Business Strategies

Learn how to incorporate your Delaware business as well as tips, suggestions and smart business ideas for you to utlize before and after incorporating a company in Delaware.

Benefit of Live Chat Feature for your Company Website

By

Justin Damiani

Monday, February 4, 2019

Whether clients need assistance with brief questions or guidance through the entire formation process for a company, our live chat feature enables us to assist multiple people at once in real time... Read More

Whether clients need assistance with brief questions or guidance through the entire formation process for a company, our live chat feature enables us to assist multiple people at once in real time... Read More

Whether clients need assistance with brief questions or guidance through the entire formation process for a company, our live chat feature enables us to assist multiple people at once in real time... Read More

Whether clients need assistance with brief questions or guidance through the entire formation process for a company, our live chat feature enables us to assist multiple people at once in real time... Read More

Is an SSN or ITIN Required For Obtaining an EIN?

By

Justin Damiani

Monday, January 28, 2019

Contrary to what many assume, you can still obtain an EIN for your company even if you do not have a U.S. Social Security Number or ITIN as long as the SS4 form is completed correctly and sent to the IRS... Read More

Do I Need an EIN Number?

By

HBS

Monday, October 15, 2018

Most newly-formed companies will require an Employer Identification Number, but there are exceptions. In this post, we take a look at the criteria provided by the IRS to determine if an EIN is needed... Read More

Most newly-formed companies will require an Employer Identification Number, but there are exceptions. In this post, we take a look at the criteria provided by the IRS to determine if an EIN is needed... Read More

Most newly-formed companies will require an Employer Identification Number, but there are exceptions. In this post, we take a look at the criteria provided by the IRS to determine if an EIN is needed... Read More

Most newly-formed companies will require an Employer Identification Number, but there are exceptions. In this post, we take a look at the criteria provided by the IRS to determine if an EIN is needed... Read More

Should You Incorporate Your Band?

By

Michael Bell

Tuesday, June 19, 2018

The reason a band should incorporate is because most musicians’ dreams are to become the next Rolling Stones, Mumford & Sons or Maroon 5. However, in order to do that, you have to attract the notice of an A&R representative and then get signed to a record label... Read More

The reason a band should incorporate is because most musicians’ dreams are to become the next Rolling Stones, Mumford & Sons or Maroon 5. However, in order to do that, you have to attract the notice of an A&R representative and then get signed to a record label... Read More

The reason a band should incorporate is because most musicians’ dreams are to become the next Rolling Stones, Mumford & Sons or Maroon 5. However, in order to do that, you have to attract the notice of an A&R representative and then get signed to a record label... Read More

The reason a band should incorporate is because most musicians’ dreams are to become the next Rolling Stones, Mumford & Sons or Maroon 5. However, in order to do that, you have to attract the notice of an A&R representative and then get signed to a record label... Read More

Non-Profit vs Benefit Corporation (Infographic)

By

Veso Ganev

Wednesday, May 30, 2018

Our infographic highlights the most important ten differences between non-profits and benefit corporations... Read More

Our infographic highlights the most important ten differences between non-profits and benefit corporations... Read More

Our infographic highlights the most important ten differences between non-profits and benefit corporations... Read More

Our infographic highlights the most important ten differences between non-profits and benefit corporations... Read More

How to File an Amendment for Your Delaware Company

By

Andrew Millman

Monday, March 5, 2018

Did you know you can make more than one change in a single amendment? If you need to amend more than just one aspect of your original Certificate of Incorporation (or Certificate of Formation, for an LLC), you can do so... Read More

Did you know you can make more than one change in a single amendment? If you need to amend more than just one aspect of your original Certificate of Incorporation (or Certificate of Formation, for an LLC), you can do so... Read More

Did you know you can make more than one change in a single amendment? If you need to amend more than just one aspect of your original Certificate of Incorporation (or Certificate of Formation, for an LLC), you can do so... Read More

Did you know you can make more than one change in a single amendment? If you need to amend more than just one aspect of your original Certificate of Incorporation (or Certificate of Formation, for an LLC), you can do so... Read More

Board Portal Software: BoardBookit

By

Rick Bell

Monday, January 15, 2018

BoardBookit is a cloud-based board portal software platform that will change your life if you want to be great at managing your board... Read More

BoardBookit is a cloud-based board portal software platform that will change your life if you want to be great at managing your board... Read More

BoardBookit is a cloud-based board portal software platform that will change your life if you want to be great at managing your board... Read More

BoardBookit is a cloud-based board portal software platform that will change your life if you want to be great at managing your board... Read More

Introduction to Limited Partnerships

By

Brett Melson

Tuesday, January 9, 2018

A limited partnership is formed by filing a Certificate of Limited Partnership with the state of Delaware. A limited partnership is not required to file its governing document, the limited partnership agreement, with the state of Delaware... Read More

A limited partnership is formed by filing a Certificate of Limited Partnership with the state of Delaware. A limited partnership is not required to file its governing document, the limited partnership agreement, with the state of Delaware... Read More

A limited partnership is formed by filing a Certificate of Limited Partnership with the state of Delaware. A limited partnership is not required to file its governing document, the limited partnership agreement, with the state of Delaware... Read More

A limited partnership is formed by filing a Certificate of Limited Partnership with the state of Delaware. A limited partnership is not required to file its governing document, the limited partnership agreement, with the state of Delaware... Read More

A New Company for a New Year

By

Andrew Millman

Monday, November 13, 2017

Did you know you can set up a new Delaware LLC or Delaware corporation so it’s ready for business at the start of 2018 and you save $100 plus don’t have to pay Franchise Tax until 2019?.. Read More

Did you know you can set up a new Delaware LLC or Delaware corporation so it’s ready for business at the start of 2018 and you save $100 plus don’t have to pay Franchise Tax until 2019?.. Read More

Did you know you can set up a new Delaware LLC or Delaware corporation so it’s ready for business at the start of 2018 and you save $100 plus don’t have to pay Franchise Tax until 2019?.. Read More

Did you know you can set up a new Delaware LLC or Delaware corporation so it’s ready for business at the start of 2018 and you save $100 plus don’t have to pay Franchise Tax until 2019?.. Read More

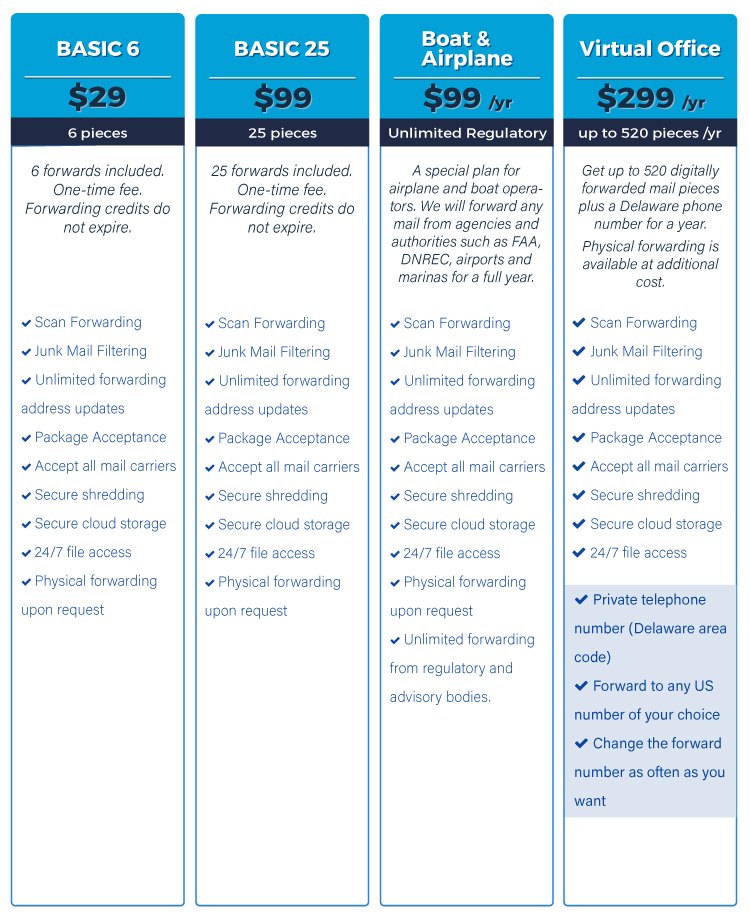

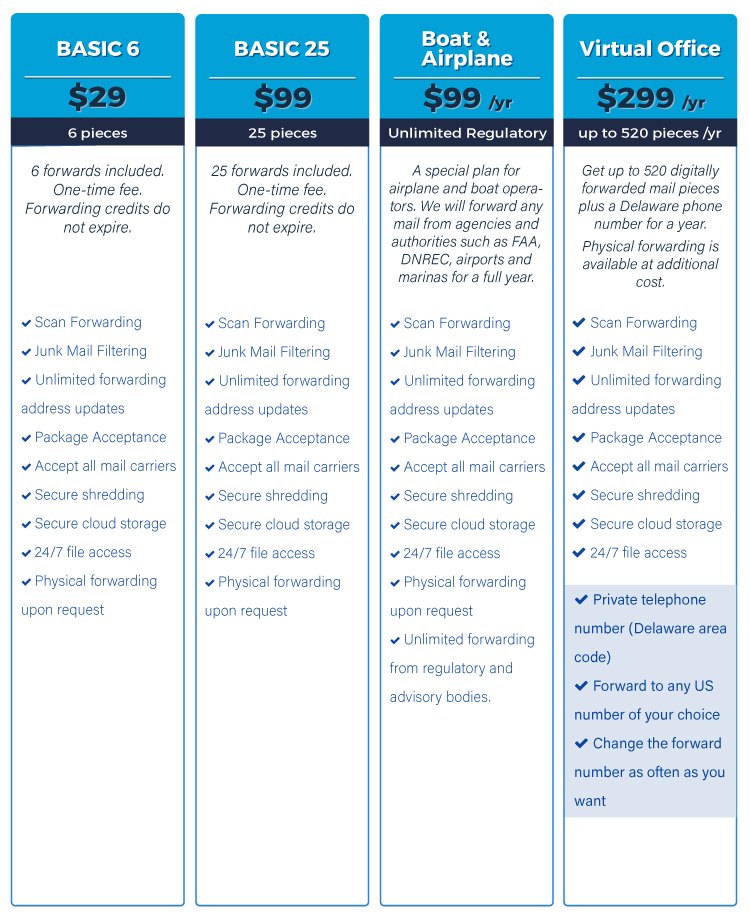

New Delaware Mail Forwarding & Virtual Office Services

By

Michael Bell

Monday, August 28, 2017

We have completely rethought and revamped our Mail Forwarding services here at Harvard Business Services. We now offer four services that are more tailored towards your business needs and the best part is we came up with new pricing... Read More

We have completely rethought and revamped our Mail Forwarding services here at Harvard Business Services. We now offer four services that are more tailored towards your business needs and the best part is we came up with new pricing... Read More

We have completely rethought and revamped our Mail Forwarding services here at Harvard Business Services. We now offer four services that are more tailored towards your business needs and the best part is we came up with new pricing... Read More

We have completely rethought and revamped our Mail Forwarding services here at Harvard Business Services. We now offer four services that are more tailored towards your business needs and the best part is we came up with new pricing... Read More