The Donor-Advised Fund – A Charitable Option on Sale of a Business

After selling a business, a founder may want to make a charitable contribution from the purchase price to decrease his or her tax burden in the year of the windfall. Donor-advised funds (or “DAFs”) are becoming an increasingly popular option for charitable giving.

After selling a business, a founder may want to make a charitable contribution from the purchase price to decrease his or her tax burden in the year of the windfall. Donor-advised funds (or “DAFs”) are becoming an increasingly popular option for charitable giving.

How Do Donor Advised Funds Work?

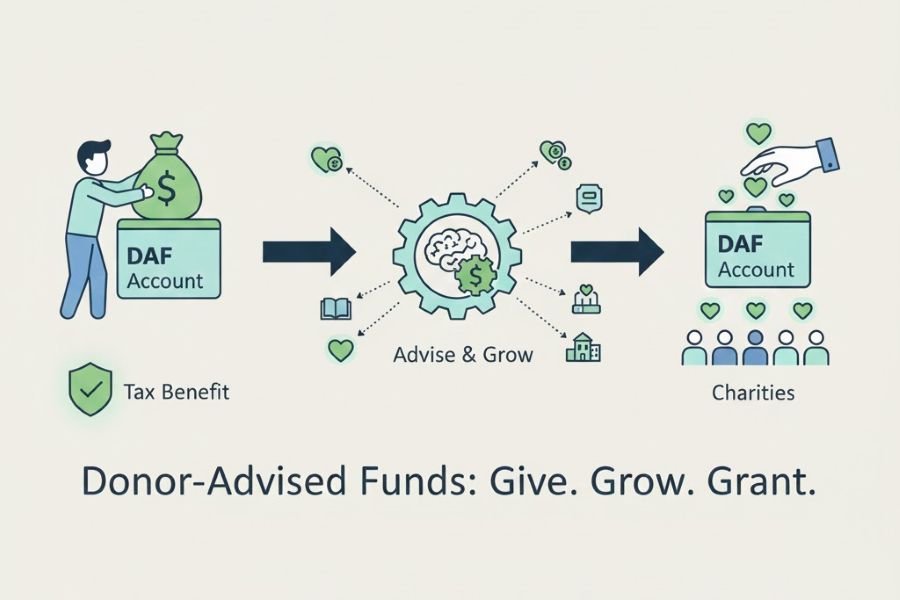

A donor makes an irrevocable contribution to a DAF, which is maintained in a separate account. The donor receives the full tax benefit of the charitable donation upon the initial contribution and then has advisory privileges to recommend when and to what charities donations are made (which, if legally permissible, are accepted by the DAF sponsor). No minimum distribution amount is required, and a DAF can hold assets for charitable giving indefinitely. The donor appoints an investment adviser (usually his or her personal adviser) to manage the funds. The donor then instructs the DAF sponsor to make distributions from the funds to charities of the donor’s choosing over time, with no minimum annual distribution required.

DAF charitable giving is a form of charity of charities and is often marketed as a personal charitable account with an immediate, up-front tax benefit. It exists to hold a donated amount, which is managed by an investment adviser of the donor’s choosing. The donor has an advisory right to determine when and to what charities donations are made. Of course, the donor does not receive any tax benefit from the DAF distribution, having already received the tax benefit of the initial contribution. While the assets legally belong to the DAF after their contribution and cannot be reclaimed by the donor or used for his or her benefit, the DAF will abide by the recommendations of the donor if legally permissible (e.g., the intended charity is not a sanctioned extremist group or affiliated with the donor). The DAF will conduct due diligence on charities selected for distributions by the donor. So long as the donation can be made under applicable law (e.g., OFAC, terrorist financing restrictions, affiliation with donor, etc.), the DAF will abide by the donor’s suggestion and make the requested charitable distribution. While the DAF could ignore a donor’s distribution recommendation, such an act would undermine the very purpose of the DAF as a financial “product” and discredit the DAF sponsor in the eyes of potential future donors.

The DAF sponsor is paid an administration fee from the contributed assets annually, and the investment adviser selected by the donor to manage the DAF assets will receive asset-based advisory compensation for its services. As noted above, the DAF is not required to make any minimum amount of distributions over a given period. The assets can sit, be managed, and grow through investment indefinitely, with the donor having already received the tax benefit of the initial charitable contribution. In many cases, DAFs are left as part of an estate to future generations to facilitate charitable giving.

The Internal Revenue Service has proposed rules that would prohibit a donor’s selected investment adviser from receiving compensation from DAF funds for managing its assets if it manages other funds of the donor apart from the DAF. The IRS has proposed to treat such an adviser as an extension of the donor, such that compensation from the DAF assets for its advisory services would constitute an improper benefit from the charitable contribution. As a result, the adviser would be subject to a punitive 100% excise tax on any compensation, making an adviser’s service for a donor impracticable. These proposed rules have languished for some time in a regulatory purgatory and are unlikely to be adopted in the current regulatory environment. If adopted, however, these regulations would fundamentally reshape how DAFs operate.

DAFs are growing in popularity and are a flexible, long-term option for charitable giving over time with an immediate tax benefit.

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.