The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups, cryptocurrency, venture capitalism and general business topics.

Form a Delaware Company for Your Cryptocurrency Venture

By

HBS

Monday, October 9, 2017

Bitcoin, Ethereum, Zcash, Litecoin and others—cryptocurrency may be how we spend and send money in the near future. There are tons of apps, software programs and storage sites already—do you have a cryptocurrency startup idea?.. Read More

Bitcoin, Ethereum, Zcash, Litecoin and others—cryptocurrency may be how we spend and send money in the near future. There are tons of apps, software programs and storage sites already—do you have a cryptocurrency startup idea?.. Read More

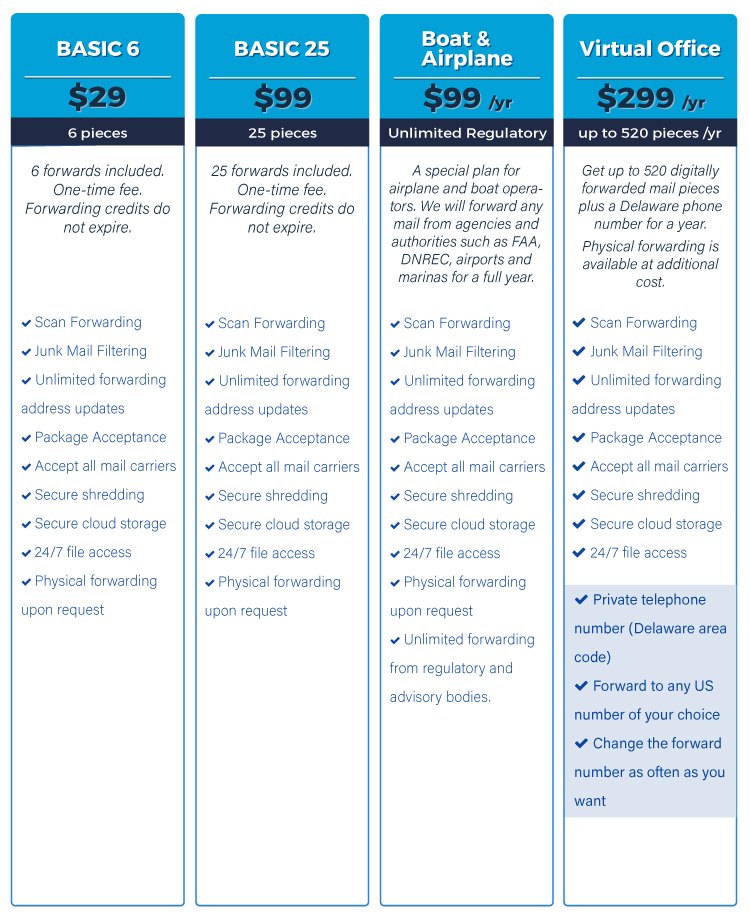

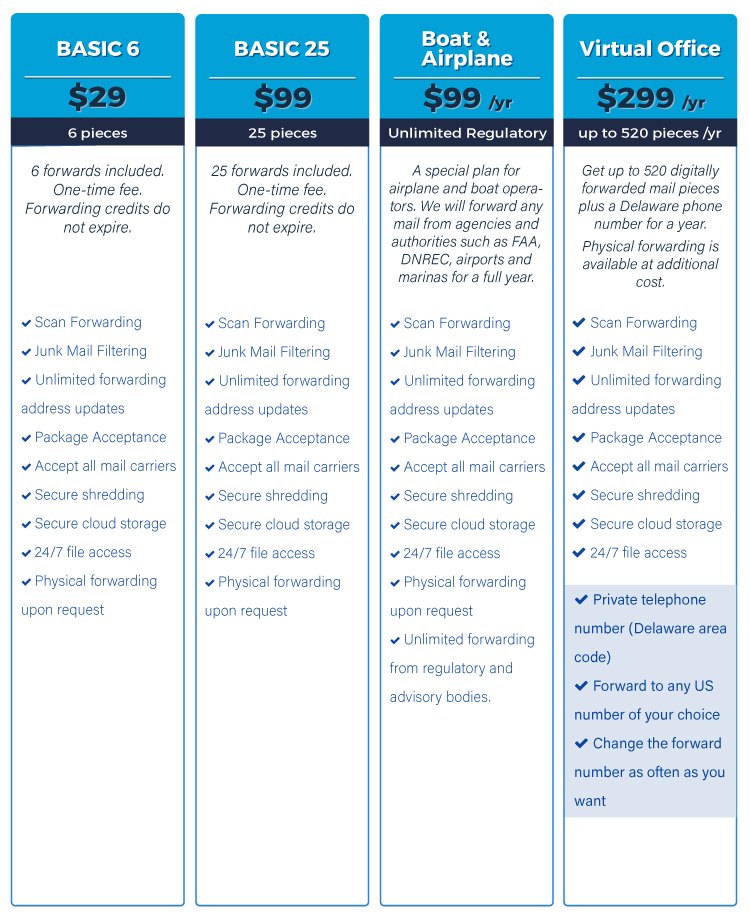

New Delaware Mail Forwarding & Virtual Office Services

By

Michael Bell

Monday, August 28, 2017

We have completely rethought and revamped our Mail Forwarding services here at Harvard Business Services. We now offer four services that are more tailored towards your business needs and the best part is we came up with new pricing... Read More

We have completely rethought and revamped our Mail Forwarding services here at Harvard Business Services. We now offer four services that are more tailored towards your business needs and the best part is we came up with new pricing... Read More

Are You Operating a Delaware Company in Indiana?

By

Devin Scott

Monday, July 31, 2017

Your Delaware company can legally operate in the state of Indiana once you file Foreign Qualification and complete the application process... Read More

Your Delaware company can legally operate in the state of Indiana once you file Foreign Qualification and complete the application process... Read More

Should You File a New Company by Yourself? [Infographic]

By

Veso Ganev

Monday, July 3, 2017

Should you file your startup company by yourself or use a business formation service? Here are the pros and cons of each... Read More

Should you file your startup company by yourself or use a business formation service? Here are the pros and cons of each... Read More

Operating a Delaware Company in Nevada

By

Devin Scott

Monday, June 26, 2017

A Delaware company doing business in the state of Nevada is considered a foreign entity and must file for Foreign Qualification, which is not difficult but is necessary to stay in compliance... Read More

A Delaware company doing business in the state of Nevada is considered a foreign entity and must file for Foreign Qualification, which is not difficult but is necessary to stay in compliance... Read More

Delaware Moves toward Blockchain Technology

By

HBS

Monday, June 19, 2017

Blockchain technology and the Delaware Blockchain Initiative are going to digitize many corporate transactions, making it easier and faster to transfer assets among companies, people, banks and law firms... Read More

Blockchain technology and the Delaware Blockchain Initiative are going to digitize many corporate transactions, making it easier and faster to transfer assets among companies, people, banks and law firms... Read More

Delaware Series LLC Operating Agreement & Structure

By

Brett Melson

Tuesday, May 16, 2017

Under Delaware law, a series LLC (limited liability company) may be composed of individual series of membership interests. This type of entity is referred to as a Delaware series LLC. Here's what you need to know about the Delaware series LLC, including the series LLC operating agreement... Read More

Under Delaware law, a series LLC (limited liability company) may be composed of individual series of membership interests. This type of entity is referred to as a Delaware series LLC. Here's what you need to know about the Delaware series LLC, including the series LLC operating agreement... Read More

Doing business in South Dakota with a Delaware Company

By

Devin Scott

Monday, May 15, 2017

If your business will have a physical presence by operating, hiring employees, banking or even holding an asset in a state other than its state of Incorporation, business owners typically foreign qualify their business to operate in that state... Read More

If your business will have a physical presence by operating, hiring employees, banking or even holding an asset in a state other than its state of Incorporation, business owners typically foreign qualify their business to operate in that state... Read More

Filing Delaware LLC Franchise Tax [INFOGRAPHIC]

By

Veso Ganev, HBS

Tuesday, May 9, 2017

Delaware LLC Franchise Tax is due June 1 of every year. Our infographic shows you what you'll need when filing, plus how to file online quickly and easily... Read More

Delaware LLC Franchise Tax is due June 1 of every year. Our infographic shows you what you'll need when filing, plus how to file online quickly and easily... Read More

Calculate Your Delaware Franchise Tax

By

Amy Fountain

Tuesday, May 2, 2017

Our Franchise Tax Calculator can compare the amounts due between different Delaware entity types, and to calculate your Delaware company's Franchise Tax... Read More

Our Franchise Tax Calculator can compare the amounts due between different Delaware entity types, and to calculate your Delaware company's Franchise Tax... Read More