Authorizing Shares for Your Delaware Corporation

A Primer on Authorized Shares

Several years ago, our chairman wrote one of his first blog articles on shares of stock entitled "Demystifying Stock." In it, he defines stock and some of the terms commonly associated with stock, such as authorized shares.

Reading his article should give you a better understanding of the definition of stock, but it may still leave you wondering, "How many shares of stock should I be authorizing for my corporation?" Some of you may also wonder, "At what par value do I authorize the stock for the corporation?" Just as a quick reminder, authorized shares are the total number of shares that a corporation may sell or trade, and are defined at the time of filing the Certificate of Incorporation. When authorizing shares, the corporation must define the quantity, the par value and the classes for the shares.

Though it is not an exact science, here are some general guidelines to consider when authorizing shares for a Delaware corporation:

Quantity – How many shares should a corporation start with? When authorizing shares for a Delaware corporation, one should consider that the annual Delaware Franchise Taxes will be based on the number of shares; therefore, whenever possible, it is best to keep the number of shares low. A good rule of thumb is to authorize only what the corporation will need. Corporations with 5,000 or less authorized shares are considered minimum stock and will pay the minimum Delaware Franchise Tax each year.

If you must exceed 5,000 authorized shares, you will be afforded the opportunity to recalculate the company’s Franchise Tax using a complicated formula called the assumed par value capital method, which will consider the company’s gross assets and the number of issued shares at the end of the year.

As a reminder, the difference between authorized shares vs issued shares is that authorized shares represent the maximum amount of shares that can be in circulation while issued shares represent the actual amount of shares possessed by shareholders.

Par Value and Share Valuation – If you decide you need more than 5,000 authorized shares for your corporation, the Delaware Franchise Tax calculation is no longer a matter of consequence, and now the focus shifts to the par value assigned to the shares. If the authorized shares of a corporation must exceed 5,000 shares, the next threshold for you to consider is a share valuation of $75,000. Share valuation is simply the number of authorized shares multiplied by the par value.

Par value is only relative to the bottom value of the share, and has no bearing on the market value or stock price of the share. As with the number of authorized shares, it is generally better to keep the par value as low as possible because the initial filing fees will be calculated based on the share valuation. Minimum stock corporations may consider a zero par value, but corporations in excess of 5,000 authorized shares will want to assign a par value to the shares to avoid additional filing fees levied by the Delaware Division of Corporations.

Delaware law allows for a par value as small as $0.000001, thus making it very easy to manipulate your company’s share valuation to remain below the $75,000 threshold. For example, if you decide you need 1,000,000 authorized shares, you can assign a par value of $0.001, which will result in a share valuation (1,000,000 shares x $0.001 par value) of $1,000. Because the share valuation is less than $75,000, the corporation will not experience any additional filing fees at the time of incorporation.

Classes of Stock – Although classes of shares have no direct influence on the Delaware Franchise Tax, it is still important to mention. For most corporations, the share class will be common but the scope of authorized shares includes all classes (i.e., common and preferred). Therefore, it is important to remember that when you are considering the quantity of authorized shares or calculating the share valuation that the authorized shares are all shares combined, both common and preferred.

You can start the corporation formation process on our website. It you'd like to learn more about how to shares of stock in a Delaware corporation, contact our team today.

You may be interested in these related articles:

Issuing Stock Certificates for a Delaware Corporation

What Are "Uncertificated" Shares?

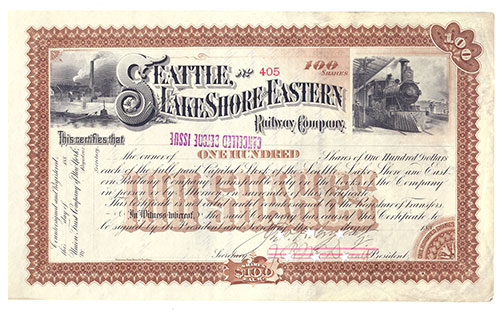

[Photo credit: William Creswell]

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.

There are 5 comments left for Authorizing Shares for Your Delaware Corporation

Lakshmi Subramanian said: Thursday, August 29, 2019Hi, Seek advice on disclosure of share premium received on common stock - can it be clubbed with share capital or is it required to be disclosed separately under 'Share / Securities premium' in the balance sheet

HBS Staff replied: Thursday, August 29, 2019Lakshmi, this is likely a question for your accountant. Unfortunately, we are unable to provide accounting advice.

armen said: Wednesday, February 21, 2018Hi, we formed a Delaware corporation and authorized shares in May 2017, but haven't issued any shares yet. Can you please tell me how much time I have between authorizing shares and issuing them?

HBS Staff replied: Monday, February 26, 2018The issuing of shares is an internal matter in the company. The company is free to issue the shares to the shareholders whenever it chooses.

Jess said: Saturday, December 2, 2017Hello we have incorporated with 5000 shares however the lawyer we employed to write up the share agreements has deemed that 420 shares will be a 10% share in the company. Can anyone explain why they would have left 800 shares

HBS Staff replied: Monday, December 4, 2017No, we do not know why certain shares in your company were not issued or not. Your best bet is to quickly contact an attorney to find out what is going on with your company's shares.

Alex Valdes said: Monday, November 27, 2017Hello, we incorporated our delaware c-corp with Incfile's services. We need to increase our authorized shares to 10,000,000. Incfile has told me that they are unable to make the amendment to service this need. Is this something that your services can help with? Thank you, Alex, CFO

HBS Staff replied: Tuesday, November 28, 2017Yes, we can certainly help to prepare the Cerificatet of Amendment to increase the shares of stock. Please call 800 345 2677, Ext 6911 and a live person will answer right away.

Daniel Jordan said: Saturday, June 10, 2017where to get a copy of public records

HBS Staff replied: Monday, June 12, 2017What type of public records? If you can be more specific or call us at 1-800-345-2677 we can try to help.