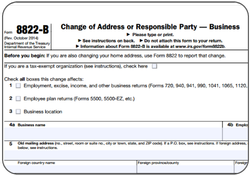

What Is IRS Form 8822-B?

The world changes. People change. The people with whom you do business change. Business partners change. More specifically, members of Delaware LLCs change. Sometimes it happens early and often, an absolute necessity as the business grows and things expand.

Other times, an LLC’s membership only changes once or twice in a generation. For many LLCs, the member or members may never change. Usually, these are simply internal matters addressed within the LLC Operating Agreement. Sometimes, however, you may need to alert the IRS about changes within your LLC.

The IRS 8822B form is traditionally used when you update the information that was provided on the SS4 application when you originally applied for a Federal Tax ID Number (EIN). The IRS created and implemented the use of the Change of Address or Responsible Party Form 8822-B on January 1, 2014. It requires the 8822-B Form to be filed within 60 days of any changes to the following:

- Principal Place of Business

- Business Mailing Address

- Name/Title of the Responsible Party

Any specific questions you may have on the 8822-B filing will be best answered by an authorized IRS representative, they can be reached either by phone at 800-829-4933 or online.

When a business owner applies for a Federal Tax ID Number for an LLC, the IRS Form SS4 requires the name, address, title and signature of the responsible party. The SS4 also requests the number of members, the number of expected employees, company’s start date and the nature of the business.

A Federal Tax ID Number (EIN) is often one of the requirements for both domestic and international business owners to open bank accounts, merchant accounts, hiring employees, paying taxes and setting up payroll and vendor accounts. In short, the EIN is the equivalent of a social security number for a business.

We suggest you consult with a tax professional for all specific tax concerns, including but not limited to tax filings, tax elections, S corporation elections, payroll, accounting, handling of profits/losses, end of year income tax returns, tax exemptions, tax deductions and what you need to do in order to expeditiously open your new business bank account or merchant account for a startup company.

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.

There are 3 comments left for What Is IRS Form 8822-B?

Jason said: Tuesday, July 4, 2023Hi, I have an S Corp and need to change the telephone contact number to my business with the IRS. Would the 8822-B be the form I would use to note that change? Thanks

HBS Staff replied: Thursday, July 6, 2023Yes, that is the form that you would submit to the IRS to update any contact information.

Vasu Sharma said: Thursday, February 4, 2021Hi, I have a LLC registered in Delaware. It was a multi member LLC with two members, taxed as partnership. Recently one of the members, also a responsible party in EIN application, had exited the LLC. Will filing Form 8822-B make the changes? Do we also need to file Form 8832 to report change in tax election since the LLC was earlier taxed as partnership and now is a single member LLC taxed as sole proprietorship?

HBS Staff replied: Thursday, February 4, 2021Hello Vasu,

Thank you for reading our article. While we can help with what form you may need for a situation. Regarding how the LLC is taxed it is best to speak with an Accountant.

Osman A. said: Wednesday, March 11, 2020Hi I have a single-member LLC. I want to add a new member and pass the EIN number on the new member. While LLC was a single member, the number of LLC members was 1 in SS-4 form. How can I put the EIN number on the new member? And how can I change the SS-4 form? Do I need to report this to the IRS? Should we file a form with 8832 IRS?

HBS Staff replied: Friday, March 13, 2020Typically, our clients in this situation will add the new member to their LLC, then file the 8822-B form to change the EIN Responsible Party with the IRS. The IRS generally does not require a new SS-4 form to be filed, but you can speak to them directly if you are unsure.