Pooled Employer Employee Benefit Plans Continue to Grow in Popularity

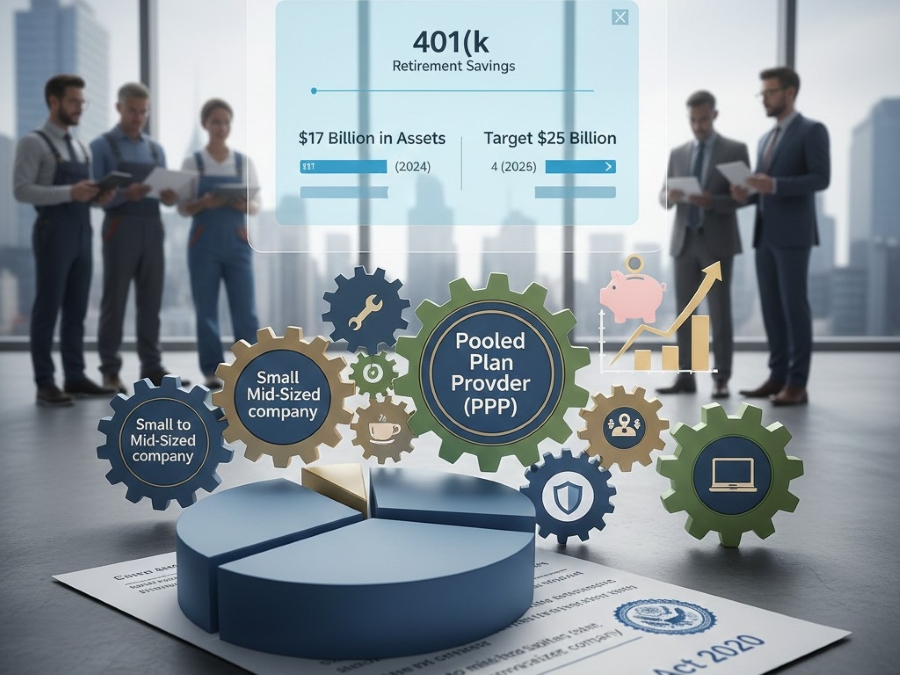

Small to mid-sized companies often struggle to efficiently and cost-effectively offer an employee benefit plan to employees. Increasingly, these companies are banding together to seek efficiency and cost savings in forming pooled employer plans (referred to as “PEPs”) rather than sponsoring individual company plans. PEPs are a form of multiple employer plan (MEP) in which unaffiliated or unconnected companies can pool their resources to operate a collective plan.

Small to mid-sized companies often struggle to efficiently and cost-effectively offer an employee benefit plan to employees. Increasingly, these companies are banding together to seek efficiency and cost savings in forming pooled employer plans (referred to as “PEPs”) rather than sponsoring individual company plans. PEPs are a form of multiple employer plan (MEP) in which unaffiliated or unconnected companies can pool their resources to operate a collective plan.

The federal SECURE Act (Setting Every Community Up for Retirement Enhancement Act) created new opportunities for employers of all sizes to join group or pooled retirement plans. Regardless of the number of participating employers, the Internal Revenue Service (IRS) considers a PEP a single 401(k) plan. The sponsor of the PEP, the pooled plan provider (or “PPP”), performs the administrative duties to ensure the plan remains in compliance with applicable regulations and guidelines and acts on behalf of the employer to oversee or outsource running the plan and selecting investments.

Each participating company (each a “plan sponsor”) signs an agreement to participate in a PEP with a pooled plan provider. The PPP is a fiduciary to the PEP. Generally, the plan sponsors retain fiduciary responsibility for the investment and management of the portion of the plan’s assets attributable to the employees of the employer (or beneficiaries of the employees). However, the plan sponsors can give the PPP, as a plan fiduciary, authority to select a fiduciary “investment manager” with discretionary authority to manage the PEP’s assets under Section 3(38) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). In that case, the plan sponsor’s fiduciary duty requires that the sponsor monitor the administration and investment of the PEP.

PEPs allow multiple unrelated companies to operate a pooled 401(k) plan, making it easier and more affordable for small and mid-sized businesses to offer competitive 401(k) retirement plans to their employees. PEPs benefit small and mid-sized employers by reducing administrative burdens, transferring certain fiduciary liability to the PPP, and lowering costs. The PPP handles most administrative tasks, such as enrollment, recordkeeping, and compliance, allowing employers to focus on their core business operations. Further, the PPP assumes most of the named fiduciary and plan administrator responsibilities, which significantly reduces fiduciary risk and liability for participating employers. Additionally, pooling resources enables economies of scale, leading to reduced administrative, investment, and compliance costs, which can be more affordable for small and mid-sized businesses. As a result of the delegation of functions and cost savings, PEPs can offer expert-driven plan design and management as well as a curated investment lineup, with the ultimate goal of producing better return outcomes for participating employers’ personnel and their retirement plans.

PEPs are growing increasingly popular, with the Department of Labor seemingly encouraging participation in such PEPs as a means of obtaining cost-effective retirement plan services. Given the potential efficiencies of pooling resources and delegating management among a group of companies, these plans will continue to be more widely adopted. PEP assets topped $17 billion at the end of 2024 and are expected to exceed $25 billion by the end of 2025. PEPs may allow a business owner to offer a top-notch retirement plan without the time and cost ordinarily required to do so.

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.