Why Delaware Corporate Law Divides Power Between Shareholders, Directors, and Officers

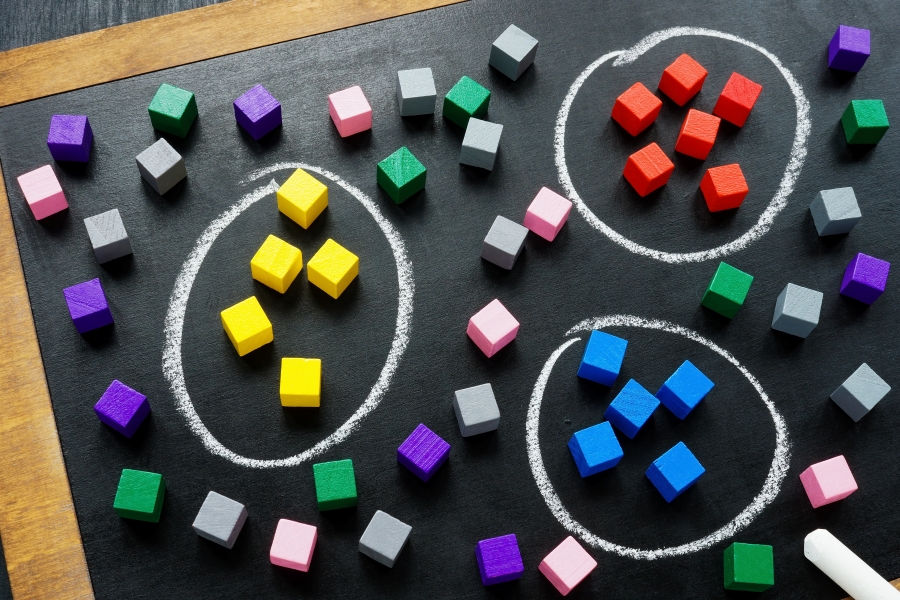

If you have ever looked closely at how a Delaware corporation is structured, you may notice something that feels very intentional. Corporate power is not concentrated in one place. Instead, it is divided across three distinct groups: shareholders, directors, and officers.

If you have ever looked closely at how a Delaware corporation is structured, you may notice something that feels very intentional. Corporate power is not concentrated in one place. Instead, it is divided across three distinct groups: shareholders, directors, and officers.

That design is not accidental. Delaware corporate law has spent over a century refining a system that balances authority, accountability, and flexibility. The result is a structure that works just as well for a small, closely held company as it does for a Fortune 500 corporation.

Let’s break down why Delaware uses three tiers of power and why it matters.

Tier One: The Shareholders (The Owners)

Shareholders are the owners of the corporation. They invest capital, take on risk, and ultimately benefit from the company’s success. But in Delaware, ownership does not mean day-to-day control.

Shareholders typically vote on big-picture items, such as:

- Electing and removing directors

- Approving major corporate changes like mergers or dissolutions

- Amending the certificate of incorporation or bylaws

This limited but powerful role is intentional. Delaware law allows shareholders to protect their ownership interests without requiring them to manage the business themselves. That separation is especially important as companies grow or add more investors.

Tier Two: The Board of Directors (The Decision Makers)

The board of directors sits at the center of Delaware’s corporate structure. Under Delaware law, the board is responsible for managing, or directing the management of, the corporation’s business and affairs.

In practical terms, the board:

- Sets the company’s overall strategy

- Appoints and oversees officers

- Makes major financial and operational decisions

- Acts in the best interests of the corporation and its shareholders

This middle tier exists to create accountability. Directors are not owners in the same way shareholders are, and they are not involved in daily operations like officers. Their role is to provide oversight, judgment, and long-term direction.

Delaware’s legal framework gives boards significant authority, but also clear duties. That balance is one of the reasons investors and entrepreneurs alike are comfortable operating under Delaware Corporate law.

Tier Three: The Officers (The Operators)

Corporate officers handle the day-to-day operations of the corporation. Titles like President, CEO, CFO, and Secretary exist to turn strategy into action.

Officers:

- Run the daily business

- Execute contracts and transactions

- Hire employees and manage operations

- Report back to the board

Delaware law generally allows corporations to customize officer roles through bylaws and board resolutions. That flexibility is critical.

For many startups, especially in the early stages, this structure is far more practical than it may sound. One individual can hold all officer positions, serve as the sole director, and be the only stockholder. That person can be located anywhere in the world and does not need to be a US citizen or US resident.

In other words, a Delaware corporation can legally begin with a single founder acting as the entire company, then add investors, directors, and officers over time as the business grows.

Why Delaware Divides Power This Way

The three-tier structure is designed to prevent any single group from having unchecked control.

- Stockholders provide capital and oversight without operational burden

- Directors focus on strategy and accountability

- Officers concentrate on execution and management

This separation reduces risk, encourages professional management, and creates clear lines of authority. It also allows corporations to scale smoothly as ownership and operations become more complex.

For Delaware corporations, this structure is a feature, not a formality. It is one of the reasons Delaware remains the preferred jurisdiction for incorporation in the United States.

A System Built for Flexibility

Perhaps the most important part of Delaware’s three-tier system is how adaptable it is. Through certificates of incorporation, bylaws, and board actions, corporations can fine-tune how power flows between stockholders, directors, and officers.

That flexibility allows Delaware corporations to evolve without constantly rewriting the rulebook. The framework stays the same, even as the business changes.

Delaware’s three tiers of corporate power are not about bureaucracy. They are about balance. By clearly defining who owns, who decides, and who operates, Delaware corporate law creates a structure that supports growth, protects stakeholders, and stands the test of time.

Forming a Delaware corporation does not need to be complicated or expensive. Harvard Business Services has been helping businesses form Delaware entities for almost 50 years!

Our registered agent fee is $50 per year, a rate that has never increased since 1981 and is guaranteed never to go up.

Whether you are starting out on your own or planning for future growth, Delaware offers a flexible foundation. To get started creating your new company, call our team or complete the application online at www.delawareinc.com/order.

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.