Can You Have Multiple Businesses Under One LLC?

Sometimes, forming one business just isn’t enough. When you have several amazing business ideas that can change the world, you might be tempted to form several LLCs at the same time. However, as you pursue the path of business ownership, several questions may arise. What type of business activity can I conduct with my LLC? How many different businesses can I operate under one LLC? Will a Series LLC work for me?

Depending on the scope of your individual businesses, the answers to your questions may vary. Operating multiple businesses under a single LLC is an option, but you may also want to consider a few alternatives. First, let’s review the basics.

Can You Operate Multiple Businesses Under One LLC?

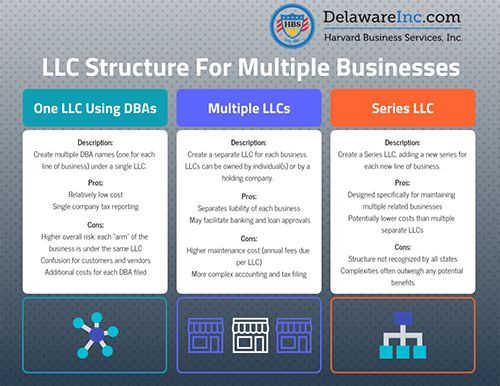

Yes, you can operate multiple businesses under one LLC. This setup allows all business activities to be managed under a single legal entity, which can simplify administration and reduce formation costs. However, it’s important to understand that all operations under the LLC share the same legal and financial liability, meaning if one business faces a lawsuit or debt, the others could be affected.

Using Multiple DBAs Under One LLC

To run different businesses under one LLC, many entrepreneurs file for DBAs, or “Doing Business As” names (also called Fictitious Name Statements). A DBA lets your LLC legally operate under multiple brand names without forming new legal entities. For example, if a business owner has a trucking company incorporated as an LLC, they could also host a real estate service with a separate DBA. These are two completely different types of businesses, so it might be surprising that the owner can provide both services under one LLC. Just keep in mind that all DBAs remain tied to the same LLC and share tax reporting and liability.

This structure will help reduce startup costs and annual fees, but it’s important to maintain clear internal records and branding for each business to avoid confusion. Some LLCs even use separate bank accounts under one LLC for cleaner bookkeeping.

However, just because it’s possible to operate an LLC with multiple businesses doesn't mean you should, as there can be downsides. For example, if a lawsuit is filed against any one of the businesses, the assets of the others could be at stake. The result is that you put yourself at a higher degree of liability risk. As the old adage says, "Do not put all your eggs in one basket."

Using a Series LLC

Some people choose to explore the low-cost series LLC when they want to operate several different businesses. This option is very enticing, as it only calls for one annual Franchise Tax payment to the State of Delaware and one annual Registered Agent Fee.

However, the Series LLC is still quite uncommon, so a variety of hurdles can arise while operating your business. Many service providers, banks, attorneys, and accountants are still unfamiliar with the series concept. It often takes time to explain the series concept and to obtain approval for documentation that you’ve requested, for example, from a bank's lending group. Nevertheless, it is generally considered safer and smarter for people to keep their business ventures completely separate from one another by forming an LLC for each aspect of a business. In essence, what you are doing is creating one Delaware LLC as a holding company, and other, individual LLCs within it, yet separate from it.

Separate LLCs for Separate Businesses

As an alternative to hosting multiple DBAs or a Series LLC, many people still opt to file a new LLC for each of their start-up ventures. Owning multiple businesses under separate LLCs isolates the risk by separating each business's debts and liabilities. There are, of course, additional maintenance fees, but these can be well worth it in order to protect your businesses and offer the peace of mind that separate LLCs will afford. As it stands today, this practice is traditionally still the most highly recommended strategy by tax professionals, attorneys, and business consultants all over the world.

Sometimes this means that for every sector of the business, for each product line, for every service provided, for each piece of real estate held, business owners will consider creating another LLC. This ensures that the assets, debts, and liabilities of each LLC are completely disconnected and shielded from one another in the event of any possible litigation.

When establishing multiple LLCs, it can be extremely helpful to develop a blueprint hierarchy that will coincide with the relationship of the respective LLCs. For example, people typically set up numerous LLCs for real estate development. This framework often consists of one parent LLC at the top of the hierarchy and multiple sibling LLCs, one for each piece of actual real estate.

Each LLC may own, manage, and be responsible for a single piece of property; thus, while all the LLCs share the same holding company and may possess similar structures, assets, and liabilities, they are shielded from one another in order to protect the properties and resources of each individual LLC.

How to Structure Your Business

So, do you need a separate LLC for each business? Not always, but there are a few factors to consider. If your businesses are small, low-risk, or closely related, consider operating them under one LLC with separate DBAs. For more legal separation without the cost of forming multiple entities, a Delaware Series LLC may be more attractive. For maximum protection, especially if your businesses carry different risk levels or involve substantial assets (like real estate), forming separate LLCs is often the safest solution.

If you would like more information or have any questions about forming your own companies or adding another business under the parent LLC, please contact us by phone (800-345-2677), Skype (DelawareInc), email or live chat. One of our knowledgeable business startup specialists will be happy to assist you. Alternatively, read on for a list of FAQs.

How many DBAs can an LLC have?

An LLC can technically have any number of DBAs under its umbrella. As long as each DBA is registered separately with the Delaware Division of Corporations and you pay a filing fee for each name, you can continue to add new DBAs.

What states allow Series LLCs?

There are currently over a dozen different states that allow you to form a Series LLC. Delaware does allow them, and was even the first state to introduce the Series LLC structure back in 1996. Other states include Illinois, Texas, Nevada, and Wisconsin.

Can an LLC own another LLC?

Yes, an LLC can own another LLC. Such cases are referred to as a parent-subsidiary relationship, where the parent LLC holds ownership in a subsidiary LLC. In these scenarios, the parent will have control of the subsidiary’s operations while remaining a separate legal entity.

Next: How to Create and Use a DBA

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.

There are 27 comments left for Can You Have Multiple Businesses Under One LLC?

Mokgohlwa said: Monday, March 12, 2018Hi, what is the procedure of combining two or three different businesses?

HBS Staff replied: Monday, March 12, 2018Typically, a DBA is set up with the state and/or county that you are operating out of. Before setting up the DBA, your home jurisdiction may require you to foreign qualify there, if you have not done so already. We are not able to file the DBA, but we are more than happy to assist with the foreign qualification.

Your business is considered domestic to the state where formed, and foreign in all other States. To take advantage of the strong corporate law structure, Delaware is by far the most popular domestic choice.

If your business will have a physical presence by operating, hiring employees, banking or even holding an asset in a state other than its state of incorporation, clients will often qualify the business to operate in that state.

The foreign qualification process enables a company to transact business in a jurisdiction other than where it was formed. By failing to comply with local compliance issues, you may be putting the protection of your company at risk.

For further information on the DBA visit https://www.delawareinc.com/blog/dba-or-doing-business-as/

For more information on the foreign qualification process https://www.delawareinc.com/blog/what-is-foreign-qualification/

R said: Saturday, December 2, 2017

I own parts of 4 restaurants, all S-Corps. Core partners are the same but a couple have additional ones. I am not listed as an officer in any of them. Should I force the issue? Does it impact my tax benefits? Or is my tax status affected for my umbrella LLC just formed now by me as only member affected at all? I will likely add equity positions in other industries over time under the umbrella LLC.

HBS Staff replied: Monday, December 4, 2017Thanks for reading our blog. Unfortunately, we can't answer your questions as they are out of our realm of experience. A tax professional and/or a lawyer would be better suited to help you.

Miles Fidelman said: Wednesday, November 1, 2017Is this not the whole point of Series LLCs? Has the status been clarified at all when it comes to tax treatment, and filing requirements when operating in other states notably MA?

HBS Staff replied: Thursday, November 2, 2017The Series LLC is treated as a single entity that can have different series or classes internally in the LLC. Each series can hold its own assets, have its own members and conduct its own operations yet remain insulated from claims of members, creditors or litigants pursuing the assets of, or asserting claims against, another series. Typically, each series is considered a separate entity for the purposes concerning the federal taxation of the entity. Many accountants or tax professionals are still not familiar with the structure adding to the many uncertainties that make it difficult to actually utilize a series LLC

If physically operating the Delaware Series LLC in MA, people typically qualify the entity there as a foreign LLC. The entire process to qualify the Delaware Series LLC there only takes a couple of business days on average.

Naimah Makor said: Friday, October 20, 2017I just applied for an EIN # to sell handmade crafts, but I also want to see products on Amazon. Do l need another EIN #?

HBS Staff replied: Friday, October 27, 2017Traditionally, the IRS will only issue one EIN per company. Generally, clients consult with a tax professional in order to determine if anything additional is needed to become an Amazon vendor, just to be on the safe side.

Andeywala said: Monday, July 24, 2017

Thanks for sharing up–to-date on this subject! I find it is very informative and very well written one! Keep up on this quality!

HBS Staff replied: Monday, July 24, 2017Thank you and we're glad you are enjoying our blog.