Can You Have Multiple Businesses Under One LLC?

Sometimes, forming one business just isn’t enough. When you have several amazing business ideas that can change the world, you might be tempted to form several LLCs at the same time. However, as you pursue the path of business ownership, several questions may arise. What type of business activity can I conduct with my LLC? How many different businesses can I operate under one LLC? Will a Series LLC work for me?

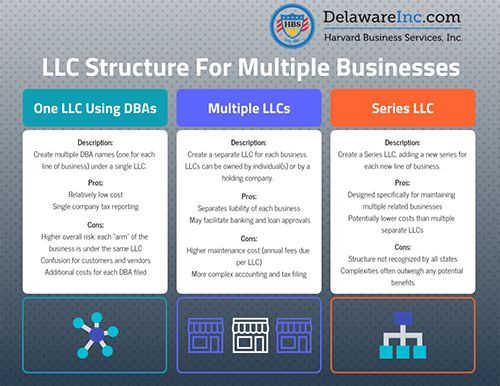

Depending on the scope of your individual businesses, the answers to your questions may vary. Operating multiple businesses under a single LLC is an option, but you may also want to consider a few alternatives. First, let’s review the basics.

Can You Operate Multiple Businesses Under One LLC?

Yes, you can operate multiple businesses under one LLC. This setup allows all business activities to be managed under a single legal entity, which can simplify administration and reduce formation costs. However, it’s important to understand that all operations under the LLC share the same legal and financial liability, meaning if one business faces a lawsuit or debt, the others could be affected.

Using Multiple DBAs Under One LLC

To run different businesses under one LLC, many entrepreneurs file for DBAs, or “Doing Business As” names (also called Fictitious Name Statements). A DBA lets your LLC legally operate under multiple brand names without forming new legal entities. For example, if a business owner has a trucking company incorporated as an LLC, they could also host a real estate service with a separate DBA. These are two completely different types of businesses, so it might be surprising that the owner can provide both services under one LLC. Just keep in mind that all DBAs remain tied to the same LLC and share tax reporting and liability.

This structure will help reduce startup costs and annual fees, but it’s important to maintain clear internal records and branding for each business to avoid confusion. Some LLCs even use separate bank accounts under one LLC for cleaner bookkeeping.

However, just because it’s possible to operate an LLC with multiple businesses doesn't mean you should, as there can be downsides. For example, if a lawsuit is filed against any one of the businesses, the assets of the others could be at stake. The result is that you put yourself at a higher degree of liability risk. As the old adage says, "Do not put all your eggs in one basket."

Using a Series LLC

Some people choose to explore the low-cost series LLC when they want to operate several different businesses. This option is very enticing, as it only calls for one annual Franchise Tax payment to the State of Delaware and one annual Registered Agent Fee.

However, the Series LLC is still quite uncommon, so a variety of hurdles can arise while operating your business. Many service providers, banks, attorneys, and accountants are still unfamiliar with the series concept. It often takes time to explain the series concept and to obtain approval for documentation that you’ve requested, for example, from a bank's lending group. Nevertheless, it is generally considered safer and smarter for people to keep their business ventures completely separate from one another by forming an LLC for each aspect of a business. In essence, what you are doing is creating one Delaware LLC as a holding company, and other, individual LLCs within it, yet separate from it.

Separate LLCs for Separate Businesses

As an alternative to hosting multiple DBAs or a Series LLC, many people still opt to file a new LLC for each of their start-up ventures. Owning multiple businesses under separate LLCs isolates the risk by separating each business's debts and liabilities. There are, of course, additional maintenance fees, but these can be well worth it in order to protect your businesses and offer the peace of mind that separate LLCs will afford. As it stands today, this practice is traditionally still the most highly recommended strategy by tax professionals, attorneys, and business consultants all over the world.

Sometimes this means that for every sector of the business, for each product line, for every service provided, for each piece of real estate held, business owners will consider creating another LLC. This ensures that the assets, debts, and liabilities of each LLC are completely disconnected and shielded from one another in the event of any possible litigation.

When establishing multiple LLCs, it can be extremely helpful to develop a blueprint hierarchy that will coincide with the relationship of the respective LLCs. For example, people typically set up numerous LLCs for real estate development. This framework often consists of one parent LLC at the top of the hierarchy and multiple sibling LLCs, one for each piece of actual real estate.

