Asset Protection for Taxi Drivers & Owners

You're in the transportation business. As with trucks, planes, and buses, your vehicles move things from Point A to Point B—in your case, people. When vehicles are in motion, they can collide with other things. Sometimes it's a fender bender; Sometimes it's far worse. That's why a number of taxi drivers, including Uber and Lyft drivers, consider creating an LLC or corporation to protect their assets.

Asset protection is an important strategy to legally separate your taxi from your personal assets—your home, bank accounts, personal vehicles, and more—and can typically be achieved by forming a Delaware corporation or LLC for your taxi.

We have more than three decades of experience forming Delaware companies for taxi drivers and for people who want to protect their assets. That longevity and leadership give us the expertise to incorporate your vehicle quickly and efficiently, helping to protect your assets. However, we are not a law firm and cannot give legal advice. Please consult an attorney if you need legal advice before starting a taxi business.

Why Incorporate Your Taxi?

You likely have insurance to protect you in the event of an accident, but it will only protect so much if a lawsuit occurs. If the claim is large enough, the plaintiff's lawyer often will attempt to go after your personal assets. If you're operating as a sole proprietorship, generally your vehicles (including your Taxi or Uber/Lyft vehicles, as well as personal vehicles), home, bank accounts, and more are at risk.

Furthermore, creating a business for your taxi will also create an aura of professionalism for your company when dealing with customers, suppliers and potential stakeholders.

How to Incorporate Your Taxi

We've heard drivers ask, "I drive my own taxi, so how can incorporating protect me from liability?" They mistakenly believe that if they are behind the wheel they are liable no matter what. That's not true if they take the right precautions.

If you own one taxi...

The smart way to protect your assets is to form a Delaware corporation or LLC and purchase your vehicle in that company's name. That would make it the property of your company, and would not be considered your personal property. This offers you protection on two levels: Your taxi is typically considered off-limits in the event of a lawsuit involving you personally, and your personal assets are typically considered off-limits in the event of a lawsuit involving your taxi LLC or corporation.

If you own multiple taxis...

Some taxi owners who own multiple cabs will form a taxi corporation or LLC and place the ownership of all of their taxis under that one company. While this is preferable to a sole proprietorship, it leaves your company vulnerable to losing all of its taxis if one vehicle is involved in a lawsuit.

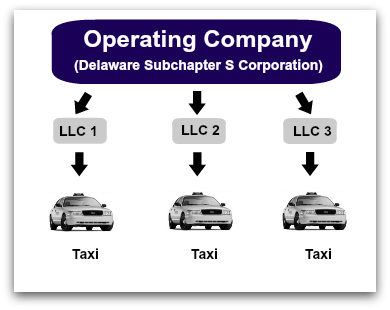

The safest strategy is to form multiple taxi companies and have each company own one taxi. Here's how it could work:

To employ this strategy, first form a Delaware subchapter S corporation. This corporation is your operating company, the one you use with clients and suppliers. All payments flow into this company. This subchapter S corporation legally separates your taxis from your personal assets but does not own any of the taxis.

Each taxi is instead owned by a separate Delaware LLC, and then leased to the subchapter S corporation under a separate contract. Therefore, if one taxi is involved in a lawsuit, your other Delaware taxi LLCs can keep operating. LLCs are typically used because they are pass-through entities with strong liability protection. In addition, you typically won't need to file separate tax returns for each LLC if you set them up correctly.

Creating an LLC or corproation is just one of many methods of asset protection for taxi drivers. Please consult with your attorney and accountant first, and then rely on us to handle the details of filing and maintaining your taxi driver company.

Ready to form your taxi company now and protect your assets? Click on the button below. The process only takes a few minutes!

Protect Your Taxi. Form a Company Now.

Since 1981, Harvard Business Services, Inc. has helped form over 400,000 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: