The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups, cryptocurrency, venture capitalism and general business topics.

Podcasts We Love: How I Built This, Instacart App

By

Veso Ganev

Monday, May 1, 2017

Next up in our ongoing series Podcasts We Love is “How I Built This” on NPR. This episode focuses on Apoorva Mehta, founder of the Instacart app... Read More

Next up in our ongoing series Podcasts We Love is “How I Built This” on NPR. This episode focuses on Apoorva Mehta, founder of the Instacart app... Read More

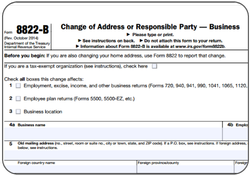

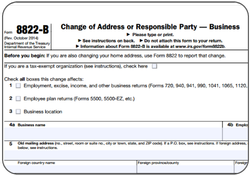

What Is IRS Form 8822-B?

By

Andrew Millman

Tuesday, April 25, 2017

For many LLCs, the member(s) may never change. Usually, these are simply internal matters addressed within the LLC Operating Agreement. Sometimes, however, you may need to alert the IRS about changes within your LLC... Read More

For many LLCs, the member(s) may never change. Usually, these are simply internal matters addressed within the LLC Operating Agreement. Sometimes, however, you may need to alert the IRS about changes within your LLC... Read More

Foreign Qualify a Delaware Company in Tennessee

By

Devin Scott

Monday, April 17, 2017

.svg.png) Your Delaware company can operate legally in Tennessee, as long as you file for Foreign Qualification and stay in compliance in both states... Read More

Your Delaware company can operate legally in Tennessee, as long as you file for Foreign Qualification and stay in compliance in both states... Read More

.svg.png)

Why Startups Should Consider Using Bitcoin

By

HBS

Monday, April 10, 2017

Bitcoin is a type of digital currency in which encryption techniques are utilized to regulate the generation of unites of currency and verify the transfer of funds, without any bank, financial institution or government involvement... Read More

Bitcoin is a type of digital currency in which encryption techniques are utilized to regulate the generation of unites of currency and verify the transfer of funds, without any bank, financial institution or government involvement... Read More

Operate a Delaware Corporation in Wisconsin

By

Devin Scott

Monday, March 27, 2017

If you would like to operate your Delaware corporation in Wisconsin, you must first file for Foreign Qualification, pay a fee and provide a Delaware Certificate of Good Standing... Read More

If you would like to operate your Delaware corporation in Wisconsin, you must first file for Foreign Qualification, pay a fee and provide a Delaware Certificate of Good Standing... Read More

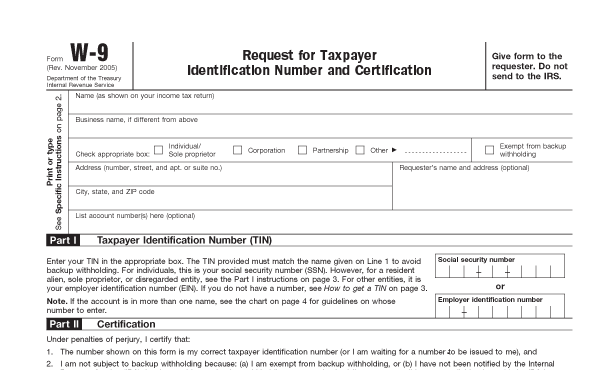

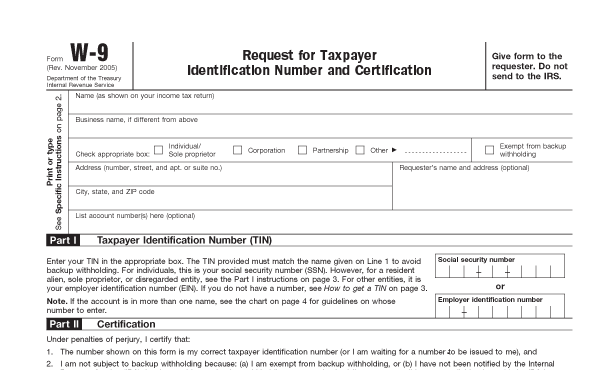

W9 Form: When and Why to Use It

By

Andrew Millman

Monday, February 20, 2017

The W-9 is typically used to request tax information from freelancers, independent contractors and other self-employed people... Read More

The W-9 is typically used to request tax information from freelancers, independent contractors and other self-employed people... Read More

How to Do Business in Wyoming with a Delaware Company

By

Devin Scott

Tuesday, February 14, 2017

If you would like your Delaware LLC or corporation to operate in the state of Wyoming, you will have to file for Foreign Qualification in order to be granted the authority to do business in Wyoming from the state... Read More

If you would like your Delaware LLC or corporation to operate in the state of Wyoming, you will have to file for Foreign Qualification in order to be granted the authority to do business in Wyoming from the state... Read More

Proof Delaware Is The Most Corporate-Friendly State

By

HBS

Monday, February 13, 2017

The Delaware Division of Corporations 2015 Annual Report is out and proves, yet again, that Delaware is the best state to incorporate your business in... Read More

The Delaware Division of Corporations 2015 Annual Report is out and proves, yet again, that Delaware is the best state to incorporate your business in... Read More

Angel Investing: Words of Wisdom from David S. Rose

By

Rick Bell

Monday, February 6, 2017

As of now, after more than 25 years of investing in more than 100 start-up companies, David S. Rose is recognized by just about everybody as one of the world’s most active angel investors... Read More

As of now, after more than 25 years of investing in more than 100 start-up companies, David S. Rose is recognized by just about everybody as one of the world’s most active angel investors... Read More

Delaware Corporation Doing Business in Massachusetts

By

Devin Scott

Monday, January 30, 2017

Many corporations that are headquartered elsewhere incorporate in Delaware in order to take advantage of Delaware’s corporate law structure, which is known for providing the best corporate liability protection... Read More

Many corporations that are headquartered elsewhere incorporate in Delaware in order to take advantage of Delaware’s corporate law structure, which is known for providing the best corporate liability protection... Read More