the directors.

C-Corp Structure

Like all corporations, C corporations have three structural tiers, which must be composed of shareholders, Directors and officers. Shareholders own the company; the Board of Directors oversees the corporation and makes major decisions, such as hiring officers; the officers actually run the company on a daily basis.

A C-Corp must also comply with the usual corporate formalities, such as holding shareholder and Board of Director meetings; filing annual reports; maintaining proper corporate records, such as meeting minutes (which must be kept separate from the owners' records); and paying annual fees.

C-Corp Ownership

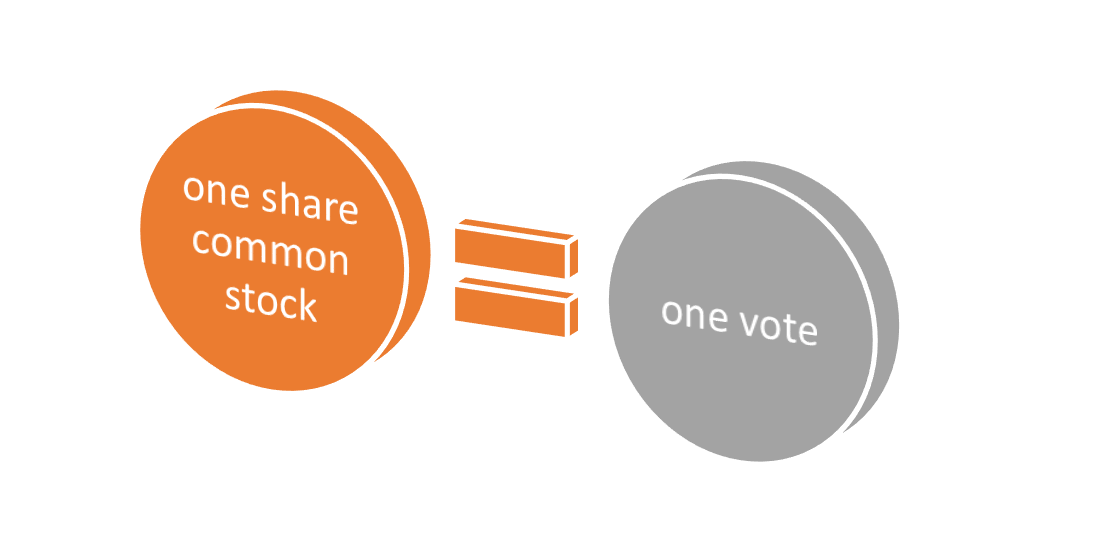

Ownership of a C corporation is evidenced by shares of stock in the company. Every C corporation has one class of common stock, with each share representing one vote at stockholder meetings.

The number of authorized shares in the company is decided at the inception of the company and is listed on the company's Certificate of Incorporation.

The authorized number of shares can be increased by filing an amendment to the Certificate of Incorporation with the Delaware Division of Corporations.

In addition to the first class of common stock, a C corporation may authorize other classes of stock, such as preferred stock or non-voting common stock, or a wide variety of other choices.

These classes of stock may have different rights regarding voting rights, dividend rights and may even be granted security interests in the company's assets.

The Board of Directors possesses the exclusive right to issue shares in a C corporation. It sets any price it wants to on the shares of stock. In addition, the C-Corp does not need to issue the total number of authorized shares; the Board of Directors can decide to hold some back in case more owners are added in the future.

There are no restrictions on ownership in a C corporation - you can have as many owners as you want, and foreign nationals can own shares in a C corporation.

If you are an employee of a C corporation and a stockholder, you are not considered to be self-employed, as you would be as a sole proprietor, a member of an LLC or an owner with more than 2% of shares in an S-Corp.

C Corporation Perpetual Existence

One of the benefits of forming a C corporation is that it exists perpetually. this mean that your business continues to exist independently of the lifespan or actions of its owners. Even if shareholders sell their shares or pass away, the company can continue operations.

Can a C-Corp Own an LLC?

Yes. A C corporation can own an LLC. This alloss the C Corp and the LLC to operate as seperate legal entities, which offers liability protection to the parent company.

In general, a C corporation has no limits to its ownership, but S corporations do. A C-Corp can own and be owned by other C-Corps, but C Corporations cannot own S corporations. This is generally due to an S-Corps eligibility for favorable tax treatment as a pass-through entity.

Difference Between C-Corps & S-Corps

The C-Corp tax status is the standard format when forming a corporation. However, the corporation can elect for S-Corp tax status by making an additional filing (form 2553) directly with the IRS. S-Corps are pass-through entities, meaning the profits and losses will pass through the business, instead reported on the owner's personal tax returns. In spite of this benefit, S-Corps also have limitation to their number of shareholders and they are limited to one class of stock. You can learn more about the Delaware S-Corp on our website to decide which tax status is best for your business.

If you'd like to grow your business into a large, publicly traded company, a Delaware C-Corp is a great choice. Create your Delaware C Corporation with our help at Harvard Business Services, Inc. or contact our team to learn more.

Advantages of C Corporation

There are several benefits of a C corporation that you should consider before starting your own business:

-

Tax Deductions (Ask an Accountant)

-

Capital Raising Opportunities

-

Stock Flexibility

-

Easy Transfer of Ownership

-

Perpetual Existence

Since 1981, Harvard Business Services, Inc. has helped form 430,506 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: