The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups, cryptocurrency, venture capitalism and general business topics.

Public Benefit Corporation

By

Rick Bell

Tuesday, November 5, 2013

What is a Delaware public benefit corporation? Harvard Business Services, Inc. outlines the facts on a public benefit corporation... Read More

Forfeited Companies May Still Owe Taxes

By

Amy Fountain

Monday, October 28, 2013

If your company is under forfeited status, you may still need to pay an annual franchise tax fee. Here’s why... Read More

The Delaware Court of Chancery Faces Change

By

Brett Melson

Monday, October 21, 2013

Chief Justice Myron Steele is retiring from the Delaware Court of Chancery. See why people are closely watching for his replacement... Read More

Can I File a Delaware Company on My Own? [Infographic]

By

Devin Scott

Monday, September 30, 2013

People often wonder about the benefits of utilizing a business formation company to prepare and file their company formation documents as opposed to filing these documents on their own.. Read More

People often wonder about the benefits of utilizing a business formation company to prepare and file their company formation documents as opposed to filing these documents on their own.. Read More

How the New SEC Rules Can Help Businesses Get Funding

By

Kathryn Hawkins

Tuesday, September 17, 2013

Learn How the New SEC Rules Can Help Businesses Get Funding... Read More

How to Access Free Government Data

By

Kathryn Hawkins

Monday, August 26, 2013

Here are some free sources of data that can help your business... Read More

Business Credit Builder

By

Andrew Millman

Monday, August 19, 2013

Business credit builder ideas from Harvard Business Services, Inc. | Business formation services... Read More

Communicating in a Business Crisis

By

George Merlis

Monday, August 12, 2013

Does every business need a crisis communications plan? No, but a surprising number of businesses -- even small businesses -- do need such a plan... Read More

Mail Forwarding Service for Delaware Companies

By

Devin Scott

Monday, August 5, 2013

Learn more about our Mail Forwarding Service for Delaware Companies | Harvard Business Services, Inc... Read More

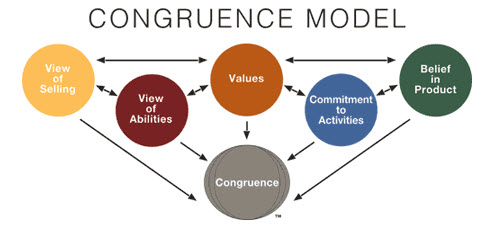

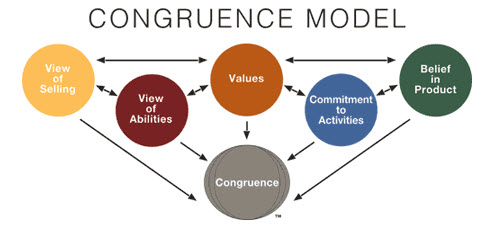

Changing Behavior for Sales Performance

By

Tom Caso

Thursday, July 25, 2013

It’s no wonder that CEOs are reluctant to invest in sales training as their experience tells them that there is little measurable ROI... Read More

It’s no wonder that CEOs are reluctant to invest in sales training as their experience tells them that there is little measurable ROI... Read More