Asset Protection for Inventors

Are you an inventor? From the invention of the light bulb to the creation of the iPhone, ingenuity and inventiveness have paid dividends not only for society but also for individuals. However, being an inventor involves an array of risks, chief among them liability. If you are operating as a sole proprietor and your invention harms someone, either in the testing stage or once it has entered the free market, your personal assets could be at stake.

Luckily, incorporating your invention can help protect you in the event of a lawsuit. Forming a Delaware LLC or corporation is a common way to legally separate and protect your personal assets from your inventions; in fact, it may be your best asset protection. Harvard Business Services, Inc. has specialized in Delaware business formations for more than 30 years. That longevity and leadership give us the expertise to form your business quickly and efficiently, helping to protect your assets and investments. However, we are not a law firm and cannot give legal advice. Please consult an attorney if you need legal advice on asset protection for inventors.

We can, however, explain why many inventors consider asset protection, as well as point out different strategies to consider in order to protect both your inventions and personal assets.

Does an LLC Protect Intellectual Property?

Liability Protection and Best Asset Protection

You can protect your personal assets by forming a corporation or LLC; this will create a barrier between your invention’s liability and your personal assets, thereby protecting your cars, house, bank accounts and other personal assets. Without this barrier, a damage award resulting from a liability lawsuit could claim your cars, house, bank accounts and other personal assets. If an invention is incorporated, it provides a layer of protection for inventors, as it becomes very difficult for a plaintiff’s attorney to seek your personal assets as damages in the event of a lawsuit.

Prestige

Creating a groundbreaking idea and executing it is just one step in the invention process. Once your invention is created, you'll want to get it on the market and into the hands of consumers. This generally involves finding investors. Many investors don't want to invest in ideas—they want to invest in stock, which provides tangible proof they own a portion of the company (and are therefore positioned to earn a profit from their investment). The esteemed abbreviations "LLC" or "Inc." appended to your business name may make investors consider you a serious business professional. In the event you should ever require a loan for your business, incorporating may also speed up that process, as a number of lenders are more comfortable lending to a company rather than a sole proprietorship.

How to Incorporate Your Invention

Now that you understand the need to incorporate your invention, you should know how to incorporate it and take advantage of what may be the best asset protection for you.

If you have one invention...

First, decide which type of business entity is right for you. Then, form your company with Harvard Business Services, Inc. We make the process easy for you. Simply fill out our online order form. Once your company is formed, you'll typically want to file for a patent or trademark to protect your idea. This can be done through the United States Patent and Trademark Office.

If you have multiple inventions...

Some inventors form a corporation or LLC and place several inventions under one umbrella. While this is preferable to a sole proprietorship, it leaves your other inventions vulnerable if one invention is involved in a lawsuit.

Forming multiple entities, so that each one holds a single invention, is the safest strategy.

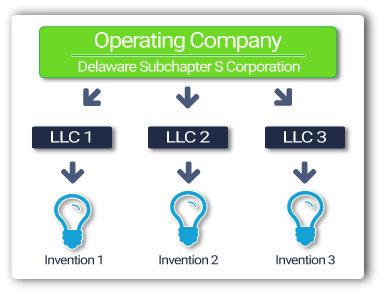

In order to utilize this strategy, first form a Delaware subchapter S corporation. This entity is your operating company, and all payments flow into this company. Using a subchapter S corporation offers you tax benefits while at the same time, it separates your personal assets from your inventions, thus protecting your personal assets from the inventions' potential liabilities. While the S corporation protects your personal assets from the inventions' potential liabilities, this subchapter S corporation doesn't own any of the inventions.

Instead, each invention is owned by a separate Delaware LLC and then leased to your operating company under a separate contract. As a result, if one LLC is involved in a lawsuit, the other LLCs can keep operating. LLCs are used to hold the assets because they are tax-free companies with strong liability protection. In general, if your companies are set up correctly, then you typically won't need to file separate tax returns for each of them.

This strategy may not be right for every inventor, so it would be wise to consult with your attorney and accountant first, and then rely on Harvard Business Servicses, Inc. to handle the details of filing and maintaining your company.

Should My LLC Own My Patent?

Ready to form your LLC and protect both your personal assets and your invention? Harvard Business Services, Inc. makes it easy for you. Simply click on the button below and fill out our order form.

Protect Your Invention. Form a Company Now.

Since 1981, Harvard Business Services, Inc. has helped form 430,506 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: