Sample Stock Transfer Ledger

When forming your Delaware Corporation, we ask for the company name, initial directors and contact information, as well as the company stock structure. The company stock structure is the total number of authorized shares and par value of the stock. In Delaware, the state requires that certain information be listed on the Certificate of Incorporation that is filed with the Delaware Secretary of State including: the name of the company, the name and address of the Registered Agent and the corporation’s stock structure (total number of authorized shares and par value of the shares).

When forming your Delaware Corporation, we ask for the company name, initial directors and contact information, as well as the company stock structure. The company stock structure is the total number of authorized shares and par value of the stock. In Delaware, the state requires that certain information be listed on the Certificate of Incorporation that is filed with the Delaware Secretary of State including: the name of the company, the name and address of the Registered Agent and the corporation’s stock structure (total number of authorized shares and par value of the shares).

Many times, clients will contact us and inform us that additional shareholders will be issued a certain number of authorized shares. While this is important information, the Delaware Secretary of State does not require this information and neither does the Registered Agent. The old school way that clients keep track of their corporation’s issued shares is within a Stock Transfer Ledger and sometimes, stock certificates are issued.

What Is a Stock Ledger?

The Stock Ledger is a record-keeping document maintained by a corporation to track and manage stock ownership information. This can help your company keep a record of shareholders and their ownership interests. Neither the State of Delaware, nor your registered agent requires this information or keeps the ledger on file. The Stock Transfer Ledger is for your company’s internal records only.

In the Stock Transfer Ledger, the names of the shareholders can be listed along with important information such as their places of residence, the time that they gained ownership within the corporation, the number of shares issued, the amount paid for the shares, and the stock certificate number that was distributed (if stock certificates were issued to the shareholder internally). If a corporation has multiple classes of stock (such as common stock and preferred stock), the stock ledger may also specify the class of shares held by each shareholder. You can also keep track of transferred shares, to whom the shares were transferred, on which date, as well as the value of the stock transfer.

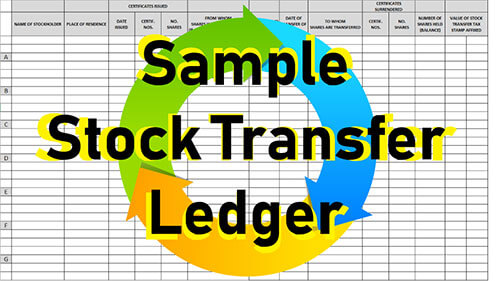

For reference, here is a free Stock Transfer Ledger template.

Delaware also allows for corporations to keep their corporate records internally using digital ledger technology or blockchain technology. In other words, corporate transactions can be recorded digitally worldwide. As blockchain becomes more prevalent, you will see more companies move to blockchain technology to maintain their corporate records.

It’s critically important to maintain an accurate stock transfer ledger to ensure that there are no errors in ownership and so that the company does not violate corporate law. With StockTreasury, records would be immutable.

Our most popular formation package is the Standard Delaware Formation Package that includes a physical corporate kit that ships to your address. The kit contains the Stock Transfer Ledger and other items such as: a physical seal embosser, a Delaware Company Guidebook, a Meeting Minute Book, customizable bylaws, organizational resolutions and ten numbered stock certificates that feature the company name. If you formed your Delaware company and did not order a Corporate Kit, but change your mind, let us know. We are happy to help you.

As your company brings on more investors, you may need more authorized shares. If this is the case, again we are happy to help. We can prepare and file a Stock Amendment with the Delaware Secretary of State for approval. It takes about 3 to 5 business days for the Delaware Secretary of State to approve the Amendment with our service. Our filings team will prepare the Stock Amendment and email the document for review and your electronic signature. Once signed, we will file the Amendment with the state for approval.

If you have any questions, I can be reached at 1-302-645-7400 ext. 6144 or via email at Justin@delawareinc.com.

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.

There are 2 comments left for Sample Stock Transfer Ledger

Alfredo Asuncion said: Wednesday, September 30, 2020What to do in case of lost Stock Transfer Book?

HBS Staff replied: Wednesday, September 30, 2020If you don't have records of the past stock transfers, you may want to work with an attorney on creating a new ledger with correct and accurate information. You may also be interested in a new product we offer - Stock Treasury - which allows you maintain your stock records digitally and securely: https://www.delawareinc.com/ourservices/stocktreasury/

Rick Harrison said: Sunday, August 2, 2020Do you have a sample stock certificate on your website?

HBS Staff replied: Monday, August 3, 2020Yes, you can download a stock certificate template in our Download Center: https://www.delawareinc.com/resources/download-center/