The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups, cryptocurrency, venture capitalism and general business topics.

An Easier Way to Pay Delaware LLC/LP Franchise Taxes

By

Amy Fountain

Monday, May 9, 2016

Even if we are not your Registered Agent, you can still use our system to pay your Delaware Franchise Tax.

We are excited to announce that in an effort to improve our clients’ user experience, it is now possible to submit annual Franchise Tax payments for multiple LLCs and Limited Partnerships in a single transaction... Read More

Even if we are not your Registered Agent, you can still use our system to pay your Delaware Franchise Tax.

We are excited to announce that in an effort to improve our clients’ user experience, it is now possible to submit annual Franchise Tax payments for multiple LLCs and Limited Partnerships in a single transaction... Read More

Keep your Delaware LLC or Corporation in Compliance

By

Devin Scott

Monday, May 2, 2016

For companies that operate in Delaware in a brick-and-mortar business, home business or online business, there are additional requirements to maintain compliance, such as business licenses or permits... Read More

For companies that operate in Delaware in a brick-and-mortar business, home business or online business, there are additional requirements to maintain compliance, such as business licenses or permits... Read More

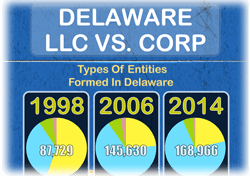

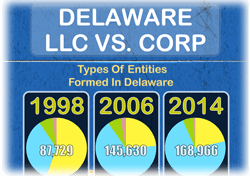

Compare Business Entities: Corporation vs LLC

By

HBS

Tuesday, March 29, 2016

What’s the difference between LLCs and corporations? Which is better for raising capital, limiting liability, easy management & paying taxes?.. Read More

What’s the difference between LLCs and corporations? Which is better for raising capital, limiting liability, easy management & paying taxes?.. Read More

Business Start-Up Guide: Merchant Services

By

Jeremy Reed

Tuesday, March 22, 2016

Merchant services have become increasingly important for start-ups in the information age. In the past, start-ups would market their product or services in their local area and many accepted only cash or checks for payment... Read More

Merchant services have become increasingly important for start-ups in the information age. In the past, start-ups would market their product or services in their local area and many accepted only cash or checks for payment... Read More

How to Obtain a U.S. Visa for Business Travel

By

HBS

Tuesday, March 8, 2016

If you are planning to visit to the United States in order to conduct any type of temporary, international business—including to attend conferences, consultations or conventions—you will need a non-immigrant Business Visitor Visa, known as a B-1... Read More

If you are planning to visit to the United States in order to conduct any type of temporary, international business—including to attend conferences, consultations or conventions—you will need a non-immigrant Business Visitor Visa, known as a B-1... Read More

What Is An Executive Coach?

By

HBS

Monday, February 22, 2016

An executive coach teaches you not only the necessity of strategic thinking but also the tools you will need to utilize in order to think strategically throughout your career and life. In addition, by helping you eliminate your own self-limiting beliefs, an executive coach teaches you how to define your vision, confront obstacles, develop a work-life balance and sustain motivation, accountability and responsibility... Read More

An executive coach teaches you not only the necessity of strategic thinking but also the tools you will need to utilize in order to think strategically throughout your career and life. In addition, by helping you eliminate your own self-limiting beliefs, an executive coach teaches you how to define your vision, confront obstacles, develop a work-life balance and sustain motivation, accountability and responsibility... Read More

Successful Entrepreneurs Series: Custody Calculations

By

Christina Cornelius

Monday, February 15, 2016

Our ongoing series of successful entrepreneurs... Read More

The Fastest Way to Get a Tax ID Number Online

By

Brett Melson, Andrew Millman

Monday, January 11, 2016

The IRS website is not the only way to get your EIN online. It's certainly not the fastest... Read More

The IRS website is not the only way to get your EIN online. It's certainly not the fastest... Read More

Successful Entrepreneurs Blog Series: Alltham, PBC

By

Christina Cornelius

Monday, December 21, 2015

Welcome to the Successful Entrepreneurs Blog Series. In this monthly blog series, Harvard Business Services, Inc. will interview a variety of successful entrepreneurs whose companies’ range from small to large and local to international... Read More

Indian Business in the United States of America

By

Andrew Millman

Tuesday, December 8, 2015

The increase in Indian business in the U.S.A. is going to continue as the population of India is projected to surpass China within ten years... Read More

The increase in Indian business in the U.S.A. is going to continue as the population of India is projected to surpass China within ten years... Read More