Each LLC may own, manage, and be responsible for a single piece of property; thus, while all the LLCs share the same holding company and may possess similar structures, assets, and liabilities, they are shielded from one another in order to protect the properties and resources of each individual LLC.

How to Structure Your Business

So, do you need a separate LLC for each business? Not always, but there are a few factors to consider. If your businesses are small, low-risk, or closely related, consider operating them under one LLC with separate DBAs. For more legal separation without the cost of forming multiple entities, a Delaware Series LLC may be more attractive. For maximum protection, especially if your businesses carry different risk levels or involve substantial assets (like real estate), forming separate LLCs is often the safest solution.

If you would like more information or have any questions about forming your own companies or adding another business under the parent LLC, please contact us by phone (800-345-2677), Skype (DelawareInc), email or live chat. One of our knowledgeable business startup specialists will be happy to assist you. Alternatively, read on for a list of FAQs.

How many DBAs can an LLC have?

An LLC can technically have any number of DBAs under its umbrella. As long as each DBA is registered separately with the Delaware Division of Corporations and you pay a filing fee for each name, you can continue to add new DBAs.

What states allow Series LLCs?

There are currently over a dozen different states that allow you to form a Series LLC. Delaware does allow them, and was even the first state to introduce the Series LLC structure back in 1996. Other states include Illinois, Texas, Nevada, and Wisconsin.

Can an LLC own another LLC?

Yes, an LLC can own another LLC. Such cases are referred to as a parent-subsidiary relationship, where the parent LLC holds ownership in a subsidiary LLC. In these scenarios, the parent will have control of the subsidiary’s operations while remaining a separate legal entity.

Next: How to Create and Use a DBA

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.

There are 27 comments left for Can You Have Multiple Businesses Under One LLC?

Paul Bernedo said: Saturday, October 22, 2022I have an LLC and was looking to open another business that is unrelated to my first business. I believe that I can apply for a DBA and have this business under the first. However, I was thinking of keeping them separately by doing a sole proprietorship and then getting an EIN for the second business. How can I get a trade name "dba for a sole proprietorship? It seems that the only way I can register a trade name dba is by registering it under another entity, or my llc

HBS Staff replied: Monday, October 24, 2022Hi Paul,

Thank you for reading our blog and for you question. Generally, for each separate entity you will file separate LLCs that way all your eggs are not in one basket. A representative from our office will reach out to provide you with more information and help answer all your questions.

Stephanie said: Friday, October 14, 2022Hello I’m a landlord with four properties . By chance can advise which type of LLC is recommend. I will also be purchasing properties in a neighboring state will I need to establish another LLC in that state? Thanks Stephanie

HBS Staff replied: Friday, October 14, 2022Hi Stephanie,

Thank you for reading our blog and for your question. We would be happy to assist your with your question and will be reaching out shortly to further assist you.

Kandra Brooks said: Tuesday, August 16, 2022Hello, Thank you very much for the article. I plan to start a laundromat business as an LLC and hope to own multiple. However, I also have a DBA in process can I use the DBA for banking purposes as an LLC but have each potential laundromat have its own LLC separate from the DBA. Or will I need to have completely different accounts for each business under their individual LLC?

HBS Staff replied: Friday, August 19, 2022Hello Kandra,

Thank you for reading our blog and for your question. One of our representatives will be happy to reach out to you to help explain this all in great detail.

Precious said: Wednesday, June 29, 2022Hi, My name is Precious. Thank you for the article, really insightful. I currently have a business proffering services but looking to set up others that deal in products, would you suggest I register a trademark instead for all my businesses or do I open an LLC for all of them with my current business as the parent company?

HBS Staff replied: Tuesday, July 5, 2022Hello Precious,

We would be happy to reach out to you to further discuss you inquiries. One of our representatives will reach out shortly.

Jeremiah said: Monday, May 9, 2022Hi. I found your website to be very informative. My question is that Ive started a llc incorporated that is in the process of becoming a non-profit corporation. A good friend wants to start a for-profit business completely unrelated to my original llc, but asked me to set-up the for-profit under my new llc. Should I do the original as a parent llc Inc with subsidiaries, or should i do individual llc's? There's no danger of litigation as they are spirituality based businesses.

HBS Staff replied: Tuesday, May 10, 2022Hi Jeremiah,

Thank you for your question and for reading our blog. We are happy to assist you. Generally, clients will form separate entities for each business venture that way not all their eggs are in one basket. With that being said if you wanted to make the current entity be the owner of the new entity that is possible. We will reach out to help with any additional questions.