The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups, cryptocurrency, venture capitalism and general business topics.

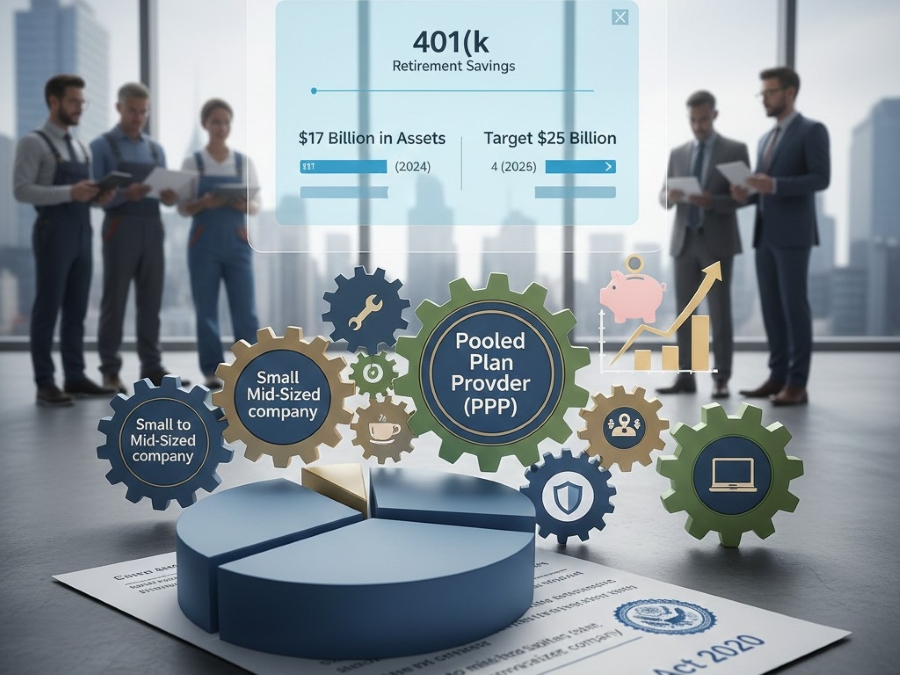

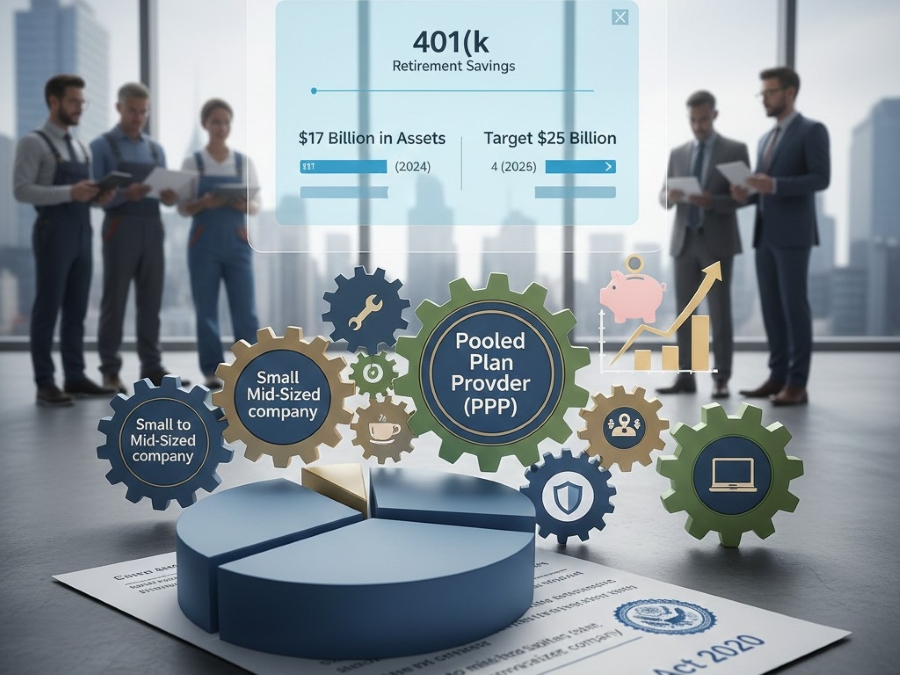

Pooled Employer Employee Benefit Plans Continue to Grow in Popularity

By

Jarrod Melson, Esq.

Monday, December 22, 2025

Pooled employer plans (PEPs) help small and mid-sized companies offer affordable, compliant 401(k) benefits. Read about these employer plans today... Read More

Pooled employer plans (PEPs) help small and mid-sized companies offer affordable, compliant 401(k) benefits. Read about these employer plans today... Read More

Delaware and the SEC – Recent Diverging Policies on Mandatory Arbitration

By

Jarrod Melson, Esq.

Tuesday, December 16, 2025

Delaware and the SEC are at odds over mandatory arbitration agreements. Learn how the 2025 changes reshape corporate governance and IPO strategy... Read More

Delaware and the SEC are at odds over mandatory arbitration agreements. Learn how the 2025 changes reshape corporate governance and IPO strategy... Read More

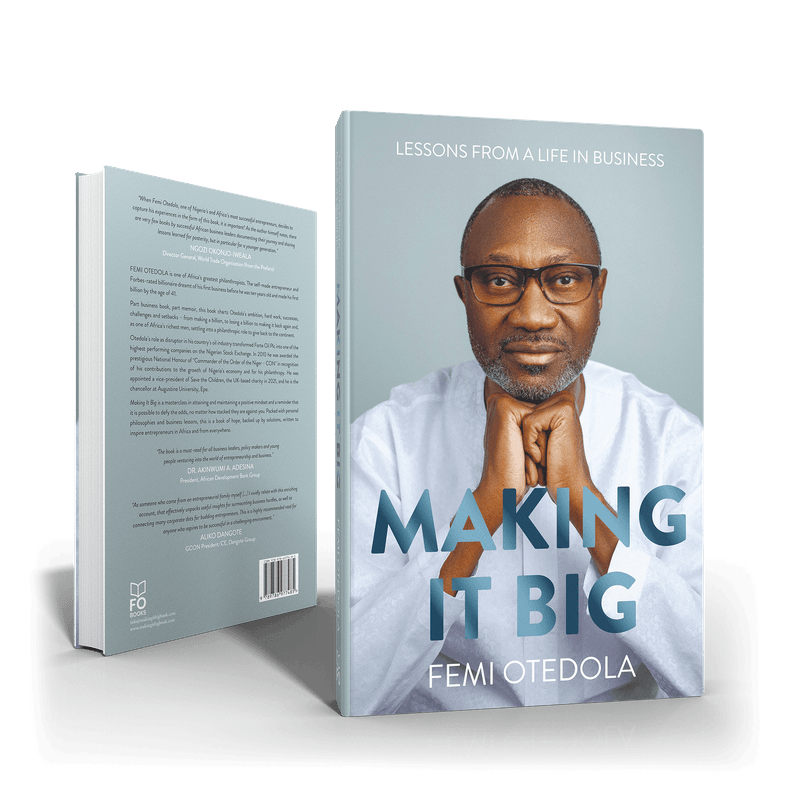

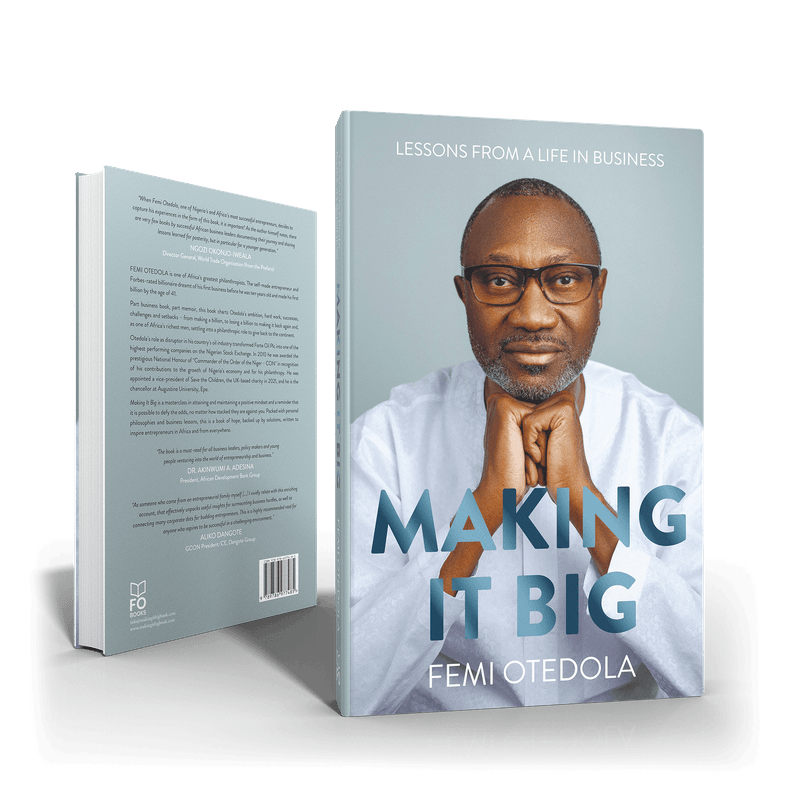

Book Review: Making It Big: Lessons from a Life in Business by Femi Otedola

By

Devin Scott

Monday, December 15, 2025

Making It Big is a memoir and guide by Femi Otedola, detailing his journey and findings as a successful business owner. Read our book review today... Read More

Making It Big is a memoir and guide by Femi Otedola, detailing his journey and findings as a successful business owner. Read our book review today... Read More

The Delaware Series LLC is Gaining Popularity

By

Brett Melson

Tuesday, December 9, 2025

Delaware series LLCs are growing in popularity. Learn about the differences between protected series and registered series LLCs, then form one online today... Read More

Delaware series LLCs are growing in popularity. Learn about the differences between protected series and registered series LLCs, then form one online today... Read More

How to Close Your Delaware Company

By

Amy Fountain

Monday, December 8, 2025

Are you closing your Delaware LLC or corporation? Do it by Dec. 31st! By filing your cancellation or dissolution by the end of the year, you’ll avoid having to pay the next year's franchise tax... Read More

Are you closing your Delaware LLC or corporation? Do it by Dec. 31st! By filing your cancellation or dissolution by the end of the year, you’ll avoid having to pay the next year's franchise tax... Read More

2025 Delaware Annual Report Now Requires “Nature of Business”

By

Brett Melson

Tuesday, December 2, 2025

Starting in 2025, Delaware Annual Report filings must include a “Nature of Business” description. Learn more about this change and then file online today.v.. Read More

Starting in 2025, Delaware Annual Report filings must include a “Nature of Business” description. Learn more about this change and then file online today.v.. Read More

Stuck With a Tie-Breaker Manager in an LLC

By

Jarrod Melson, Esq.

Monday, December 1, 2025

When a vote is split amongst LLC leadership, an LLC deadlock provision offers a solution via a tie-breaker manager. Learn more about the role & their removal... Read More

When a vote is split amongst LLC leadership, an LLC deadlock provision offers a solution via a tie-breaker manager. Learn more about the role & their removal... Read More

Delaware Launches Artificial Intelligence Commission

By

Logan Donovan

Tuesday, November 18, 2025

Delaware's new AI Commission will revolutionize corporate filing and governance. Learn how AI innovation keeps Delaware the premier incorporation choice.. Read More

Delaware's new AI Commission will revolutionize corporate filing and governance. Learn how AI innovation keeps Delaware the premier incorporation choice.. Read More

Why was my Corporate Filing Rejected?

By

Justin Damiani

Monday, November 17, 2025

Read about some of the most common reasons why formation documents are rejected, then form your own Delaware LLC or corporation on our website... Read More

Read about some of the most common reasons why formation documents are rejected, then form your own Delaware LLC or corporation on our website... Read More

When Is the Best Time to Form Your Delaware Company?

By

Andrew Millman

Tuesday, November 11, 2025

When is the best time of year to form a new LLC or corporation? Learn some pro tips about when to file your business, then get started on our website... Read More

When is the best time of year to form a new LLC or corporation? Learn some pro tips about when to file your business, then get started on our website... Read More