Airplane Protection: Aircraft LLCs & Corps

If you own an airplane as an individual, you're putting your personal assets at risk. In the case of an accident or incident involving the plane, the owner of the aircraft could be personally liable for the damages. However, you can legally separate your plane from your other assets by placing your airplane in a Delaware LLC or corporation. This form of asset protection for airplane owners is an important strategy to separate your plane from your other assets, and will protect your bank accounts, home, cars, and more in the event of a lawsuit involving your plane.

At Harvard Business Services, Inc., we have more than three decades of experience forming Delaware companies for people who want to protect their assets. Forming a corporation or LLC for aircraft ownership is a common way to create a corporate veil and protect both you and your plane. However, we are not a law firm and cannot give legal advice. Please do not consider our services legal advice. If you need legal advice on asset protection for plane owners, please consult an attorney.

Read on to learn more about why other airplane owners have chosen to protect their assets by incorporating a plane in Delaware, as well as how the process works.

Why Incorporate Your Plane

Fortunately, airplane crashes are rare. Unfortunately, those that do occur are almost always catastrophic. If such a catastrophe involves an airplane owned by you personally - a plane in your name and not owned by another entity-your personal assets will be at risk. One of the main benefits of airplane registration, specifically into a Delaware LLC or Delaware corporation, is the ability to shield your personal assets from the consequences of a crash or other issues involving your plane. If you are sued for an accident that wasn't your fault, a Delaware airplane LLC or corporation will provide another layer of protection that complicates the plaintiff's lawyer's task. Because of the airplane LLC, only the assets within the LLC or corporation will be at risk. This extra layer of protection may cause the lawyers to reconsider suing you personally, or may be an inducement for them to attempt to reach a settlement.

Creating an LLC for airplane ownership can provide an additional layer of protection for the actual owners of the aircraft. The ownership information of the LLC is not stored in any database with the Delaware Division of Corporations or Harvard Business Services, Inc. To the public, this means that the entity is owner of the aircraft, rather than the individual. This can be significant consideration for high-profile individuals seeking discretion.

Why Incorporate Your Plane With Us

Why incorporate your plane with us? We make the process easy for you and don't overcharge you, unlike other companies. Instead of assessing a special "airplane owner's price," which is code among some other services for a higher rate, we offer you our normal low $50 per year registered agent fee, and a special low rate for FAA mail forwarding.

We also understand the special needs of airplane owners. One example: We have the expertise to prioritize your mail, i.e., which pieces to send to you immediately and which ones to discard. Through our FAA mail service, we process all Airworthiness Warnings as well as all mail from the FAA on a same-day basis. However, we spare you the time and bother of excess promotional and junk mail.

How to Incorporate Your Plane

Once you've decided to make a corporation or LLC for aircraft ownership you need to know how to incorporate your plane in Delaware. The first step is to determine which type of entity is right for you. Typically, U.S. clients who own an airplane form an LLC for asset protection, while the FAA requires non-U.S. airplane owners to form a corporation.

The following are strategies used by our customers to protect their assets, depending on whether they own one plane or multiple planes.

If you own one plane...

There are several ways to approach the process of incorporating a plane that will be for personal use, but this is one method that can be used: Form an LLC and purchase your plane under that LLC's name. This aircraft LLC will protect you on multiple levels—the plane is separated from your personal assets in the event of a lawsuit aimed against you personally, and your personal assets are protected in the event of a lawsuit involving the plane.

If you own more than one plane...

Some airplane owners who own multiple planes choose to form one Delaware corporation for aircraft and place the ownership of all the planes in that corporation. While this arrangement provides a level of liability protection for plane owners and is preferable to a sole proprietorship, it still leaves the corporation vulnerable to losing all its other assets and planes in a lawsuit resulting from an accident involving one plane.

Forming multiple entities so that each one owns a single plane is the safest method of asset protection for airplane owners, and one that large transportation companies—including major airlines—employ. Creating multiple airplane LLCs offers the most protection from lawsuits and is a common form of asset protection for airplane owners. Here's how it works:

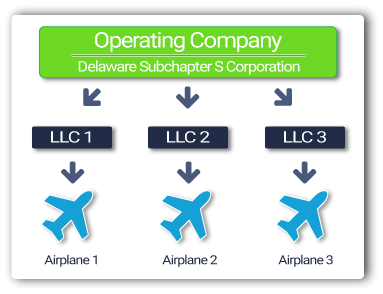

To use this strategy, form a Delaware subchapter S corporation. This entity is your operating company, the one you use with customers and suppliers. Your subchapter S corporation gives you tax benefits while separating your personal assets from your flying business, protecting them from the business's potential liabilities.

This subchapter S corporation doesn't own any of the planes. Instead, each plane is owned by and titled in the name of a separate Delaware aircraft LLC and leased to your operating company under a separate contract. As a result, if one plane is involved in a lawsuit, the other planes, each in their own LLC, can keep flying without being grounded or sold.

Pursuing Asset Protection as a Plane Owner

Why are airplane LLCs utilized? They are tax-free companies with strong liability protection. If you set them up correctly, you won't need to file separate tax returns for each.

Forming a Delaware LLC for aircraft ownership is one of the most popular ways to protect your assets. It's wise to consult with your attorney and accountant first, and then rely on us to handle the details of filing and maintaining your company.

Ready to form your Delaware corporation or LLC for an aircraft now and protect your assets? Click on the button below to register your aircraft into an LLC or corporation. The process only takes a few minutes!

Protect Your Plane. Form a Company.

Since 1981, Harvard Business Services, Inc. has helped form 430,780 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: