What is the Delaware Public Benefit LLC

The Delaware Public Benefit LLC is available to entrepreneurs and investors seeking to do good while profiting. Public Benefit Corporations have been provided for under Delaware law since 2013. However, the law governing Delaware Limited Liability Companies was amended August 1st of 2018, so a little-known fact is that an LLC may elect to be a “Public Benefit LLC.” A Public Benefit LLC is a for-profit entity; however, in operating a Public Benefit LLC, the LLC’s management can consider social, economic and political considerations without violating its fiduciary duty to act in the best interests of the company.

A Public Benefit LLC may consider several factors—the effect of action on the company’s employees, a neighborhood or region in which the company operates, certain minority groups or special interest groups, environmental concerns stemming from corporate action or inaction, or the desire to avoid perceived mistreatment of a group of persons—without being in breach of its financial obligation to act in the best interests of the company.

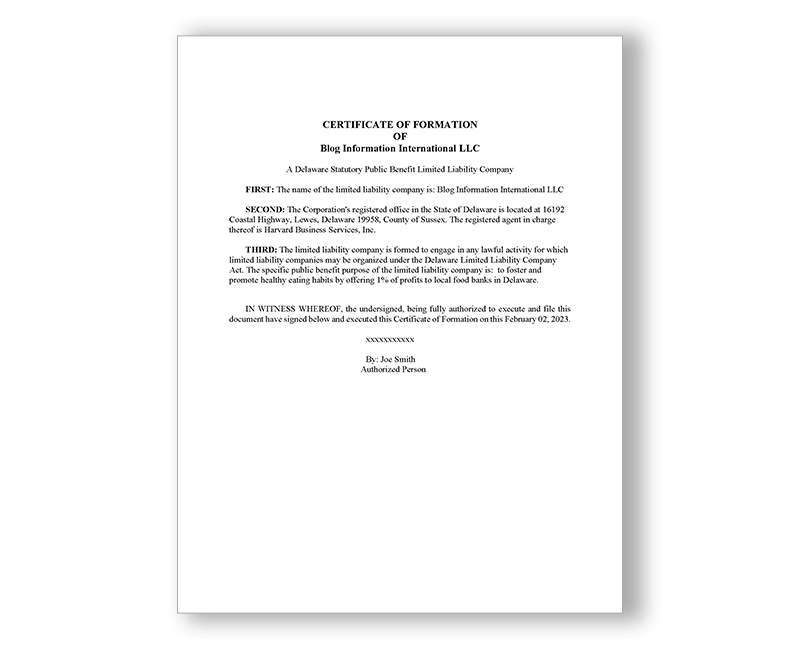

An LLC wishing to elect Public Benefit status must include a Public Benefit Statement in its Certificate of Formation and cannot elect to terminate its status without a two-thirds vote of the members. In addition, the LLC’s limited liability company agreement should articulate in detail the “public benefits” that management may consider in operating the LLC. Clear articulation of public benefit factors provide the LLC with greater clarity in acting within the parameters provided in the formation document.

The Certificate of Formation for the Public Benefit LLC will need to contain the following:

- Will clearly state the LLC is a Public Benefit LLC; however, the name of the LLC does not need to contain PB or Public Benefit LLC since that will be clearly visible on the Certificate of Formation.

- Indicate one (or more) public benefit purpose(s) or goal(s) the company will specifically promote. These should be artistic, charitable, cultural, economic, educational, environmental, literary, medical, religious, scientific and/or technological in nature.

- All the other information typically required on a LLC’s Certificate of Formation is also needed, such as the name of the Authorized Person and the name and address of your Delaware Registered Agent.

Every two years, a Public Benefit LLC must provide its members with information regarding its advancement of the public benefit(s) it seeks to promote, which must include:

- The objectives that have been established to promote the LLC’s stated public benefit goals.

- The standards the LLC is using to assess its progress in promoting its stated public benefits.

- An assessment of the LLC’s success in meeting its objectives and progress goals.

The advantage of a Public Benefit LLC comes largely in the way that it can be marketed. By formally electing the Public Benefit LLC status, members of the LLC show a level of commitment to the public benefit(s) selected and provide investors with a standard of expectations and guidelines. It is true that what is provided for in the statute governing a Public Benefit LLC could be accomplished through a standard LLC Operating Agreement. However, founders who choose a Delaware Public Benefit LLC add a formal qualification to their company—one that can be touted when seeking investors or with potential customers.

The annual fees for maintaining a Public Benefit LLC, after the first year, include our $50 Registered Agent Service fee and the $300 Delaware Franchise Tax, that franchise tax is typically the only tax paid to Delaware if not physically here in Delaware operating.

Harvard Business Services, Inc. can assist with the formation of the Public Benefit LLC, however currently our website does not have the option to create the entity online. To proceed please call us at 800 345 2677 ext 6900 or email info@delawareinc.com with any questions, it is our pleasure to assist!

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.