W9 Form: When and Why to Use It

We are asked many questions about W-9s by business owners and entrepreneurs, so we thought a brief blog post on the topic might be helpful. However, as is the case for all other tax-related issues, questions, or concerns it’s always best to reach out to a tax professional for any in-depth discussions regarding the W9.

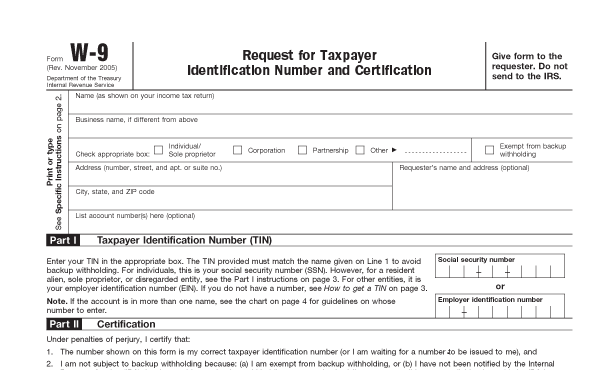

What is a W9?

Form W-9 (Request for Taxpayer Identification Number and Certification) is typically used to request tax information from freelancers, independent contractors and other self-employed people.

Who needs a W9?

Anyone who does work for a company but is not a full-time employee of the company should fill out the W-9 federal income tax form. Freelancers and independent contractors may have to fill out many W-9 forms, depending on how many companies they work for over the course of a year.

Consultants are also required to fill out a W-9 for each company they consulted with throughout the year.

Here is the IRS guidance on using the W9:

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example:

- Income paid to you.

- Real estate transactions.

- Mortgage interest you paid.

- Acquisition or abandonment of secured property.

- Cancellation of debt.

- Contributions you made to an IRA.

How do I get a W9?

Form W-9 can be downloaded for free from the IRS website.

W9 vs. W4

Form W-4 is not the same as Form W-9. Whereas a W-9 is likely to be used by a contracted worker, a W-4 is sent by an employer to an employee to establish tax withholding preferences from the employee's salary. In other words, if you are hired as an employee -- not an external freelancer or consultant -- you should receive a W-4 and not a W-9.

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.