The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups, cryptocurrency, venture capitalism and general business topics.

Speed and Strategy: Understanding the Delaware Rapid Arbitration Act

By

Veso Ganev

Tuesday, January 27, 2026

In the world of business, time is often just as valuable as capital. When disputes arise, the traditional legal route can sometimes feel like a marathon when you need a sprint. For companies operating under Delaware law, there is a specialized tool designed specifically to keep business moving: the Delaware Rapid Arbitration Act.. Read More

In the world of business, time is often just as valuable as capital. When disputes arise, the traditional legal route can sometimes feel like a marathon when you need a sprint. For companies operating under Delaware law, there is a specialized tool designed specifically to keep business moving: the Delaware Rapid Arbitration Act.. Read More

How to Change Your Business Name with the IRS

By

Paul Sponaugle

Monday, January 26, 2026

Under most circumstances, changing your business name will not require a new EIN, but you will typically have to notify the IRS. There are two main ways to so.. Read More

Under most circumstances, changing your business name will not require a new EIN, but you will typically have to notify the IRS. There are two main ways to so.. Read More

Book Review: Superagency: What Could Possibly Go Right With Our AI Future

By

Devin Scott

Tuesday, January 20, 2026

Superagency by Reid Hoffman & Greg Beato highlights the possible benefits of AI in the business formation sector. Read our book review online today... Read More

Superagency by Reid Hoffman & Greg Beato highlights the possible benefits of AI in the business formation sector. Read our book review online today... Read More

Converting an LLC to a Series LLC

By

Brett Melson

Monday, January 19, 2026

It's possible to convert an LLC to a series LLC. Here's how the process works & when/why you should consider this change. | File a Delaware LLC today... Read More

It's possible to convert an LLC to a series LLC. Here's how the process works & when/why you should consider this change. | File a Delaware LLC today... Read More

Book Review: 1929 by Andrew Ross Sorkin

By

Devin Scott

Tuesday, January 13, 2026

Discover timeless business lessons that remain relevant for forming and managing LLCs. Read our book review of 1929 by Andrew Ross Sorkin... Read More

Discover timeless business lessons that remain relevant for forming and managing LLCs. Read our book review of 1929 by Andrew Ross Sorkin... Read More

Managing Ownership Changes for Your Delaware LLC

By

Brett Melson

Monday, January 12, 2026

Change of ownership for an LLC can be complicated and requires costly amendments in most U.S. states. However, not in the state of Delaware. Unlike other states, Delaware requires very little information to be made public in order to form an LLC... Read More

Change of ownership for an LLC can be complicated and requires costly amendments in most U.S. states. However, not in the state of Delaware. Unlike other states, Delaware requires very little information to be made public in order to form an LLC... Read More

What Does Service of Process Mean?

By

HBS

Tuesday, January 6, 2026

In Delaware, service of process is the method by which a company is served time-sensitive legal documents, including lawsuits and subpoenas. The person receiving the service of process has a designated period of time in which to send a reply... Read More

In Delaware, service of process is the method by which a company is served time-sensitive legal documents, including lawsuits and subpoenas. The person receiving the service of process has a designated period of time in which to send a reply... Read More

The SEC Eases Restrictions on Private Offerings

By

Jarrod Melson, Esq.

Monday, January 5, 2026

The SEC’s latest changes to accredited investor verification has made it easier for companies to market through private offerings. Learn more in our blog... Read More

The SEC’s latest changes to accredited investor verification has made it easier for companies to market through private offerings. Learn more in our blog... Read More

Small Businesses – Deciding Between External and In-House Legal Counsel

By

Jarrod Melson, Esq.

