Delaware LLC vs Corporation

Are you ready to start a Delaware business, but are unsure which entity type is best for you? Our team at Harvard Business Services, Inc. will help you choose: LLC vs Corporation. There are three major differences between LLCs and corporations in Delaware: governance, taxation and privacy.

Learn more about each to help you decide whether a corporation or LLC is right for you.

1. Governance Structure

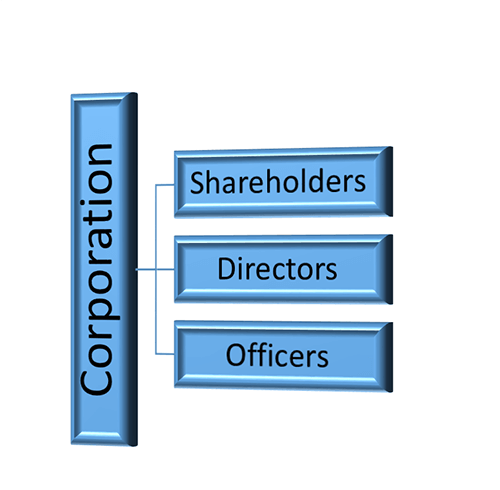

The principal difference between a corporation and an LLC is the governance structure.

Governance for Corporations

A corporation is structured with three tiers of power: Shareholders, Directors and Officers. This structure is prescribed by Delaware Corporation Law and cannot be changed.

The duties of each tier, and the relationship between them, are also designed by Delaware law.

The shareholders are the owners of the company; they invest money by purchasing stock, thus becoming owners. Once shareholders buy stock, they become entitled to two specific rights: 1) one vote per share in stockholder votes; and 2) their pro rata share of the dividends when the Board of Directors declares a distribution of profits in the form of shareholder dividends.

Governance for LLCs

An LLC is governed by a contract between all the members, called an Operating Agreement. The Operating Agreement is binding on all signatories, and all members of the LLC must sign it. Some of the specific issues an LLC's Operating Agreement may determine are:

- Member interests

- LLC interests

- Capital accounts

- Management rights and responsibilities

- Contributions to the company (financial or otherwise)

- Allocation of profits and losses

- Distributions

- Liquidation rights, procedures and distributions

- Fiduciary duty

- Dissolution procedures

An LLC can customize their own operating agreement, or you can use one of our LLC Operating Agreement Templates to speed up the process.

An LLC's default structure consists of members and one manager. The members may manage the company themselves or they may hire an external manager.

The organizational formalities of an LLC are much more casual than in a corporation; there is no Board of Directors in an LLC, thus no Board of Directors meetings. LLC members (owners) do not need to hold regular meetings and therefore don't need to record meeting minutes or submit state annual reports.

2. Federal Taxation for Corporations vs LLCs

The second substantial difference between incorporating vs forming an LLC is federal taxation.

Taxation for Corporations

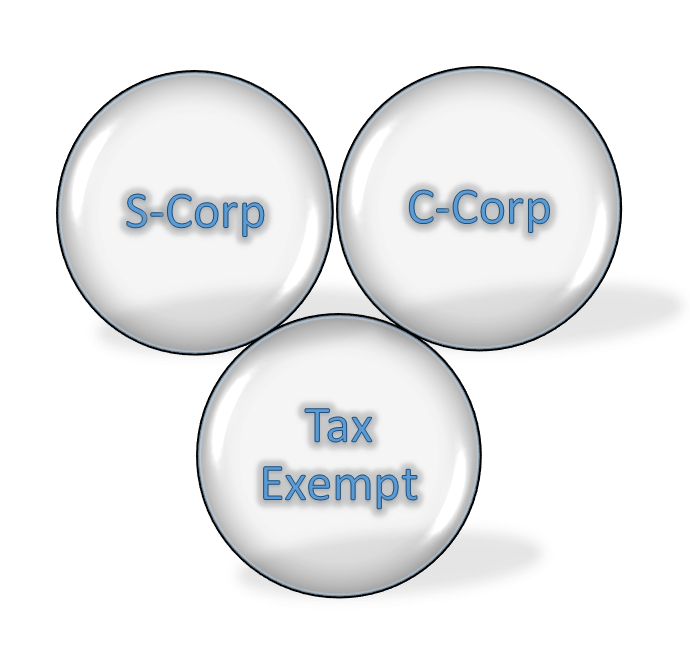

Those forming a corporation can choose one of three IRS taxation options: c corporation, s corporation, or non-profit.

C Corporations

The default classification is called a C corporation. This type of company pays taxes on its profits each year and may choose to distribute dividends to its shareholders.

When shareholders receive a dividend, they pay individual tax on the money. If the shareholders are a small, tight-knit group, this is often referred to as double taxation.

S Corporations

An S corporation is a tax status for a C corporation, an S corporation offers limited liability protection to its shareholders, meaning their personal assets will be protected from litigation and business expenses. However, S corporations eliminate double taxation.

In order to avoid double taxation, a corporation with fewer than 100 shareholders can elect Subchapter S tax status by filing IRS Form 2253 within 75 days of its formation date, or in subsequent tax years.

A subchapter S company is often referred to as an "S corporation." Under this form of taxation the entity does not pay taxes to the federal government. Instead, the tax liability on the profits and losses of the company are "passed through" to the shareholders of the company in their pro-rata share of the company. Then, the shareholders must pay the taxes.

Please note: non-U.S. citizens cannot apply for S corporation status.

Tax Exempt / Non-Profit

The third taxation option for a corporation is tax exempt status, which turns the corporation into a non-profit company. To gain tax exempt status, the company must file IRS Form 1023 and qualify for tax exempt status by engaging in a qualifying charitable, religious or public service purpose.

Taxation for LLCs

Tax classification for an LLC is initially gained by filing an application for an Employer Identification Number or EIN (also called a Federal Tax ID Number). Typically, for tax purposes, the IRS considers a single-member LLC a disregarded entity and a multi-member LLC a partnership.

To change the Entity Classification Election to a C-Corp for federal tax purposes, the company needs to file IRS Form 8832. To change the classification to an S-Corp, the company needs to file IRS Form 8832 and, simultaneously, IRS Form 2553.

Before you decide to create an LLC, learn more about the different options for Delaware LLC Tax Status to decide which option is best for your company.

3. Privacy Differences: LLC vs. Corporation

The third significant difference between a Delaware corporation and an LLC is privacy.

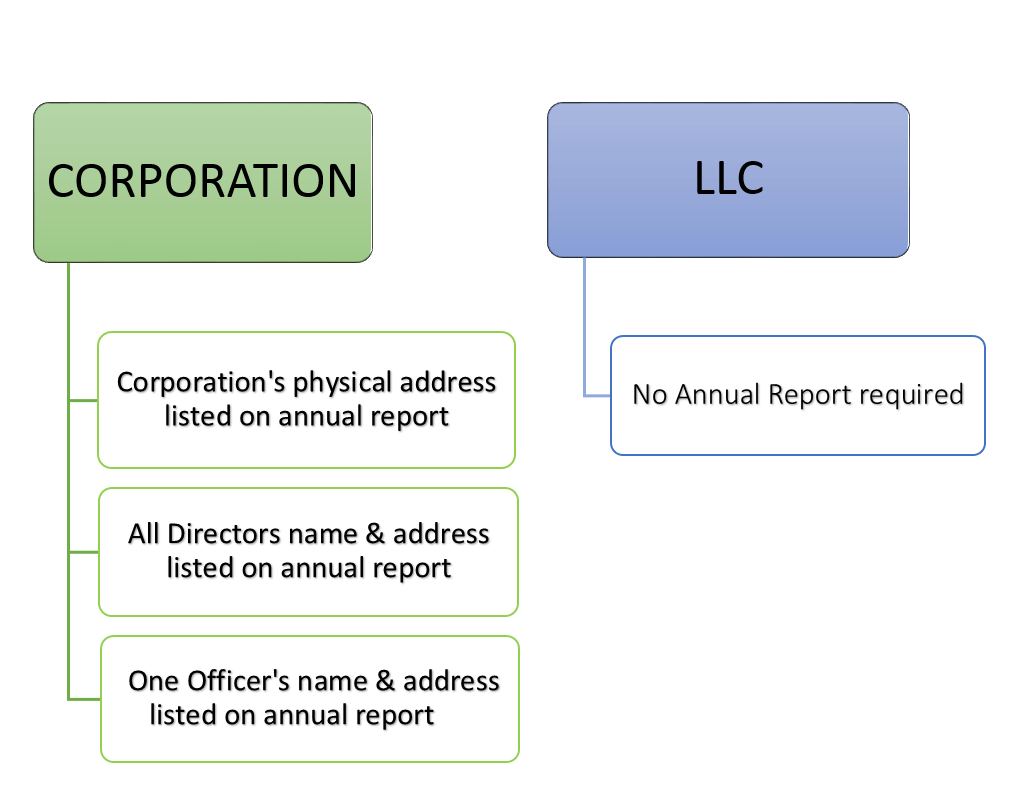

Privacy for Corporations

Privacy for Corporations

A Delaware corporation's annual report must state the name and physical address of all the Directors, the name and physical address of one officer, and the physical address of the corporation's principal place of business.

Privacy for LLCs

In contrast, the state of Delaware requires very little information in order to file an LLC; in fact, it does not require the personal names and addresses of the members/managers, and doesn't need to submit an annual report to the state of Delaware. Therefore, none of your info will exist on the public record.

All the state requires is that the LLC's Registered Agent possesses the name and address of a Communications Contact, who can be a member/manager of the LLC or merely a representative, such as the company's attorney.

Under normal circumstances, it is difficult to obtain the LLC's members' names, as they are not required to be disclosed, but if required by law, Registered Agents are obligated to disclose any and all information on record as well as all transactions with the LLC and its founders, members and representatives.

Delaware LLCs and corporations are similar in that both require state filing upon formation; both exist perpetually unless otherwise specified; and both entities shield their members/shareholders from personal liability.

What is Better for a Small Business: LLC or Corporation?

Corporation vs LLC State Filing Fees

Corporation vs LLC Liability

LLC vs Corporation ComplianceBoth corporations and LLCs have certain compliance matters to keep with in order to remain in good standing with the state of Delaware.

Corporations

- Annual report - Corporations need to file an annual report with the Delaware Division of Corporations every year

- Franchise Tax - Corporations need to pay their franchise tax by March 1 every year

- Delaware Registered Agent fee - Delaware corporations must maintain a registered agent at all times.

- Shareholder meetings - Corporations need to hold at least one annual shareholder meeting

LLCs

- Franchise tax - LLCs need to pay their franchise tax by June 1 every year

- Delaware Registered Agent fee - Delaware LLCs must maintain a registered agent at all times.

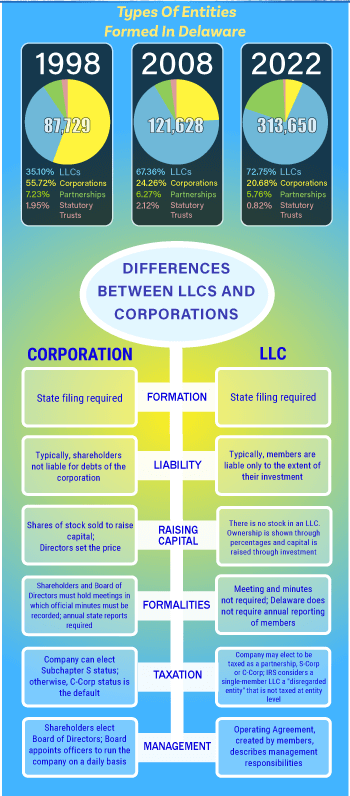

Infographic: LLC vs. Corporation

Our quick-reference infographic on the differences between an LLC and a corporation.

Our quick-reference infographic on the differences between an LLC and a corporation.

This infographic provides statistics and a quick recap of key differences, such as:

- Liability

- Raising Capital

- Formalities

- Taxation

- Management

Simply click or tap the image for the full size downloadable version.

So, LLC vs Inc.; which is best for you? Be sure to read more about the Benefits of a Delaware LLC and the Benefits of a Delaware Corporation. If you would like more information on either a Delaware corporation or LLC, please feel free to contact the experienced business formation specialists here at Harvard Business Services, Inc. You can call us at 800-345-CORP (2677) or email us.

If you are ready to form a Delaware corporation or LLC, it's easy to do so with our online order form. Our helpful staff can assist you at any point with any questions you may have.

Form a Delaware LLC or Corporation

Related Articles From Our Blog

The HBS Blog on offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups and general business topics.

Since 1981, Harvard Business Services, Inc. has helped form 430,838 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: