The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups, cryptocurrency, venture capitalism and general business topics.

Certification for Veteran Small Business Owners

By

Jeremy Reed

Tuesday, November 7, 2023

Learn about the benefits of becoming certified as a veteran small business owner. Sign up online with the Small Business Administration as a VOSB today... Read More

Learn about the benefits of becoming certified as a veteran small business owner. Sign up online with the Small Business Administration as a VOSB today... Read More

Disadvantages & Hidden Costs of a Sole Proprietorship

By

HBS

Monday, November 6, 2023

Typically, a sole proprietorship makes you personally liable for all of your business debts and gets taxed at the personal (not corporate) tax rate. That's not all... Read More

Typically, a sole proprietorship makes you personally liable for all of your business debts and gets taxed at the personal (not corporate) tax rate. That's not all... Read More

Directors Cannot Vote By Proxy at Board Meetings

By

Jarrod Melson, Esq.

Tuesday, October 31, 2023

Can directors vote by proxy at board meetings? Learn about the rules of board meeting votes and what happens when a board member cannot be present... Read More

Can directors vote by proxy at board meetings? Learn about the rules of board meeting votes and what happens when a board member cannot be present... Read More

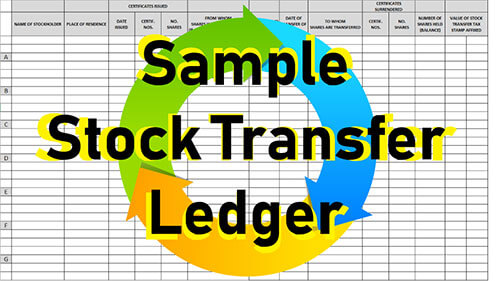

Sample Stock Transfer Ledger

By

Justin Damiani

Monday, October 30, 2023

The Stock Transfer Ledger is a very important item to update and maintain internally within your Corporation as it will document shares issued or transferred to your company’s shareholders. Free PDF download included... Read More

The Stock Transfer Ledger is a very important item to update and maintain internally within your Corporation as it will document shares issued or transferred to your company’s shareholders. Free PDF download included... Read More

Does an LLC Have Stock or Shareholders?

By

Justin Damiani

Tuesday, October 24, 2023

Can LLCs have shareholders or issue stocks? Learn more about the simple LLC ownership structure, ownership changes & how they differ from corporations... Read More

Can LLCs have shareholders or issue stocks? Learn more about the simple LLC ownership structure, ownership changes & how they differ from corporations... Read More

What Is an LLC Operating Agreement?

By

Brett Melson

Monday, October 23, 2023

The Delaware legislature created the limited liability company (LLC) in such a way as to allow the LLC's members the freedom to contract with one another upon whatever terms they deem are best suited to their company... Read More

The Delaware legislature created the limited liability company (LLC) in such a way as to allow the LLC's members the freedom to contract with one another upon whatever terms they deem are best suited to their company... Read More

The Perils of LLC Flexibility – How are Operating Agreements Interpreted

By

Jarrod Melson, Esq.

Tuesday, October 17, 2023

Read about the importance of a well-drafted LLC operating agreement. Without clarity and context, Delaware courts will need to interpret the agreement... Read More

Foreign Qualification Common Mistakes

By

Andrew Millman

Monday, October 16, 2023

Foreign qualifying your business is tricky, but our team of professionals can help you avoid common mistakes in applying for foreign qualifications. Some of the most frequent foreign qualification errors include: delaying the process until the last minute, using the wrong title on the application, omitting information such as the address for one of the officers, directors, members, or managers, or failing to provide the appropriate accompanying documentation, such as a Certificate of Good Standing or a Certified Copy. At a time when nearly every single Secretary of States’ office in the US is experiencing some form of processing delay due to the pandemic, savvy owners are seeking professional support to ensure a timely and smooth filing process... Read More

Foreign qualifying your business is tricky, but our team of professionals can help you avoid common mistakes in applying for foreign qualifications. Some of the most frequent foreign qualification errors include: delaying the process until the last minute, using the wrong title on the application, omitting information such as the address for one of the officers, directors, members, or managers, or failing to provide the appropriate accompanying documentation, such as a Certificate of Good Standing or a Certified Copy. At a time when nearly every single Secretary of States’ office in the US is experiencing some form of processing delay due to the pandemic, savvy owners are seeking professional support to ensure a timely and smooth filing process... Read More

Stuck With a Tie-Breaker Manager in an LLC

By

Jarrod Melson, Esq.

Tuesday, October 10, 2023

When a vote is split amongst LLC leadership, an LLC deadlock provision offers a solution via a tie-breaker manager. Learn more about the role & their removal... Read More

When a vote is split amongst LLC leadership, an LLC deadlock provision offers a solution via a tie-breaker manager. Learn more about the role & their removal... Read More

Understanding the Transition from DUNS Numbers to UEIs

By

Justin Damiani

Monday, October 9, 2023

Stay Informed: UEIs to Replace DUNS Numbers! In our latest blog post, we explore the significant shift from DUNS to UEIs and its implications for businesses. Gain insights into compliance and competitiveness in this evolving landscape. Read the full article to stay ahead of the curve!.. Read More

Stay Informed: UEIs to Replace DUNS Numbers! In our latest blog post, we explore the significant shift from DUNS to UEIs and its implications for businesses. Gain insights into compliance and competitiveness in this evolving landscape. Read the full article to stay ahead of the curve!.. Read More