Tuesday, December 30, 2025

Consider your options for legal counsel as a small business. Learn about the most common reasons to pursue part-time vs. full-time general counsel... Read More

Consider your options for legal counsel as a small business. Learn about the most common reasons to pursue part-time vs. full-time general counsel... Read More

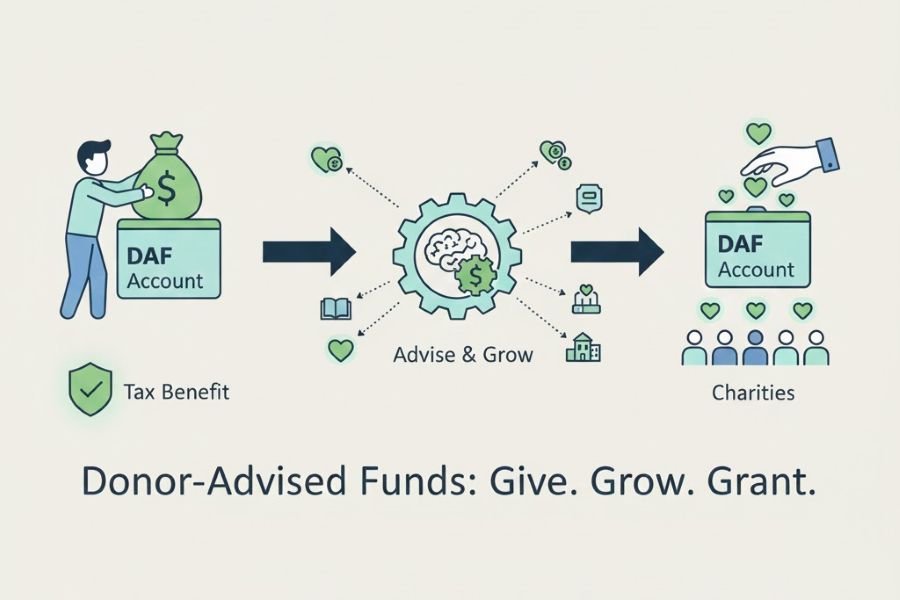

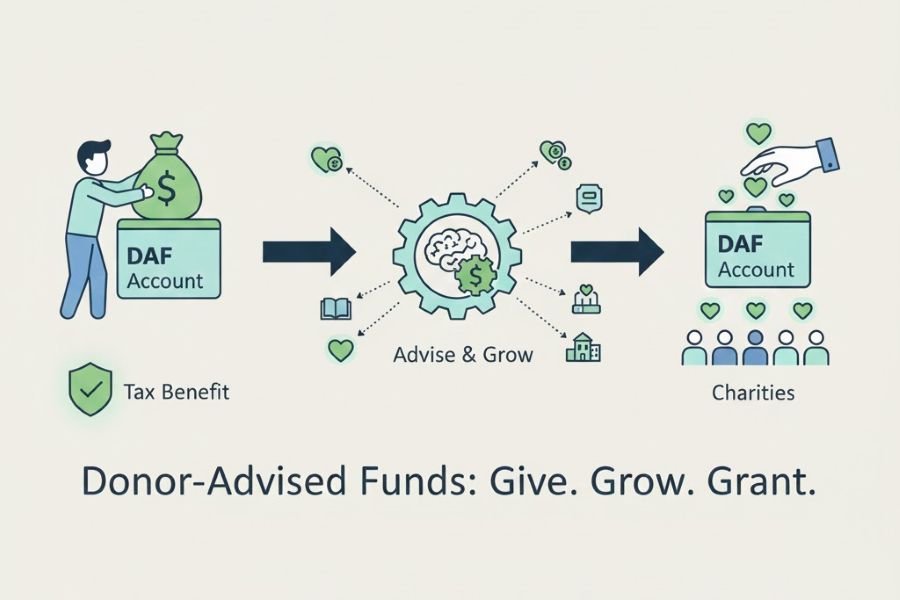

The Donor-Advised Fund – A Charitable Option on Sale of a Business

By

Jarrod Melson, Esq.

Monday, December 29, 2025

Donor-advised funds offer immediate charitable tax benefits for founders selling a business. Explore how DAFs work, fees, and the IRS regulations... Read More

Donor-advised funds offer immediate charitable tax benefits for founders selling a business. Explore how DAFs work, fees, and the IRS regulations... Read More