Asset Protection for Boat Owners

Have you ever wondered why so many private yachts and boats around the world have "Delaware" as their domicile? It's to provide asset protection for those boat owners. Many will choose to form a Delaware corporation or Delaware LLC and purchase the boat in that company's name.

Forming a company to hold your assets is a common way to protect both you and your personal assets. At Harvard Business Services, Inc. we have more than four decades of experience forming Delaware companies for people who want to protect their assets. However, we are not a law firm and cannot give legal advice. Please consult an attorney if you need legal advice before starting an LLC for boat ownership.

Below, you will learn more about why Delaware is the best state to register a boat, plus discover the smart way to buy and own a boat—whether its use is strictly personal, for charter, or for other business purposes.

Why Incorporate Your Boat

Collisions and other accidents involving boats occur, no matter how experienced a driver or sailor you are. Forming an LLC or corporation for a boat can be a good strategy to protect your personal assets, especially if the boat is used for business or has liabilty risks associated with its use. Unless you form a corporation or LLC for boat ownership, an accident involving your boat could put your other personal assets at risk.

In the likely event that your insurance doesn't cover all the expenses and damages the accident victims may seek, their heirs and insurance company will go after your personal assets—bank accounts, cars, real estate, and more.

The only smart course is to protect your personal assets by forming a Delaware corporation or LLC. When creating a corporation or LLC for boat ownership, you'll be creating a wall of separation between your boat and other personal assets. In the event of a lawsuit, a Delaware corporation or Delaware LLC will provide another layer of protection that complicates the plaintiff's lawyer's task. Holding the boat in an LLC or corporation helps contain liabilty within the entity, potentially reducing the financial impact of legal claims on the owner's personal wealth. This extra layer of protection may cause the lawyers to reconsider suing you personally, or may be an inducement for them to attempt to reach a settlement.

How to Incorporate Your Boat

Now that you understand that you need to incorporate your boat, you need to know how to incorporate a boat in Delaware, the best state to register a boat. The smart way is to form a Delaware corporation or Delaware LLC and purchase the boat in that company's name. By doing so, your boat would be the property of [Insert Company Name Here] Inc. or [Insert Company Name Here] LLC, and therefore would not be considered your personal property.

Buying a boat through a limited liability company or corporation separates the activities and operations of owning the boat from your personal assets, protecting them against any contingencies or liability risks that may arise from those activities.

If you own one boat...

There are several ways to approach the process of incorporating a boat that will be for personal use, but here is one example of how it might work: Form a Delaware LLC and structure your LLC to include three classes of members. Include your heirs as Class B and Class C members. This creates two levels of protection—the boat (as an asset) is out of reach in the event of a lawsuit aimed at you personally, and your personal assets are protected in a lawsuit involving the boat.

If you own more than one boat...

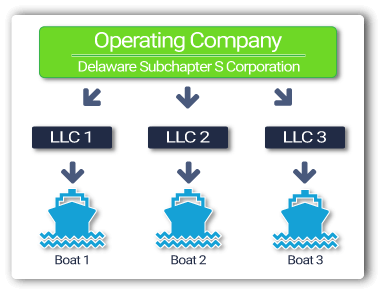

Asset protection for a commercial boat owner, or an owner of multiple boats, can be achieved in several ways. This method, which is used by some of the biggest companies in America, is a strategy to consider if you own more than one boat:

To use this method, first form a Delaware subchapter S corporation. This is your operating company, i.e. the one you use with your customers and suppliers. All payments flow into this company. Using a subchapter S corporation for the operating company gives you tax advantages and separates your boating-related business from your personal assets. It protects your assets from the business's potential liabilities, yet this subchapter S corporation doesn't own any of the boats.

Each boat is owned by and titled in the name of a separate Delaware LLC. Each boat is then leased to your operating company under a separate contract. Consequently, if one of your Delaware boat LLC is involved in a lawsuit, the other boats can continue operating.

LLCs are utilized to hold the assets because they are tax-free companies with strong liability protection. If you set them up correctly, you won't need to file separate tax returns for each LLC, saving you time and money.

Creating and maintaining a corporation or LLC for boat ownership involves legal fees, filing requirements, and possibly annual reports and taxes, which add costs and administrative responsiblities. The strategy may not be an exact fit for every circumstance, so it would be wise to consult with your lawyer and accountant first and then rely on Harvard Business Services, Inc. to handle the details of filing and maintaining your Delaware boat LLC or corporation.

Delaware Boat Registration Information

While the process of registering your boat with the state of Delaware is very simple and can be completed online, please be aware that state regulations require that your vessel be registered in its “State of Principal Use.” This refers to a state on whose waters a vessel is used or to be used most during a calendar year. Delaware regulations state that if Delaware is the “State of Principal Use,” the vessel must be used, docked, or stowed on the waters of this State for over 60 consecutive days every year. [source: DNREC]

Forming a Delaware company is the best form of asset protection for boat owners. A boat LLC or corporation will protect most of your personal assets from liability and financial risks associated with boat ownership.Simply click on the button below to create a corporation or LLC for boat ownership. The process only takes a few minutes!

Form a delaware comPany now.The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups and general business topics.

Since 1981, Harvard Business Services, Inc. has helped form 430,506 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: