What Is a Limited Partnership?

A Limited Partnership is a business entity that consists of one or more General Partners and one or more Limited Partners. A General Partner may be an individual or an entity, such as a corporation, that is responsible for daily management of the company. A limited partner on the other hand is not involved in business operations and has no obligations to manage or make business decisions.

In order to form a limited partnership, you must file a Certificate of Limited Partnership with the Delaware Division of Corporations. This is a very simple form that states the name of the General Partner.

What is the Difference Between a General Partnership and a Limited Partnership?

Not to be confused with "general partners" and "limited partners," Limited Partnerships and General Partnerships are different types of entities. A Limited Partnership and a General Partnership are actually similar except for the types of partners, or owners, involved in each entity. While Limited Partnerships consist of both limited and general partners, a General Partnership will have two or more general partners and no limited partners at all.

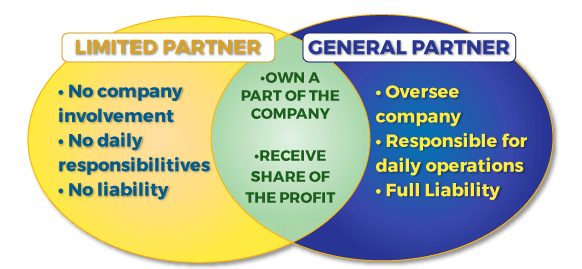

What Is The Difference Between General Partners And Limited Partners?

Typically, the General Partners are liable for any and all of the company's financial obligations, while the Limited Partners possess no liability for the company's debts, obligations or actions.

General Partners usually possess all the rights and responsibilities of managing the business entity, including all of its activities and financial matters. They also hold general liability for the debts, obligations and activities of the Limited Partnership.

On the other hand, the Limited Partners, also called Silent Partners, contribute capital but do not participate in the management of the business entity and/or its properties in any way. In fact, engaging in management activity will nullify the limitation against personal liability that a Limited Partner enjoys.

Are Limited Partnerships Pass-Through Entities?

Limited Partnerships are typically pass-through entities. This means that after the general partners and limited partners received their annual wages, they'll generally only be taxed a single time, rather than being taxed at both the corporate level and at the personal income level.

The Partnership Agreement

While a Delaware LP’s Partnership Agreement is not submitted to the state, it is still a governing document for the business. A partnership agreement outlines the rights, responsibilities, and expectations of all partners involved. While the specifics can vary, a typical limited partnership agreement will go into detail about:

- Partner Roles - The roles of general and limited partners, including their management responsibilities and liability.

- Management - Outlines the decision-making process and the authority of the general partner.

- Profit and Loss Sharing - Determines how profits and losses will be divided among the partners.

- Dispute Resolution - Establishes procedures for resolving disagreements among partners.

How to Form a Limited Partnership

Limited Partnerships are formed after submitting a Certificate of Limited Partnership with the state of Delaware. In addition to the filing fee, members of your Limited Partnership must also include the name of your business, your Delaware Registered Agent, and a list of all general and limited partners. LPs are also required to have a written partnership agreement that outlines the rights and responsibilities of the partners, as well as how profits and losses will be shared. The Limited Partnership Agreement is, however, an internal document that doesn’t need to be submitted to the state.

When Are Limited Partnerships Generally Used?

Like the LLC, the limited partnership is a creature of contract, meaning that it is flexible and subject to few requirements or terms fixed by Delaware law. However, it is used less frequently since the adoption of the Delaware Limited Liability Company Act.

Under Delaware's Uniform Partnership Act, Limited Partnerships are typically utilized for two main purposes:

- To develop commercial real estate projects where the General Partner(s) is the organizer and manager of the construction and maintenance of the project, and the Limited Partner(s) is the investor who puts up the money for the project and then gets a return from the completed project's income stream. A Limited Partner(s) is a passive investor in this scenario. Shopping malls and apartment complexes are just a few of the typical projects that might be built and managed utilizing a Limited Partnership.

- To be used as an estate planning vehicle where the General Partner(s) is the parent who holds real estate (usually commercial real estate) and the Limited Partners are the heirs of the General Partner. This type of Limited Partnership is sometimes referred to as a "Family Limited Partnership." Typically, this is used when the asset in the Limited Partnership has an income stream and the parties do not want it to be sold upon the death of the General Partner.

In both cases, if the Limited Partners comply with all laws and IRS Regulations concerning Limited Partnerships, the most they can each lose is the amount he/she invests in the partnership or the amount he/she is given in the Limited Partnership.

No court can reach into the assets of a Limited Partner in order to satisfy debts or obligations of the Limited Partnership as a business entity.

However, if a Limited Partner begins to participate in the management of the company, he/she risks personal liability, thereby reaching the same legal exposure as the General Partner(s).

Limited Partnership Compliance

In addition to the preliminary steps to form a Delaware Limited Partnership, there are a few other guidelines that the business must follow to remain compliant. Limited Partnerships in Delaware must pay the annual franchise tax and keep a Delaware Registered Agent. Delaware Limited Partnerships must also allow partners to review financial records and must hold investor meetings at least annually. For more details about how to remain in compliance, refer to the Delaware Uniform Partnership Act

Why Form a Limited Partnership?

Limited Partnerships are typically formed by individuals or corporations who want to maintain 100% of the control of an asset or project while including investors or heirs on the income from the Limited Partnership.

Limited Partnerships do not have stock or stockholders. Each Limited Partner has a specifically stated percentage of interest in the income from the entity.

Limited Partners do not receive dividends but are entitled to their share of the income. Generally, Limited Partnerships are pass-through entities, meaning that after the general partner and limited partners receive their income, they typically are taxed on it a single time. Some other business entities experience double taxation, being taxed at the corporate level and at the personal income level.

Delaware Limited Partnerships may have any number of limited partners.

Advantages of a Limited Partnership

- Personal asset protection for Limited Partners.

- Pass-through taxation treatment by the IRS.

- General Partner holds 100% control of the entity and its assets.

- Investment potential for passive investors includes long-term rents.

- Heirs can receive payments without receiving assets, thus minimizing estate tax consequences while preserving the income stream.

For even more detailed information on forming a Limited Partnership, check out Harvard Business Services Inc.’s limited partnership formation packages, then form an LP with our easy-to-use order form. You can also click on the button below to get started.

Form a Limited Partnership Now

Since 1981, Harvard Business Services, Inc. has helped form 430,354 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: