Operating Multiple Businesses Under One LLC

You have amazing ideas for new businesses. You’re ready to incorporate in order to protect yourself and your personal assets, and you’ve decided it’s time to take the next step and create an LLC holding company for your various endeavors.

Then, the questions swirl:

- What type of business activity can I conduct with my LLC?

- How many different businesses can I operate under one LLC?

- Should I set up DBAs?

- Should I create a separate LLC for each project?

- Will a series LLC work for me, or should I stick to multiple, traditional LLCs?

By now, it’s common knowledge that Delaware is the gold standard when it comes to forming an LLC, LP, or Corporation. The Delaware LLC is by far the most popular entity type for most entrepreneurs building a startup.

As a result, people often wonder if they can operate multiple LLCs under one LLC holding company.

Structuring Multiple Businesses Under One "Umbrella" LLC

Can you have multiple businesses under one LLC? For example, let's pretend a business owner has a trucking business incorporated as an LLC but after some time, he/she may also want to offer real estate services.

These are two completely different types of businesses, so it raises the question of whether or not the owner can provide both services under one LLC. Part of the consideration for owning multiple businesses is, naturally, wanting to avoid additional costs for maintaining another LLC.

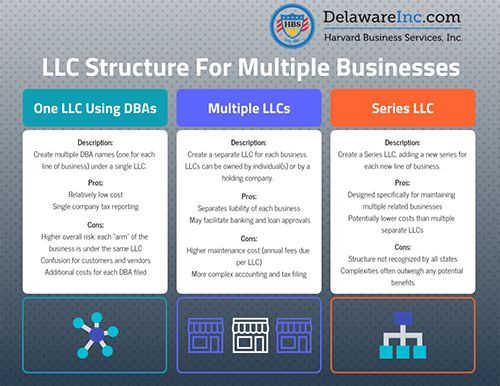

The answer is yes--it is possible and permissible to operate multiple businesses under one umbrella LLC. Many entrepreneurs who opt to do this use what is called a "Fictitious Name Statement" or a "DBA" (also known as a "Doing Business As") to operate an additional business under a different name.

However, just because it’s permissible and possible to operate multiple businesses under one LLC or corporation doesn't mean you should, as there can be downsides.

For example, if a lawsuit is filed against any one of the businesses, the assets of the others could be at stake. The result is that you put yourself at a higher degree of liability risk. In other words, if one of the pieces (businesses) within the LLC were to be held liable, then so could the entire LLC. As the old adage says, "Do not put all your eggs in one basket."

Instead, many people opt to file a new LLC for each of their start-up ventures. Owning multiple businesses under separate LLCs isolates the risk by separating each business's debts and liabilities. Think of the separate entities as helping to put up a big brick wall in between each LLC.There are, of course, additional maintenance fees, but these can be well worth it in order to protect your businesses and offer the peace of mind that separate LLCs will afford.

What About a Series LLC?

Some people explore the low-cost series LLC when they want to operate several different businesses, which is very enticing since there is only one annual Franchise Tax payment to the State of Delaware and one annual Registered Agent Fee.

However, the structure of this business entity is relatively new and unproven, so there are often many hurdles that arise when dealing with a series LLC. Many service providers, banks, attorneys, accountants and other businesses are still unfamiliar with the series concept. It often takes time to explain the series concept and to obtain approval for documentation required, for example, from a bank's lending group. It is generally considered safer and smarter for people to keep their business ventures completely separate from one another by forming an LLC for each aspect of a business; in essence, what you are doing is creating one Delaware LLC as a holding company, and other, individual LLCs within it, yet separate from it.

Separate LLCs for Separate Businesses

As it stands today, the battle-tested, proven practice of creating individual LLCs that are formed for every variant of a business is traditionally still the most highly recommended strategy by tax professionals, attorneys and business consultants all over the world.

This means that for every sector of the business, for each product line, for every service provided, for each piece of real estate held, clients will often consider creating separate, traditional LLCs. For people that own multiple businesses, this ensures that the assets, debts, and liabilities of each LLC are completely disconnected and shielded from one another in the event of any possible litigation.

When establishing multiple LLCs, it can be extremely helpful to develop a blueprint hierarchy that will coincide with the relationship of the respective LLCs. For example, people typically set up numerous LLCs for real estate development.

This framework often consists of one parent LLC at the top of the hierarchy—let’s call it ABC Holding Company, LLC. People then typically create multiple sibling LLCs, one for each piece of actual real estate—let’s call them ABC Real Estate 1, LLC; ABC Real Estate 2, LLC; and ABC Real Estate 3, LLC.

Each LLC may own, manage and be responsible for a single piece of property; thus, while all the LLCs share the same holding company—ABC Holding Company, LLC—and may possess similar structures, ownership interests, assets and liabilities, they are insulated and shielded from one another in order to protect the properties and resources of each individual LLC.

Delaware LLC holding companies are also considered a smart, strategic way to further protect your personal assets from your LLCs.

If you would like more information or have any questions about forming your own companies or adding another business under the parent LLC please contact us by phone (800-345-2677), Skype (DelawareInc), email or live chat. One of our knowledgeable business startup specialists will be happy to assist you.

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.

There are 27 comments left for Can I Operate Multiple Businesses Under One LLC?

Paul Bernedo said: Saturday, October 22, 2022I have an LLC and was looking to open another business that is unrelated to my first business. I believe that I can apply for a DBA and have this business under the first. However, I was thinking of keeping them separately by doing a sole proprietorship and then getting an EIN for the second business. How can I get a trade name "dba for a sole proprietorship? It seems that the only way I can register a trade name dba is by registering it under another entity, or my llc

HBS Staff replied: Monday, October 24, 2022Hi Paul,

Thank you for reading our blog and for you question. Generally, for each separate entity you will file separate LLCs that way all your eggs are not in one basket. A representative from our office will reach out to provide you with more information and help answer all your questions.

Stephanie said: Friday, October 14, 2022Hello I’m a landlord with four properties . By chance can advise which type of LLC is recommend. I will also be purchasing properties in a neighboring state will I need to establish another LLC in that state? Thanks Stephanie

HBS Staff replied: Friday, October 14, 2022Hi Stephanie,

Thank you for reading our blog and for your question. We would be happy to assist your with your question and will be reaching out shortly to further assist you.

Kandra Brooks said: Tuesday, August 16, 2022Hello, Thank you very much for the article. I plan to start a laundromat business as an LLC and hope to own multiple. However, I also have a DBA in process can I use the DBA for banking purposes as an LLC but have each potential laundromat have its own LLC separate from the DBA. Or will I need to have completely different accounts for each business under their individual LLC?

HBS Staff replied: Friday, August 19, 2022Hello Kandra,

Thank you for reading our blog and for your question. One of our representatives will be happy to reach out to you to help explain this all in great detail.

Precious said: Wednesday, June 29, 2022Hi, My name is Precious. Thank you for the article, really insightful. I currently have a business proffering services but looking to set up others that deal in products, would you suggest I register a trademark instead for all my businesses or do I open an LLC for all of them with my current business as the parent company?

HBS Staff replied: Tuesday, July 5, 2022Hello Precious,

We would be happy to reach out to you to further discuss you inquiries. One of our representatives will reach out shortly.

Jeremiah said: Monday, May 9, 2022Hi. I found your website to be very informative. My question is that Ive started a llc incorporated that is in the process of becoming a non-profit corporation. A good friend wants to start a for-profit business completely unrelated to my original llc, but asked me to set-up the for-profit under my new llc. Should I do the original as a parent llc Inc with subsidiaries, or should i do individual llc's? There's no danger of litigation as they are spirituality based businesses.

HBS Staff replied: Tuesday, May 10, 2022Hi Jeremiah,

Thank you for your question and for reading our blog. We are happy to assist you. Generally, clients will form separate entities for each business venture that way not all their eggs are in one basket. With that being said if you wanted to make the current entity be the owner of the new entity that is possible. We will reach out to help with any additional questions.