Asset Protection for Truckin LLCs

As a trucking company, you're in the business of moving goods from point A to point B. But the vehicle or vehicles that transport those goods are big, heavy, fast and move among vast herds of much smaller vehicles-smaller vehicles operated by drivers of questionable skills. In the event of an accident or major liability claim, a trucker's personal assets could be at risk if they are held personally liable.

Creating a Delaware trucking LLC will allow you and your team to drive without fear of delivering damaged goods. You know from experience that accidents happen. And if one occurs involving your truck, your insurance may not cover all the expenses and damages the accident victims may seek. You need to protect your assets and finances. How can you do that? Establishing a legal business structure, such as an LLC or corporation, can often create a boundary between personal and business assets, generally ensuring that personal wealth remains protected from trucking-related claims.

At Harvard Business Services, Inc., we have been helping people form Delaware trucking companies to protect their assets for more than three decades. However, we are not a law firm and cannot give legal advice. Please consult an attorney if you need legal advice on this matter.

Learn more below about why many truck drivers choose to form a trucking corporation, form a trucking LLC, and how to incorporate your truck. You can also read about our special discount for truck drivers!

Why Incorporate Your Truck?

You likely have liability insurance to protect you in the event of an accident but it will often only protect so much if a lawsuit occurs. The fact is, plaintiff's attorneys won't stop at the limits of your insurance if the claim is large enough. If you're operating as a sole proprietorship, your personal assets—your truck, home, cars, bank accounts, real estate, and more—are typically at risk.

If you are sued for an accident that wasn't your fault, it may help to be incorporated in Delaware. A Delaware trucking corporation or trucking LLC provides another layer of protection that complicates the plaintiff's lawyer's task. This extra layer of protection may cause the lawyers to reconsider suing you personally, or may be an inducement for them to attempt to reach a settlement.

Forming a trucking LLC or corporation will also help mitigate the financial impact of equipment loss and repairs. Trucks and trailers are substantial financial investments, and any damage or mechanical failure would otherwise be very costly to repair.

Why Incorporate Your Truck With Us?

We have specialized in Delaware business formations for more than 30 years. By choosing Harvard Business Services, Inc. as the company to help you make informed decisions about incorporating in Delaware, you'll join thousands of other savvy people who have turned to Delaware as the home of their trucking LLC or corporation to help them protect their personal assets.

As an added perk, we also offer an extra five percent discount off all incorporations for members of OOIDA! Simply visit our easy-to-use incorporation order form and type in the code "OOIDA" to claim your discount. You'll be done in just a few minutes!

How to Incorporate Your Truck

The smart way to protect your assets is to form a Delaware corporation or Delaware LLC and purchase your truck in that company's name. Doing so would make your truck the property of your corporation or LLC trucking company, and therefore it would not be considered your personal property. This creates a layer of separation between your truck and your personal assets.

If you own one truck...

There are several ways to incorporate a truck, but here is one example of how it might work: Form a Delaware trucking LLC and purchase your truck under that company's name. This protects you on two levels: Your truck is out of reach in the event of a lawsuit aimed at you personally, and your personal assets are out of reach in the event of a lawsuit involving your truck.

If you own multiple trucks...

Some truck owners will incorporate their business and place ownership of all of their trucks in that one business. While this is preferable to a sole proprietorship, it puts the other trucks at risk in the event of a lawsuit involving one truck.

Here is one strategy to consider if you own more than one truck:

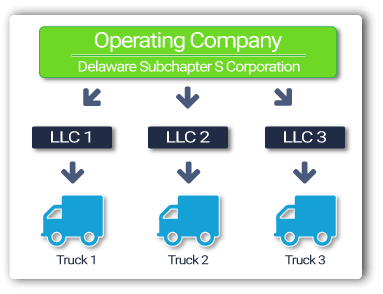

The overarching entity is a Delaware subchapter S corporation. This trucking corporation will serve as your operating company, the one you use with your customers and suppliers, and all payments flow into this company. This subchapter S corporation separates your trucking business from your personal assets but it doesn't own any of the trucks.

Instead, each truck is owned by and titled in the name of a separate Delaware trucking LLC and then leased to your operating company under a separate contract. With this structure, if one truck is involved in a lawsuit, the other trucks can keep operating. Why use LLCs? They are pass-through entities with strong liability protection. If you set them up correctly, you typically won't need to file separate tax returns for each LLC trucking company.

These are just a few examples of how truck owners can employ the same legal protection strategies used by the biggest companies in America. It may not be an exact fit for everyone, so it would be wise to consult with your lawyer or accountant first, and then rely on us to handle the details of filing and maintaining your company.

By protecting their assets, truckers can ensure long-term financial security, maintain business continuity, and handle industry-related challenges with confidence. Ready to form a tucking LLC or trucking corporation to protect your assets? Click on the button below. Your company can be formed in minutes!

Protect Your Truck. Form a Company now.

Since 1981, Harvard Business Services, Inc. has helped form over 400,000 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: